- Undercover Real Estate

- Posts

- Home Costs Strengthen Multifamily

Home Costs Strengthen Multifamily

Unveiling the Market's Secrets from Behind the Scenes

📩Was this forwarded? Join for future investigations, Sign Up Here

“This week, the 30-year fixed-rate mortgage averaged 6.22%. On a median-priced home, this could allow a homebuyer to save thousands annually compared to earlier this year, showing that affordability is slowly improving."

- Sam Khater, Chief Economist at Freddie Mac

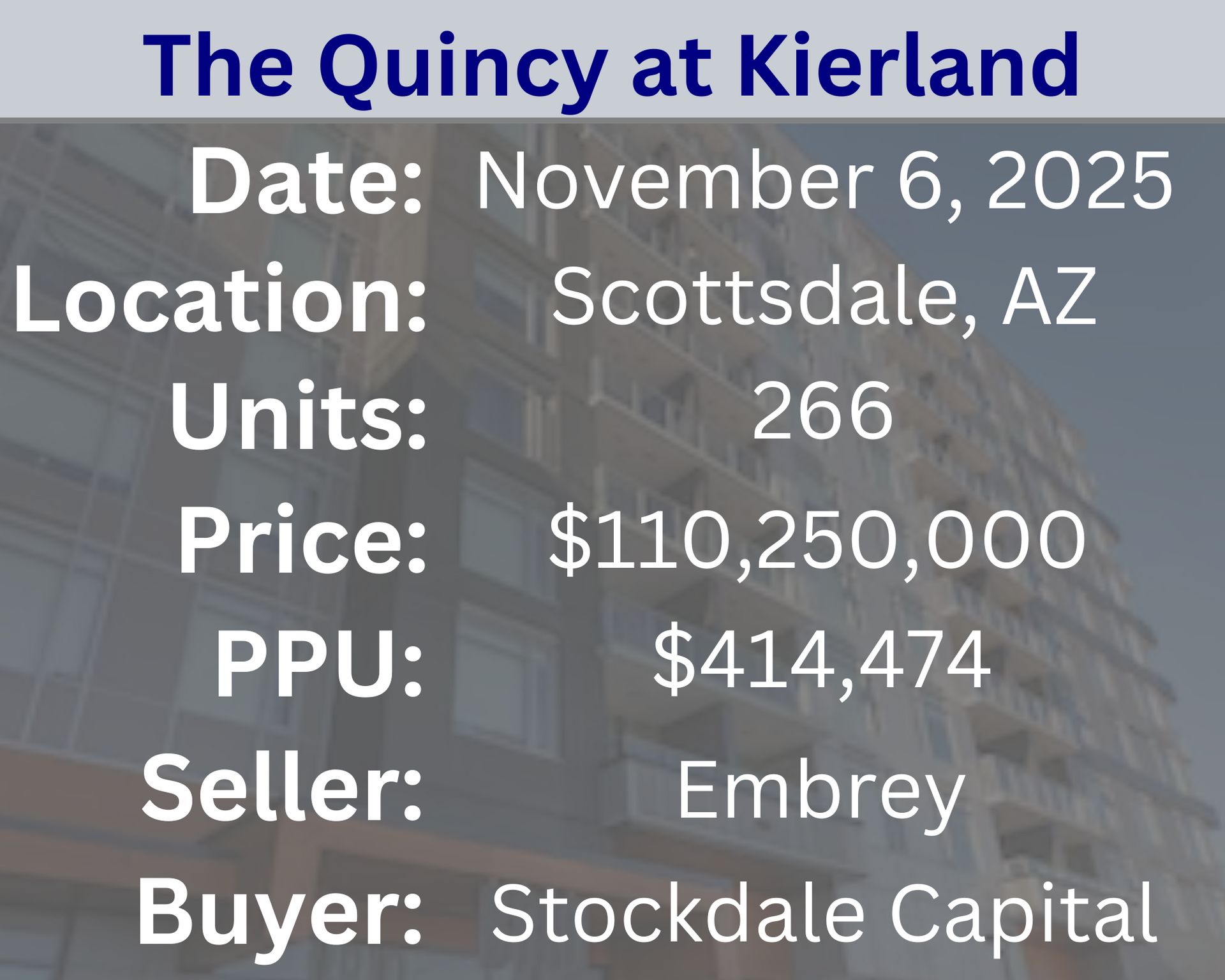

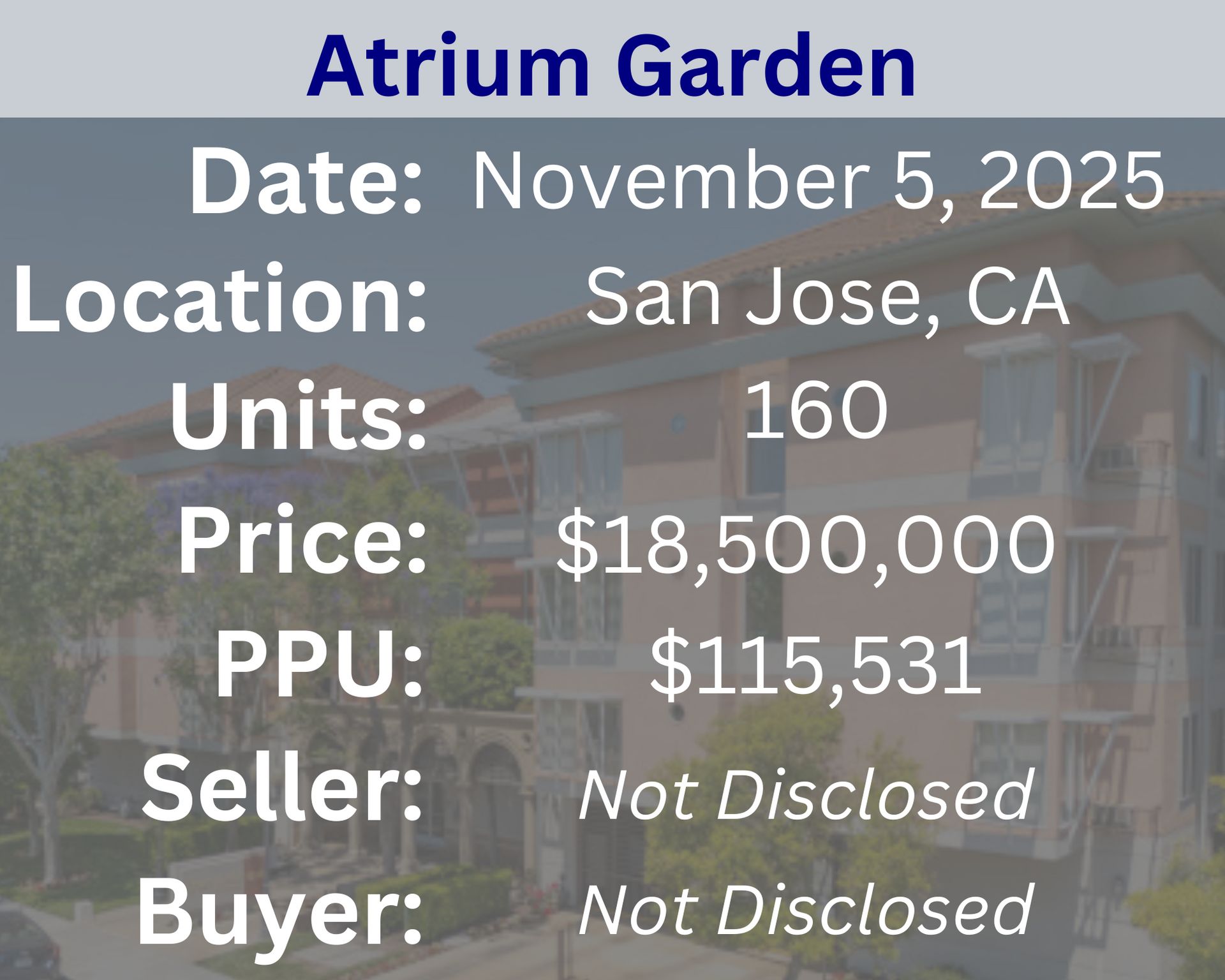

Recent Multifamily Sales (Click to view details)

Recent Multifamily Loans (Click to view details)

Question: What is "value engineering" in multifamily renovations? | Answer: Value engineering in multifamily renovations is the process of optimizing design, materials, and construction methods to achieve the best balance between cost, quality, and performance. It focuses on identifying ways to reduce expenses without compromising functionality, durability, or resident appeal. In practice, this might mean selecting more efficient building systems, durable yet affordable finishes, or reconfiguring spaces to enhance long-term value and return on investment. |

🕵️🔎Want to get your question answered? Click here to submit your question

NYC's Rent Regulation Debate, AI Innovation for CRE, Inside the Loans Driving Distress & Notable Transactions In this week’s TreppWire Podcast, we unpack the government shutdown’s market impact, the Fed’s cautious stance, and New York City’s shifting real estate landscape. We also spotlight OpenAI’s new partnership with Amazon, Trepp’s latest AI tools, October CMBS delinquency trends, and key multifamily and industrial property sales. |

Quiz of The Week

What is the purpose of a "lease agreement" in a multifamily setting?

a. To outline the terms and conditions between landlord and tenant

b. To provide a list of local restaurants

c. To document the property's construction history

ʇuǝuǝʇ puɐ pɹoʅpuɐʅ uǝǝʍʇǝq suompuoɔ puɐ sɯɹǝʇ ǝɥʇ ǝuᴉʅʇno oꓕ .ɐ

Random Tip of the Week

📊 Regularly Analyze Your Competitor Rents - Stay competitive by consistently monitoring what similar properties in your area are charging. This ensures your pricing is optimal for both attracting new tenants and retaining existing ones.

Current Rates (Weekly Update)

10-Year Treasury - 4.15% (⬆️.09)

Fed Funds Rate - 3.87% (⬇️.25%)

1-Month Term SOFR - 3.99% (⬆️.03%)

About Nuvo Capital Partners

Nuvo Capital Partners is a niche market-focused multifamily investment platform operating throughout the Southeastern United States. As a dedicated sponsor (General Partner), we specialize in institutional quality real estate investments within these regions. Our team comprises industry professionals with 25+ years of combined experience, ensuring expertise and market knowledge. We pride ourselves on offering a transparent investment process, providing our investors with access to high-quality real estate opportunities while upholding integrity throughout.

📩 Was this forwarded? Join for future investigations, Sign Up Here