- Undercover Real Estate

- Posts

- Markets Wait for January

Markets Wait for January

Unveiling the Market's Secrets from Behind the Scenes

📩 Was this forwarded? Join for future investigations, Sign Up Here

"Given that today's numbers were not a bad as feared, in conjunction with hawkish statements from the Fed recently, it does appear that the Fed will skip a cut in December. But with the negative trend in labor markets remaining in place, we'd expect the Fed to resume cutting in their next meeting in January 2026, if they don't cut this December.”

- Preston Caldwell , Chief US Economist at Morningstar Investment Management

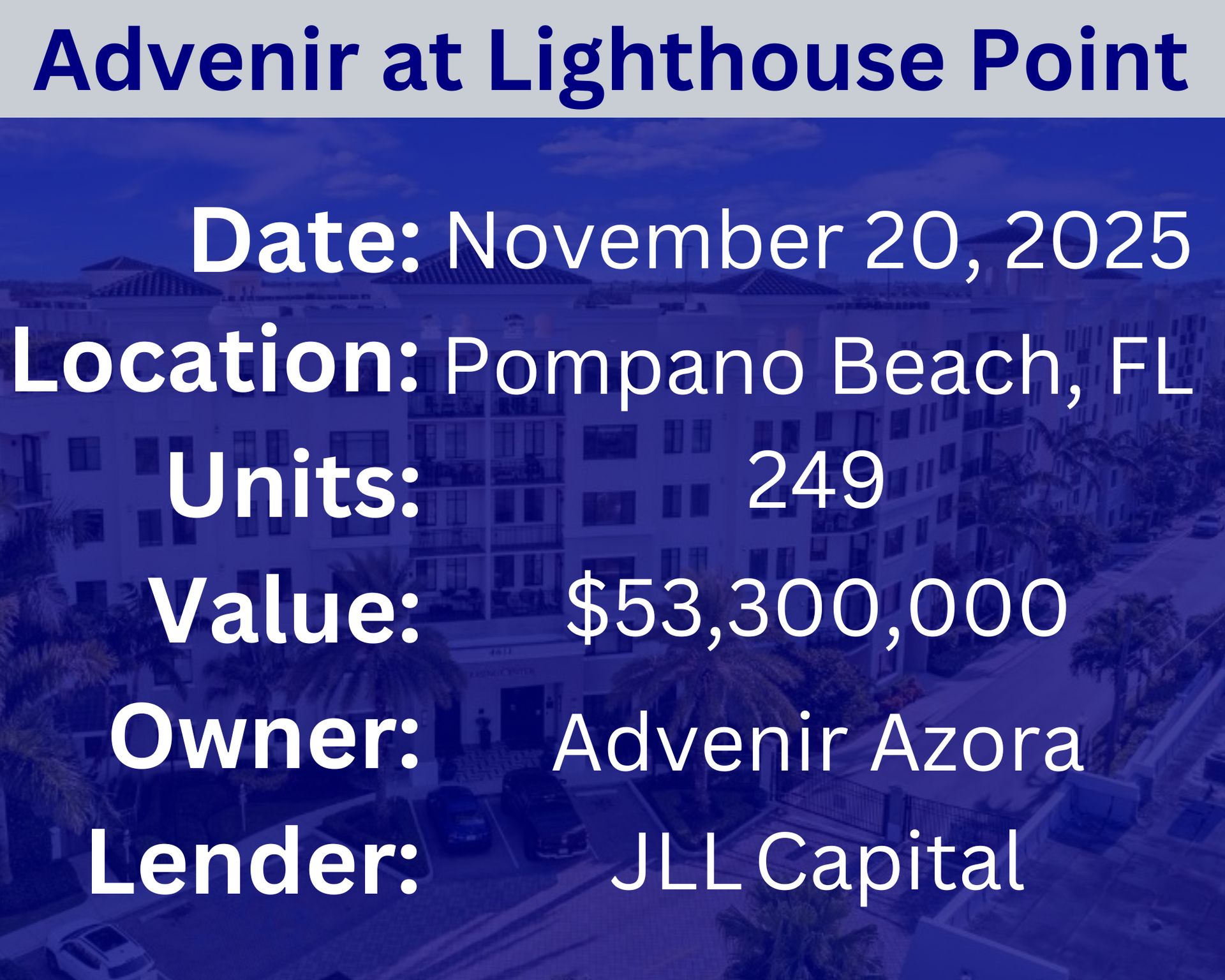

Recent Multifamily Sales (Click to view details)

Recent Multifamily Loans (Click to view details)

Question: How does "gentrification" affect multifamily investment opportunities? | Answer: Gentrification often boosts property values and increases rental demand, which can create strong profit potential for multifamily investors. As neighborhoods improve, these properties may appreciate faster than those in non-transitioning areas. However, gentrification also raises acquisition and renovation costs, making entry more expensive. It can create affordability issues that narrow the pool of potential tenants. Investors must carefully balance the promise of higher returns with the risks of rising expenses and possible community resistance. |

🕵️🔎Want to get your question answered? Click here to submit your question

Reading the Commercial Real Estate Room: Office Bifurcation, Retail Divergence, & SASB Reality Checks In this week’s episode of The TreppWire Podcast, we examine the latest Fed signals as the October FOMC minutes highlight a growing split inside the committee and a wider range of potential outcomes heading into year-end. In commercial real estate, we dig into the rising optimism in office lending and why the narrative is far from uniform... Class A assets are seeing real momentum while B/C properties face a multi-year reset. We also cover mixed retail earnings and discuss how shifting consumer behavior and remodel strategies are reshaping demand. |

Quiz of The Week

What is a "property management company" primarily responsible for?

a. Designing the architecture of new buildings

b. Overseeing the daily operations and maintenance of a property

c. Selling individual units to new owners

ʎʇɹǝdoɹd ɐ ⅎo ǝɔuɐuǝʇuᴉɐɯ puɐ suoᴉʇɐɹǝdo ʎʅᴉɐp ǝɥʇ ƃuᴉsɹǝǝʌɹO .q

Random Tip of the Week

🔬 Conduct Regular Market Feasibility Studies - Before acquiring or developing, thoroughly analyze supply and demand, absorption rates, and competitive landscapes to ensure your investment aligns with market realities.

Current Rates (Weekly Update)

10-Year Treasury - 4.12% (⬆️.06%)

Fed Funds Rate - 3.88% (⬆️.01%)

1-Month Term SOFR - 3.95% (0%)

About Nuvo Capital Partners

Nuvo Capital Partners is a niche market-focused multifamily investment platform operating throughout the Southeastern United States. As a dedicated sponsor (General Partner), we specialize in institutional quality real estate investments within these regions. Our team comprises industry professionals with 25+ years of combined experience, ensuring expertise and market knowledge. We pride ourselves on offering a transparent investment process, providing our investors with access to high-quality real estate opportunities while upholding integrity throughout.

📩 Was this forwarded? Join for future investigations, Sign Up Here