- Undercover Real Estate

- Posts

- Capital Flows to Multifamily

Capital Flows to Multifamily

Unveiling the Market's Secrets from Behind the Scenes

📩Was this forwarded? Join for future investigations, Sign Up Here

“Commercial and multifamily borrowing gained significant momentum in the second quarter of 2025, with strong increases across most property types and capital sources. While multifamily and hotel lending remain below last year’s levels, much of the strong annual growth reflects the exceptionally low levels of activity reported last year. Lending by depositories more than doubled, and originations by investor-driven lenders surged by over 90 percent, highlighting renewed interest from both traditional institutions and private capital.”

- Reggie Booker, Associate Vice President of Commercial Research at MBA.

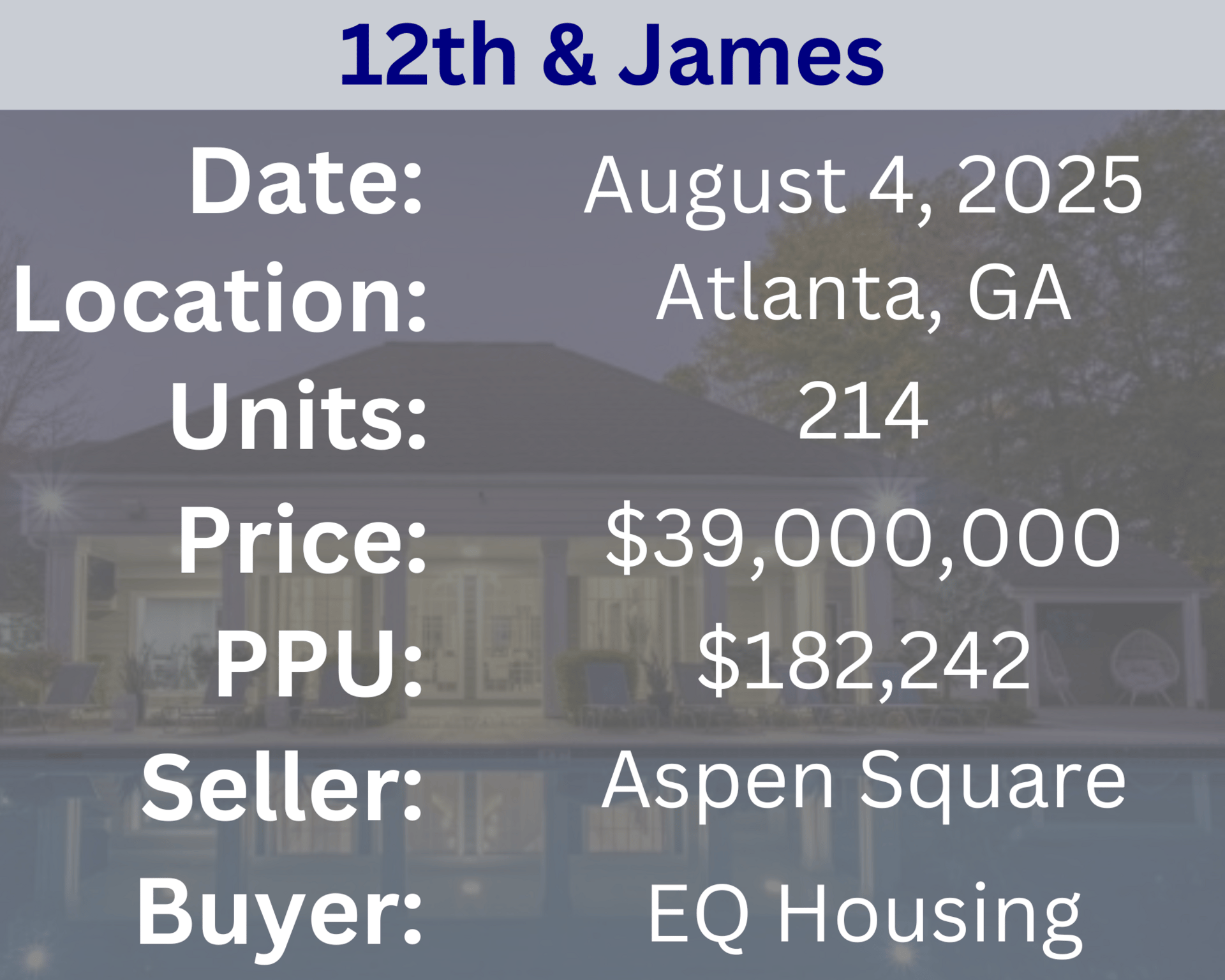

Recent Multifamily Sales (Click to view details)

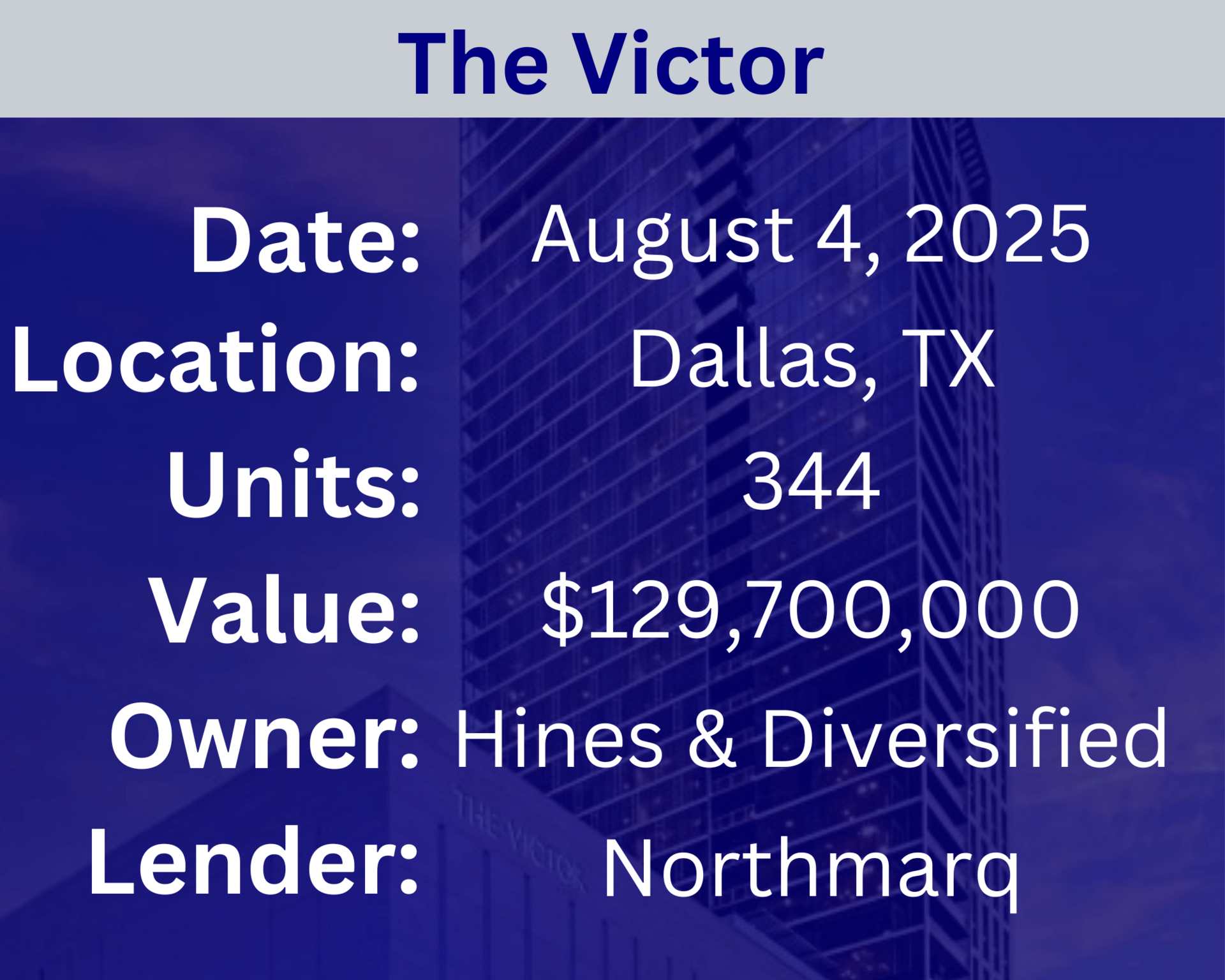

Recent Multifamily Loans (Click to view details)

Question: What is the concept of "refinancing" in multifamily investing? | Answer: Refinancing in multifamily investing involves replacing an existing mortgage with a new loan, typically to secure better terms such as a lower interest rate, longer repayment period, or to access built-up equity. Investors often refinance after improving property performance or increasing value, allowing them to pull out capital while still holding the asset. This strategy can enhance cash flow, fund other investments, or reduce overall financing costs. |

🕵️🔎Want to get your question answered? Click here to submit your question

Bill Beach on How Trump Just Politicized US Economic Data Donald Trump stunned Wall Street by firing Erika McEntarfer, head of the Bureau of Labor Statistics, after a disappointing July jobs report and major downward revisions to previous data. Trump called the numbers “rigged.” In this episode, former BLS chief Bill Beach breaks down what these revisions mean—and what the firing signals for the future of U.S. economic data. |

Quiz of The Week

What is a "turnover rate" in multifamily housing?

a. The frequency of apartment renovations

b. The rate at which tenants move out and new ones move in

c. The speed at which maintenance requests are fulfilled

uᴉ ǝʌoɯ sǝuo uɐǝu puɐ ʇno ǝʌoɯ sʇuǝuǝʇ ɥɔᴉɥʍ ʇɐ ǝʇɐɹ ǝɥꓕ .q

Random Tip of the Week

📈 Forecast Demographics and Lifestyle Trends - Anticipate shifts in household size, work-from-home trends, and preferences for urban vs. suburban living to align your property offerings with future tenant demand.

Current Rates (Weekly Update)

10-Year Treasury - 4.20% (⬇️.12%)

Fed Funds Rate - 4.33% (0%)

1-Month Term SOFR - 4.34% (⬇️. 01%)

About Nuvo Capital Partners

Nuvo Capital Partners is a niche market-focused multifamily investment platform operating throughout the Southeastern United States. As a dedicated sponsor (General Partner), we specialize in institutional quality real estate investments within these regions. Our team comprises industry professionals with 25+ years of combined experience, ensuring expertise and market knowledge. We pride ourselves on offering a transparent investment process, providing our investors with access to high-quality real estate opportunities while upholding integrity throughout.

📩 Was this forwarded? Join for future investigations, Sign Up Here