- Undercover Real Estate

- Posts

- Multifamily Confidence on Upswing

Multifamily Confidence on Upswing

Unveiling the Market's Secrets from Behind the Scenes

📩Was this forwarded? Join for future investigations, Sign Up Here

“Multifamily developer confidence and sentiment are showing slight signs of improvement when compared to this time last year. High interest rates, rising construction costs, limited land availability and restrictive local regulations are still significant issues in certain parts of the country. But confidence in subsidized affordable housing has shown considerable improvement in this survey, due in part to optimism surrounding the expansion of federal affordable housing resources flowing from the recent congressional reconciliation bill.”

- Debra Guerrero, Senior VP - Strategic Partnerships and Governmental Relations at The NRP Group

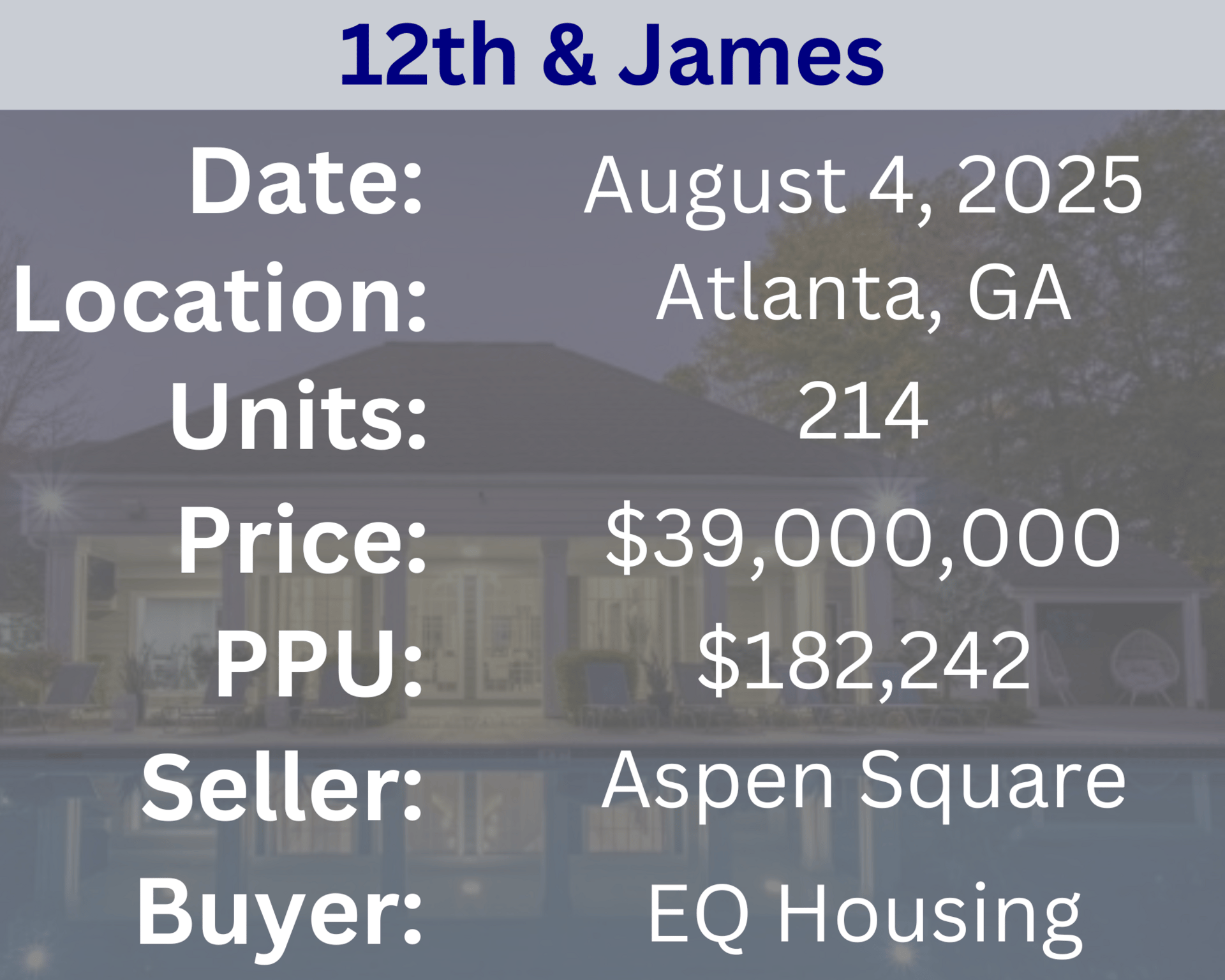

Recent Multifamily Sales (Click to view details)

Recent Multifamily Loans (Click to view details)

Question: What are "preferred returns" in a multifamily syndication? | Answer: In a multifamily syndication, a preferred return is a set percentage of profits that passive investors are entitled to receive before the syndicator (or general partner) earns their share of profits. It’s designed to prioritize investor payouts, ensuring they receive a minimum return—often around 6–8%—before profit-splitting begins. This structure helps align the sponsor’s interests with the investors’ and reduces risk for the limited partners. |

🕵️🔎Want to get your question answered? Click here to submit your question

Appraisal Sector Shakeup, Lodging Capex Crunch, Multifamily Planned Liquidation & Expansion to Industrial This week on The TreppWire Podcast: weak labor data, Fed rate cut expectations, and the appraisal regulator crisis. We cover lodging risks from pandemic underinvestment, multifamily portfolio sales and affordable housing wins, plus S2 Capital’s industrial acquisition and Chris Powers’ tech pivot. We close with notable mixed-use deals. |

Quiz of The Week

What is the significance of "location" in multifamily real estate?

a. It dictates the color scheme of the building

b. It heavily influences property value, rentability, and tenant demand

c. It determines the number of parking spaces available

puɐɯǝp ʇuǝuǝʇ puɐ 'ʎʇᴉʅᴉqɐʇuǝɹ 'ǝnʅɐʌ ʎʇɹǝdoɹd sǝɔuǝnʅⅎuᴉ ʎʅᴉʌɐǝɥ ʇI .q

Random Tip of the Week

👩💼 Invest in Top-Tier Property Management Leadership - Strong, experienced property management leadership is crucial for executing macro strategies, optimizing operations, and achieving financial goals across your portfolio.

Current Rates (Weekly Update)

10-Year Treasury - 4.29% (⬆️.09%)

Fed Funds Rate - 4.33% (0%)

1-Month Term SOFR - 4.36% (⬆️.02%)

About Nuvo Capital Partners

Nuvo Capital Partners is a niche market-focused multifamily investment platform operating throughout the Southeastern United States. As a dedicated sponsor (General Partner), we specialize in institutional quality real estate investments within these regions. Our team comprises industry professionals with 25+ years of combined experience, ensuring expertise and market knowledge. We pride ourselves on offering a transparent investment process, providing our investors with access to high-quality real estate opportunities while upholding integrity throughout.

📩 Was this forwarded? Join for future investigations, Sign Up Here