- Undercover Real Estate

- Posts

- Multifamily Financing Grows Stronger

Multifamily Financing Grows Stronger

Unveiling the Market's Secrets from Behind the Scenes

📩Was this forwarded? Join for future investigations, Sign Up Here

“Following 2023’s low-volume year, multifamily lending picked up in 2024, with activity increasing across lenders of all sizes and capital sources. While the multifamily market is served by some of the largest institutions in the country, it remains broad and diverse, with more than half of lenders active in the space making only a handful of loans in a year.”

- Reggie Booker, Associate VP Commercial/Multifamily Research at MBA

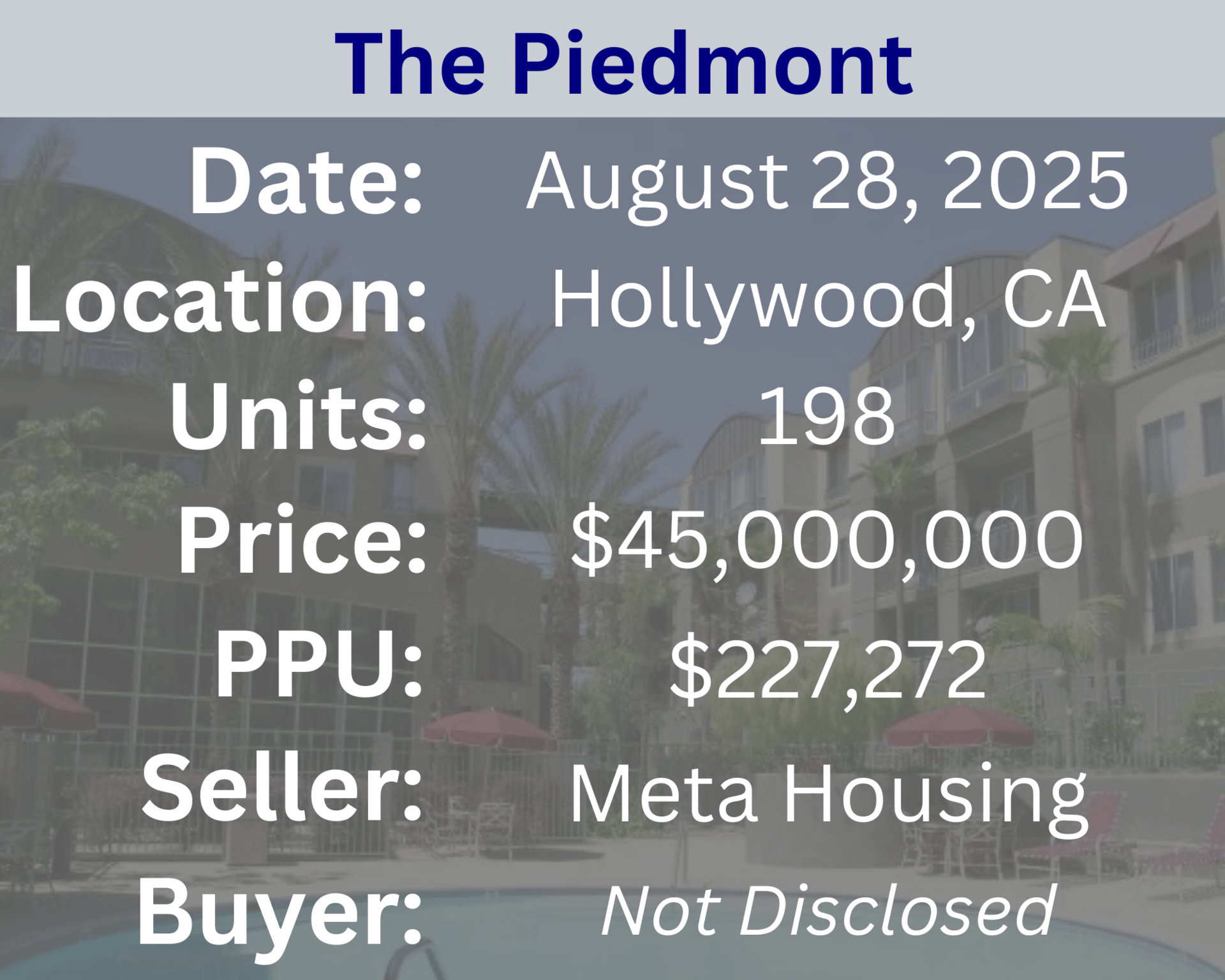

Recent Multifamily Sales (Click to view details)

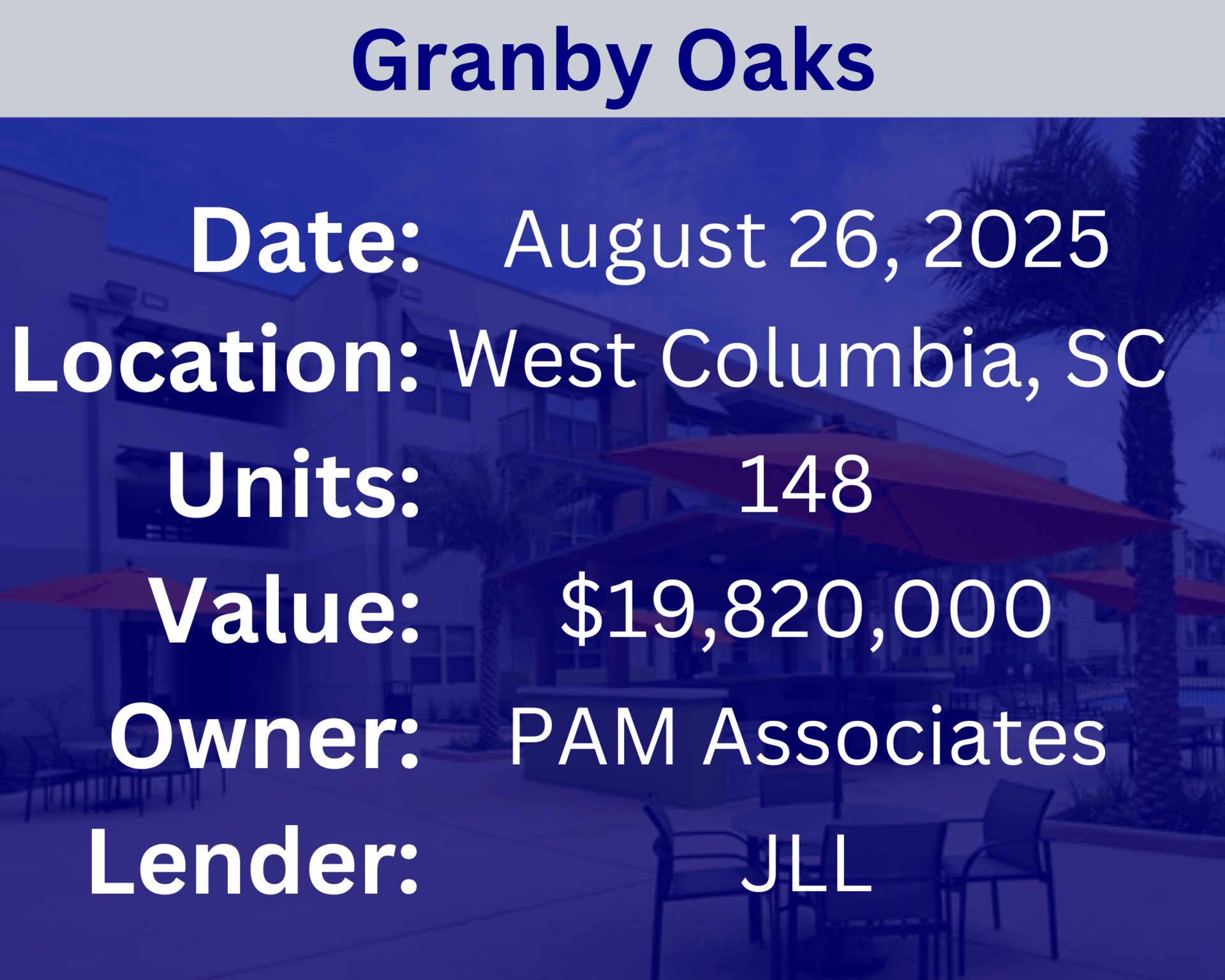

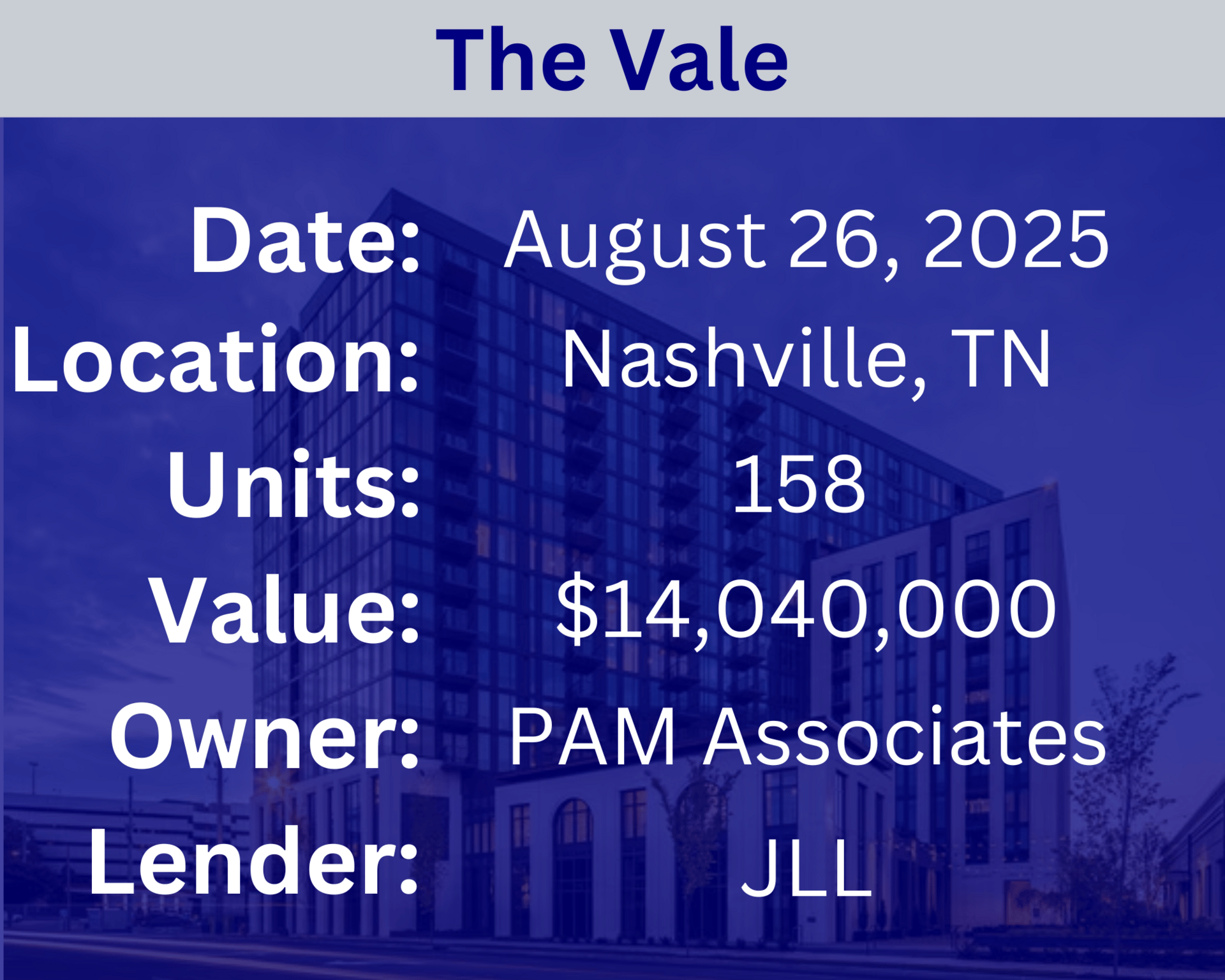

Recent Multifamily Loans (Click to view details)

Question: What is the difference between Net Operating Income (NOI) and cash flow, and which is more important? | Answer: Net Operating Income (NOI) is a measure of a property's profitability before accounting for debt service (mortgage payments) and income taxes. It's calculated by subtracting all operating expenses (e.g., property taxes, insurance, management fees, maintenance) from the property’s total rental income. Cash flow, on the other hand, is the actual amount of money remaining after all expenses, including debt service, have been paid. While NOI is crucial for evaluating a property’s inherent performance and calculating metrics like the Cap Rate, cash flow is arguably more important for the investor's personal finances as it represents the actual money they will receive from the investment after all bills are paid. A property can have a positive NOI but a negative cash flow if the mortgage payments are too high. |

🕵️🔎Want to get your question answered? Click here to submit your question

Jim Bianco: The Post Covid Economy MacroVoices Erik Townsend & Patrick Ceresna welcome, Jim Bianco. They discuss, whether a fed rate cut is even a good idea, inflation risks, the unobvious relationship between the jobs report and the southern border, why cutting short term rates could actually shock long-term yields higher, and much much more. |

Quiz of The Week

Which of the following would NOT be considered an operating expense for a multifamily property?

a. Property management fees

b. Property taxes

c. Mortgage interest payments

sʇuǝɯʎɐd ʇsǝɹǝʇuᴉ ǝƃɐƃʇɹoW .ɔ

Random Tip of the Week

🏡 Understanding Your Target Demographic - Whether it's young professionals, families, or students—helps you tailor your amenities, marketing, and rental rates to attract and retain the most suitable residents.

Current Rates (Weekly Update)

10-Year Treasury - 4.22% (⬇️.03%)

Fed Funds Rate - 4.33% (0%)

1-Month Term SOFR - 4.25% (⬇️.06%)

About Nuvo Capital Partners

Nuvo Capital Partners is a niche market-focused multifamily investment platform operating throughout the Southeastern United States. As a dedicated sponsor (General Partner), we specialize in institutional quality real estate investments within these regions. Our team comprises industry professionals with 25+ years of combined experience, ensuring expertise and market knowledge. We pride ourselves on offering a transparent investment process, providing our investors with access to high-quality real estate opportunities while upholding integrity throughout.

📩 Was this forwarded? Join for future investigations, Sign Up Here