- Undercover Real Estate

- Posts

- Credit Cards, Monetary Policy, and Consumer Stress

Credit Cards, Monetary Policy, and Consumer Stress

Unveiling the Market's Secrets from Behind the Scenes

📩Was this forwarded? Join for future investigations, Sign Up Here

"At present, I lean toward supporting a cut to the policy rate at our December meeting. But that decision will depend on whether data that we will receive before then surprises to the upside and alters my forecast for the path of inflation.”

-Christopher Waller, Governor at Federal Reserve System

Hi Nuvo Community,

Introduction

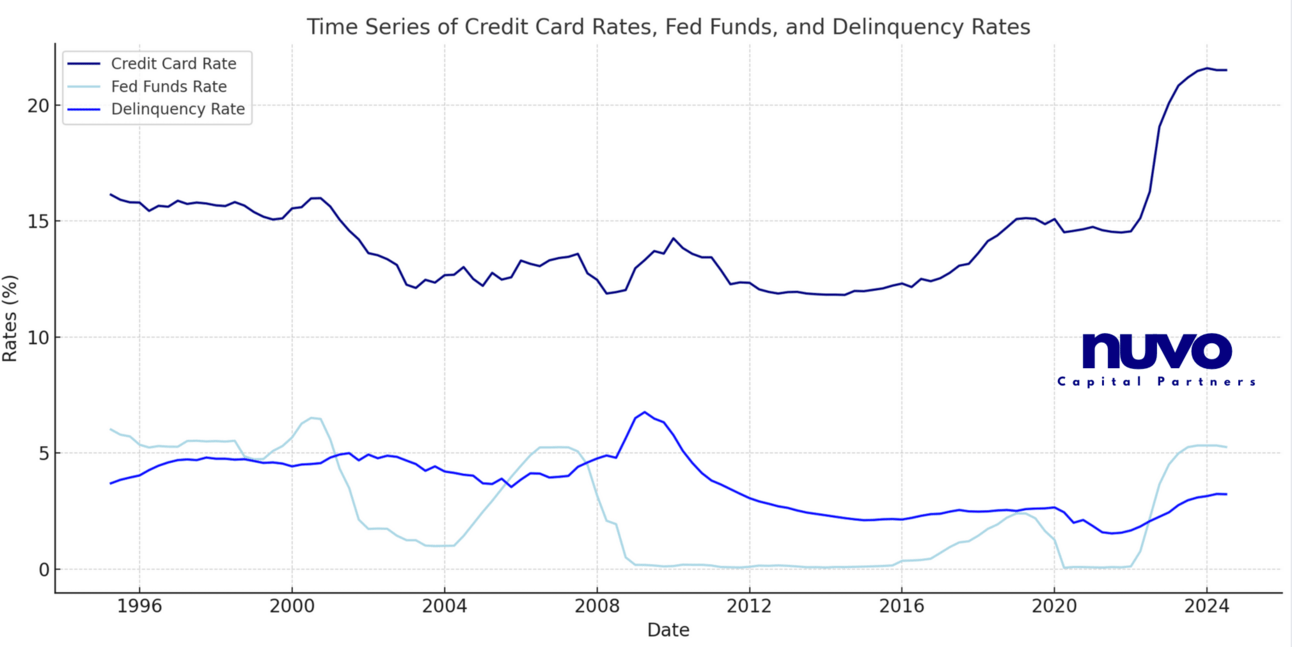

Credit card rates are more than just a measure of borrowing costs—they represent a critical intersection between monetary policy and consumer financial health. These rates react to changes in Federal Reserve policies and influence household financial behavior, making them both a reflection of macroeconomic conditions and a potential predictor of economic stress.

This article explores the relationship between Credit Card Rates, Fed Funds, and Credit Card Delinquency Rates, offering insights into how these variables interact and what they reveal about the broader economy.

Credit Card Rates and Monetary Policy

At their core, Credit Card Rates reflect the cost of consumer credit and are closely tied to the Fed Funds Rate, the Federal Reserve's primary tool for controlling inflation and economic growth.

The Predictive Relationship

Credit Card Rates appear to lead changes in Fed Funds, as evidenced by a leading correlation of 0.63 at one quarter. This suggests lenders adjust credit card rates in anticipation of future monetary policy moves, possibly based on market expectations or Federal Reserve communications.

Credit Card Rates and Delinquency Rates

Delinquency Rates measure the share of overdue loans, providing a barometer of financial strain among consumers. While weaker than the Fed Funds relationship, Credit Card Rates show important dynamics with Delinquency Rates:

Lagged Effects

Higher Credit Card Rates exhibit a growing negative lagged correlation with Delinquency Rates, peaking at -0.18 at one year. This suggests that as borrowing costs rise, financial strain builds gradually, ultimately contributing to higher delinquency levels. It’s important to note that .18 is a relatively weak correlation, so there are a number of other factors influencing delinquency.

Leading Effects

As a leading indicator, Credit Card Rates have a modest positive correlation with Delinquency Rates, reaching 0.17 months. This finding suggests that rising borrowing costs foreshadow consumer financial distress.

Comparative Insights

The correlations suggest Credit Card Rates are a stronger indicator of monetary policy (Fed Funds) than consumer distress (Delinquency Rates). Credit providers are quick to raise rates in anticipation of Fed hikes. However, their predictive value for delinquency trends should not be overlooked, particularly in times of tightening monetary policy.

Conclusion

Credit Card Rate’s correlation with the Fed Funds Rate underscores their importance as a transmission mechanism for monetary policy, while their modest predictive relationship with Delinquency Rates highlights their role in signaling consumer financial health.

As rates remain elevated in response to inflationary pressures, their impact on both borrowing costs and delinquency trends will likely intensify. Credit providers are less likely to lower their rates as quickly as they raise them.

All the best,

Yuri - Your Real Estate Investigator

Credit: Brian Underdahl, Chief Executive Officer, Nuvo Capital Partners

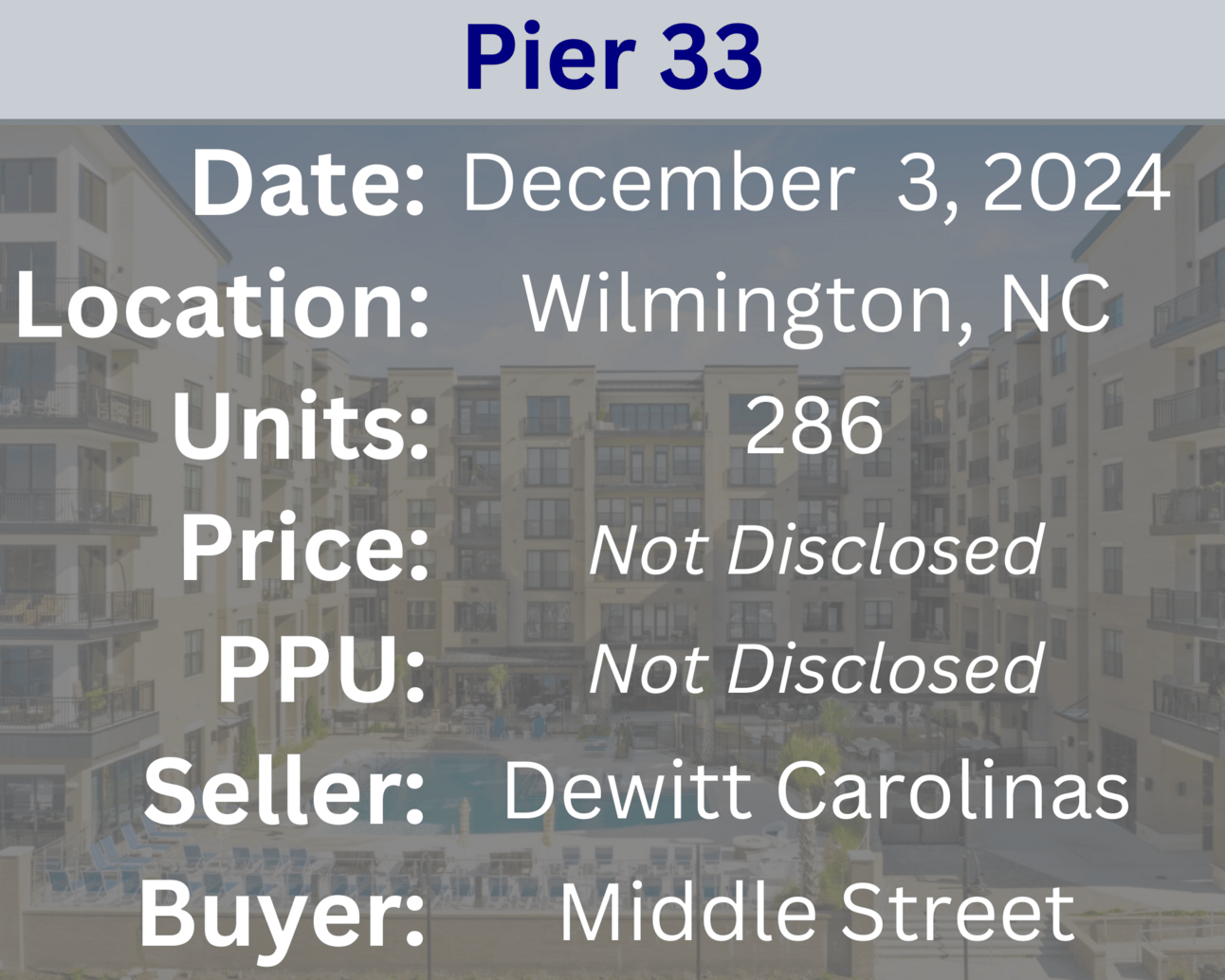

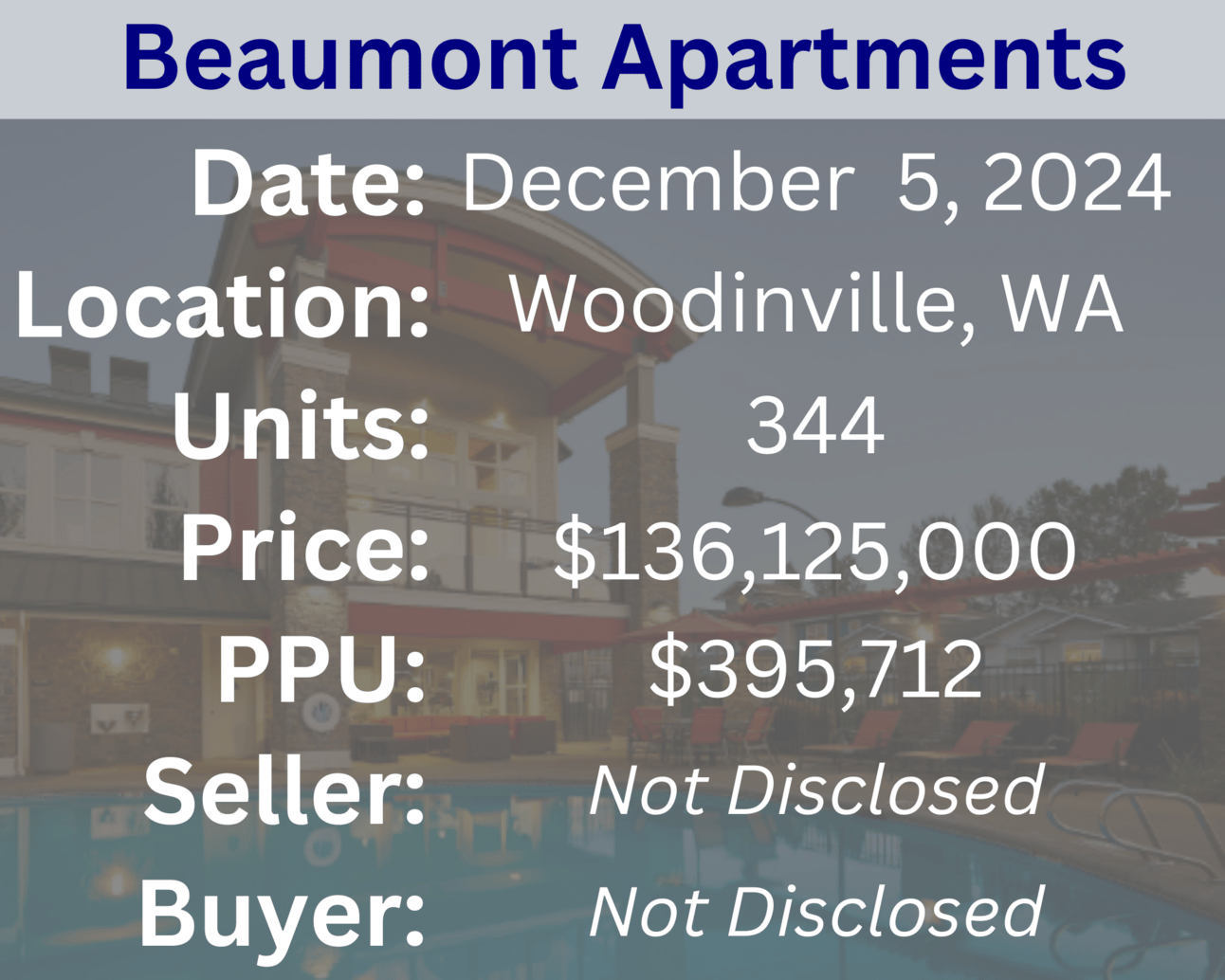

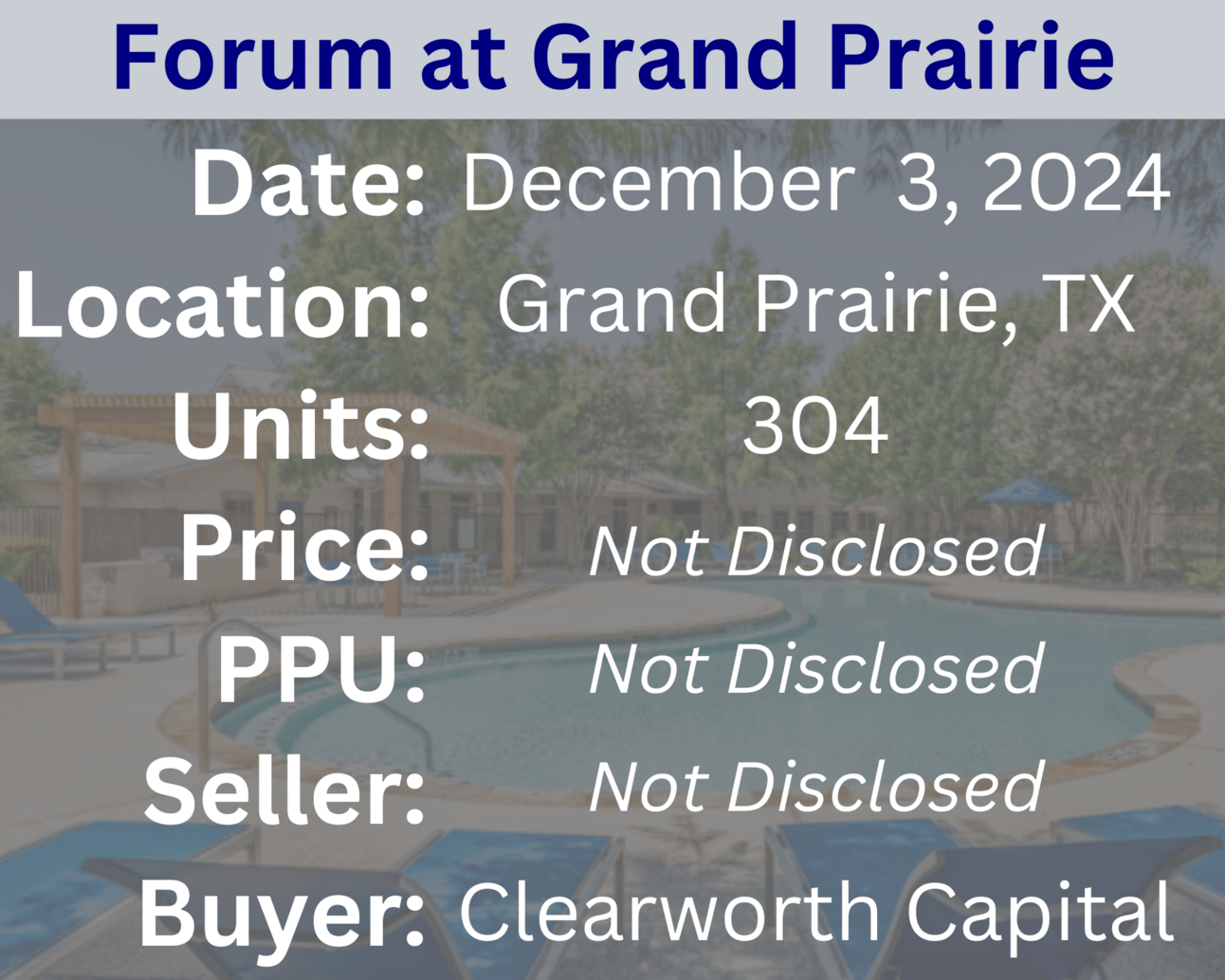

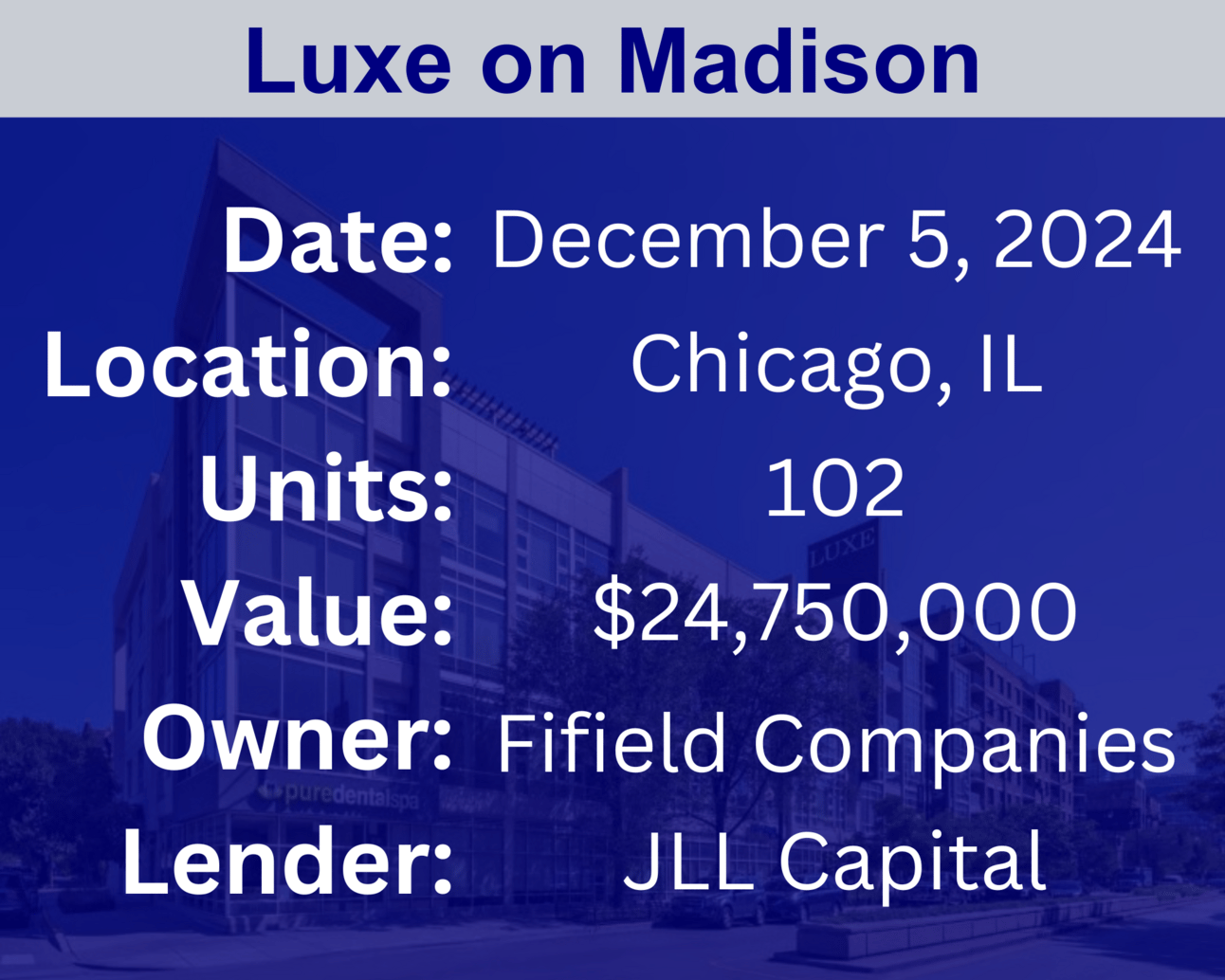

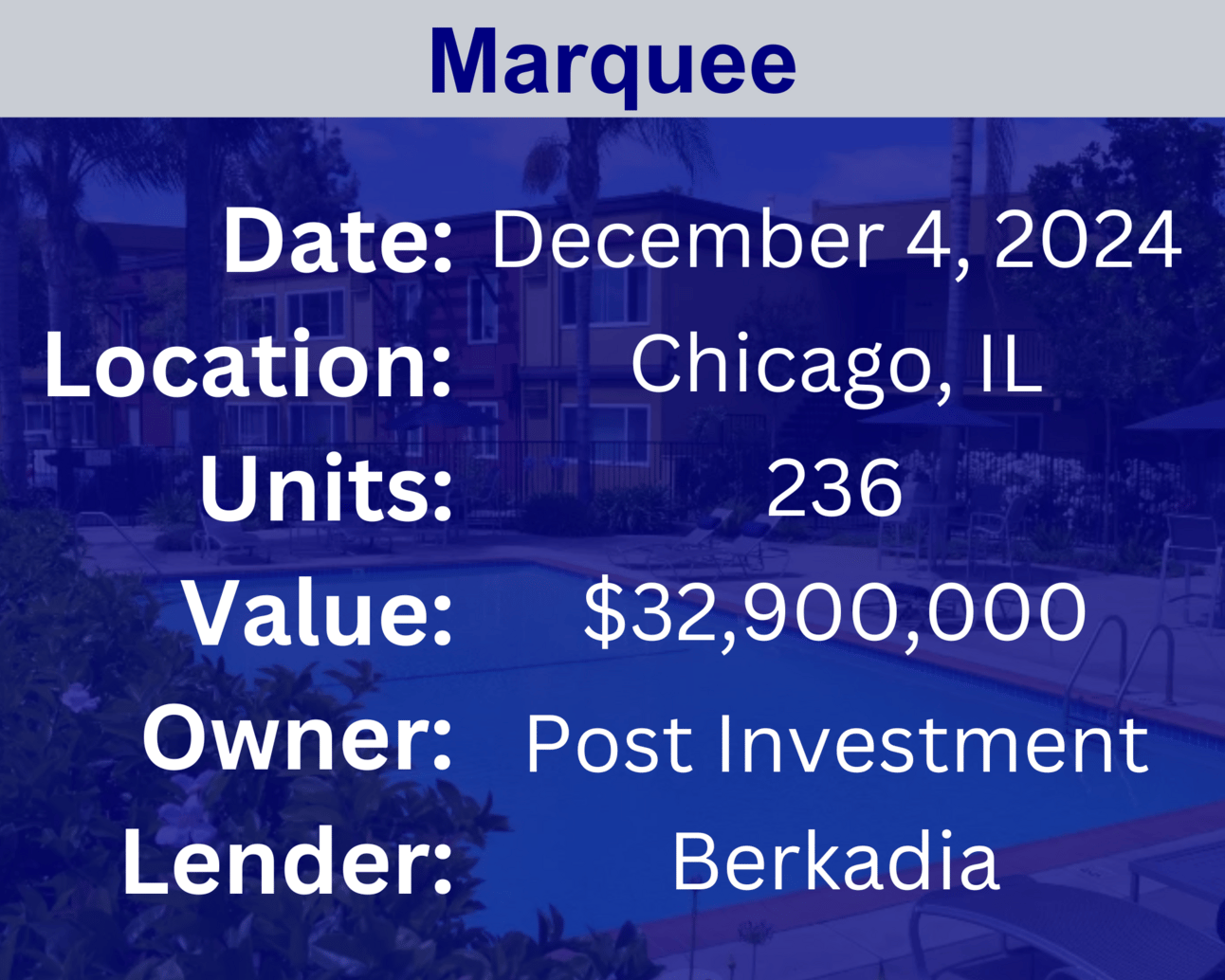

Recent Multifamily Sales (Click to view details)

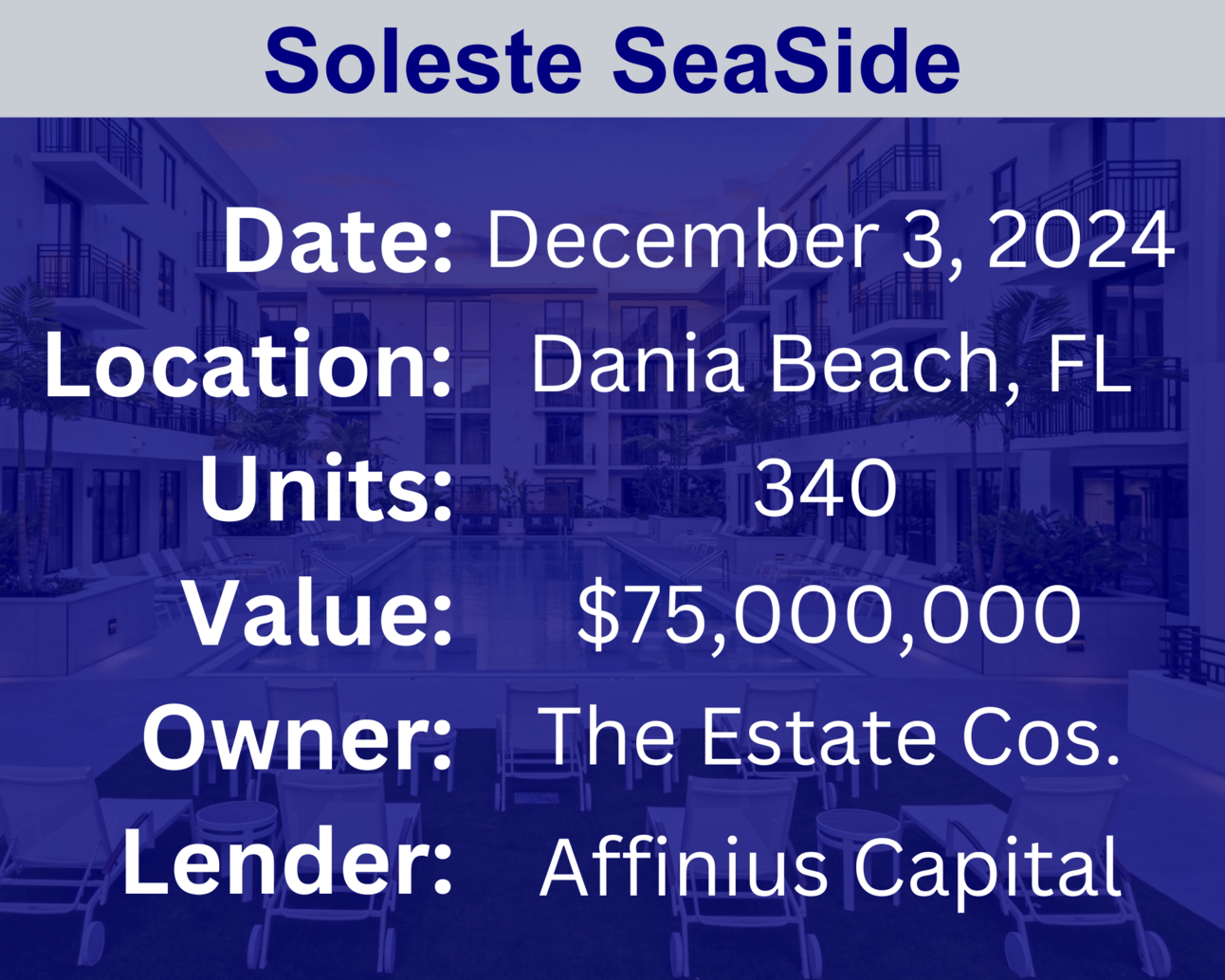

Recent Multifamily Loans (Click to view details)

Question: What are the potential exit strategies for a multifamily investment, and how do you determine the most suitable one? | Answer: Potential exit strategies for a multifamily investment include selling the property on the open market, refinancing to extract equity, or executing a 1031 exchange to defer taxes by reinvesting proceeds into another property. The most suitable exit strategy depends on factors such as market conditions, investment goals, cash flow requirements, and overall portfolio strategy. Conducting thorough financial analysis and consulting with real estate professionals can help determine the optimal exit strategy aligned with investment objectives. |

🕵️🔎Want to get your question answered? Click here to submit your question

Jeff Currie: Repricing of Macro Markets MacroVoices Erik Townsend & Patrick Ceresna welcome back, Jeff Currie. They’ll delve into all things macro, from treasury yields and credit spreads to unusual pricing patterns across various asset classes. They’ll also explore energy markets, copper, nuclear energy, and the implications of Chris Wright’s potential role as Energy Secretary in the incoming Trump administration. |

Quiz of The Week

What is the primary benefit of investing in multifamily properties over single-family homes?

a. Higher rental income potential

b. Lower maintenance costs

c. Fewer tenants to manage

lɐᴉʇuǝʇod ǝɯoɔuᴉ lɐʇuǝɹ ɹǝɥɓᴉH .ɐ

Random Tip of the Week

✅ Leverage 1031 Exchange for Tax Deferral - Use a 1031 exchange to defer taxes on capital gains when you sell a property and reinvest the proceeds into another like-kind property. This can accelerate your portfolio’s growth.

Current Rates (Weekly Update)

10-Year Treasury - 4.23% (⬇️ .15%)

Fed Funds Rate - 4.58% (0%)

1-Month Term SOFR - 4.52% (⬇️ .08%)

About Nuvo Capital Partners

Nuvo Capital Partners is a niche market-focused multifamily investment platform operating throughout the Southeastern United States. As a dedicated sponsor (General Partner), we specialize in institutional quality real estate investments within these regions. Our team comprises industry professionals with 25+ years of combined experience, ensuring expertise and market knowledge. We pride ourselves on offering a transparent investment process, providing our investors with access to high-quality real estate opportunities while upholding integrity throughout.

📩 Was this forwarded? Join for future investigations, Sign Up Here