- Undercover Real Estate

- Posts

- Multifamily Demand Builds Momentum

Multifamily Demand Builds Momentum

Unveiling the Market's Secrets from Behind the Scenes

📩 Was this forwarded? Join for future investigations, Sign Up Here

“In the first full week of the new year, mortgage rates remained within a narrow range, hovering close to the 6% mark. The combination of solid economic growth and lower rates has led to improving momentum in for-sale residential demand, with purchase applications up over 20% from a year ago.”

- Sam Khater, Chief Economist at Freddie Mac

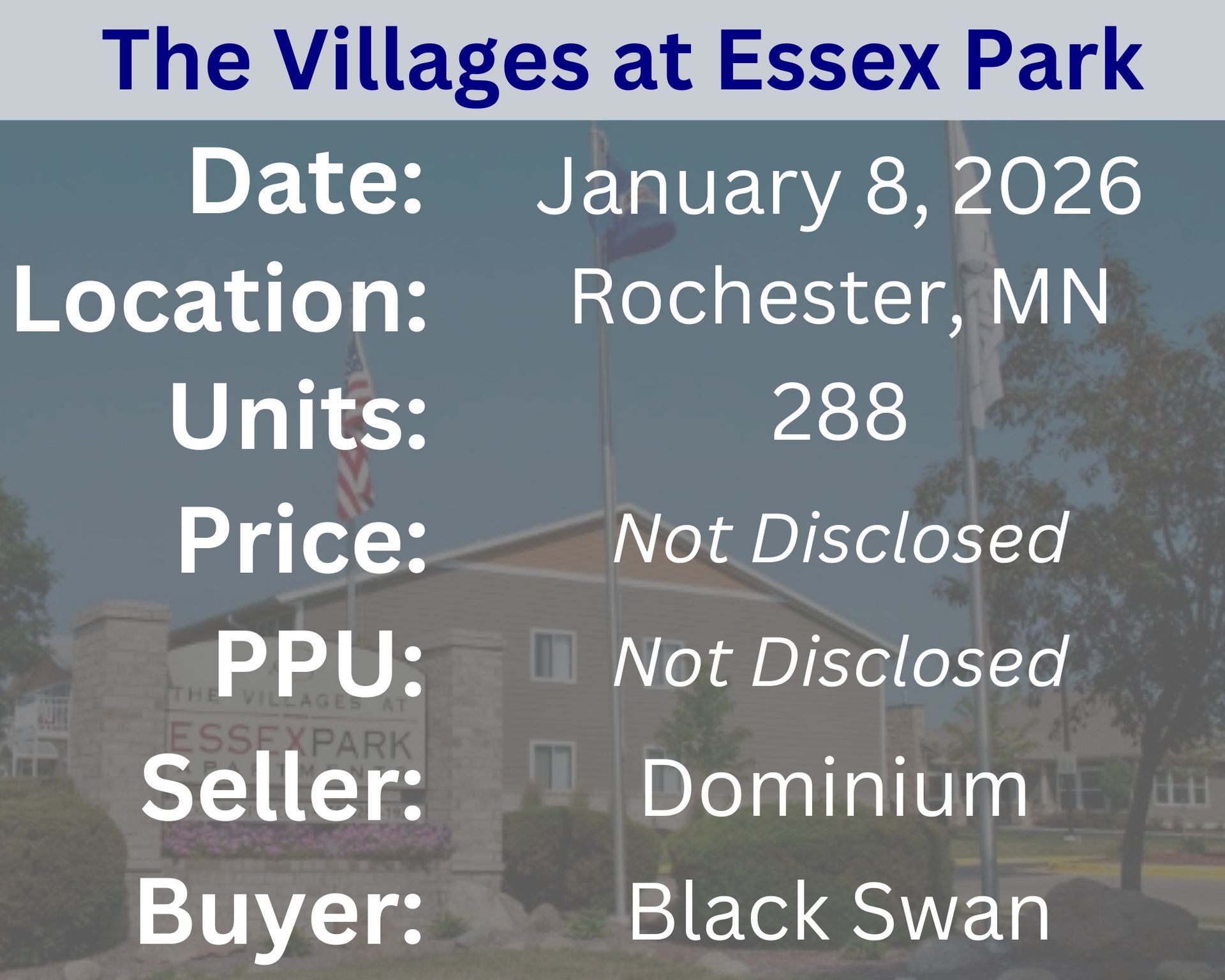

Recent Multifamily Sales (Click to view details)

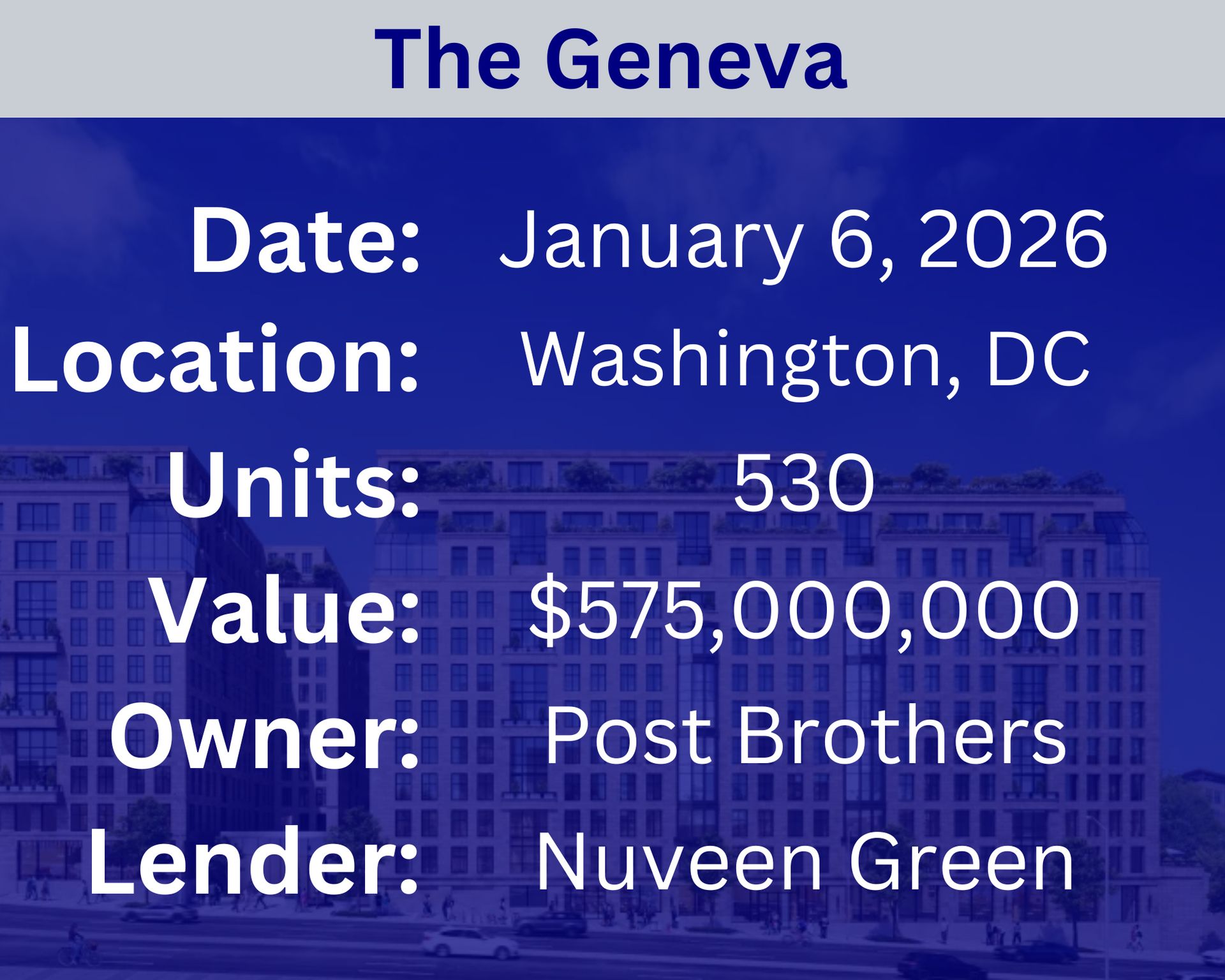

Recent Multifamily Loans (Click to view details)

Question: Why should investors analyze utility expense trends monthly? | Answer: Investors should analyze utility expense trends monthly because these costs can significantly affect a company’s operating margins and cash flow, and regular monitoring helps identify inefficiencies, cost inflation, or unusual spikes early. Monthly analysis allows investors to distinguish between normal seasonal fluctuations and structural increases in energy or water usage, assess management’s cost-control effectiveness, and anticipate future profitability impacts. By tracking trends over time, investors gain better insight into operational stability, risk exposure to energy price volatility, and the sustainability of earnings, which supports more informed valuation and investment decisions. |

🕵️🔎Want to get your question answered? Click here to submit your question

Darius Dale: 2026, Fasten Your Seat belts For Take-off MacroVoices Erik Townsend & Patrick Ceresna welcome, Darius Dale. They discuss why Darius thinks that one year from now in January 2027, we’ll probably look back on 2026 as an up year for most financial markets. But Darius says put your seat belt on for the first few months of the year, which he thinks could be quite turbulent. |

Quiz of The Week

What is the significance of "location" in multifamily real estate?

a. It dictates the color scheme of the building

b. It heavily influences property value, rentability, and tenant demand

c. It determines the number of parking spaces available

puɐɯǝp ʇuǝuǝʇ puɐ 'ʎʇᴉʅᴉqɐʇuǝɹ 'ǝnʅɐʌ ʎʇɹǝdoɹd sǝɔuǝnʅⅎuᴉ ʎʅᴉʌɐǝɥ ʇI .q

Random Tip of the Week

📊 Make Data the Backbone of Decision-Making – Use historical trends and current metrics to guide pricing, staffing, and capital improvements. Emotional or anecdotal decisions often lead to missed opportunities or unnecessary costs.

Current Rates (Weekly Update)

10-Year Treasury - 4.16% (⬆️.04%)

Fed Funds Rate - 3.64% (0%)

1-Month Term SOFR - 3.67% (⬇️.04%)

About Nuvo Capital Partners

Nuvo Capital Partners is a niche market-focused multifamily investment platform operating throughout the Southeastern United States. As a dedicated sponsor (General Partner), we specialize in institutional quality real estate investments within these regions. Our team comprises industry professionals with 25+ years of combined experience, ensuring expertise and market knowledge. We pride ourselves on offering a transparent investment process, providing our investors with access to high-quality real estate opportunities while upholding integrity throughout.

📩 Was this forwarded? Join for future investigations, Sign Up Here