- Undercover Real Estate

- Posts

- Multifamily Impact of Credit

Multifamily Impact of Credit

Unveiling the Market's Secrets from Behind the Scenes

📩 Was this forwarded? Join for future investigations, Sign Up Here

"Specifically, people will lose access to credit, like on a very, very extensive and broad basis, especially the people who need it the most, ironically. And so, that's a pretty severely negative consequence for consumers, and frankly, probably also a negative consequence for the economy as a whole right now.”

- Jeremy Barnum, CFO at JPMorgan

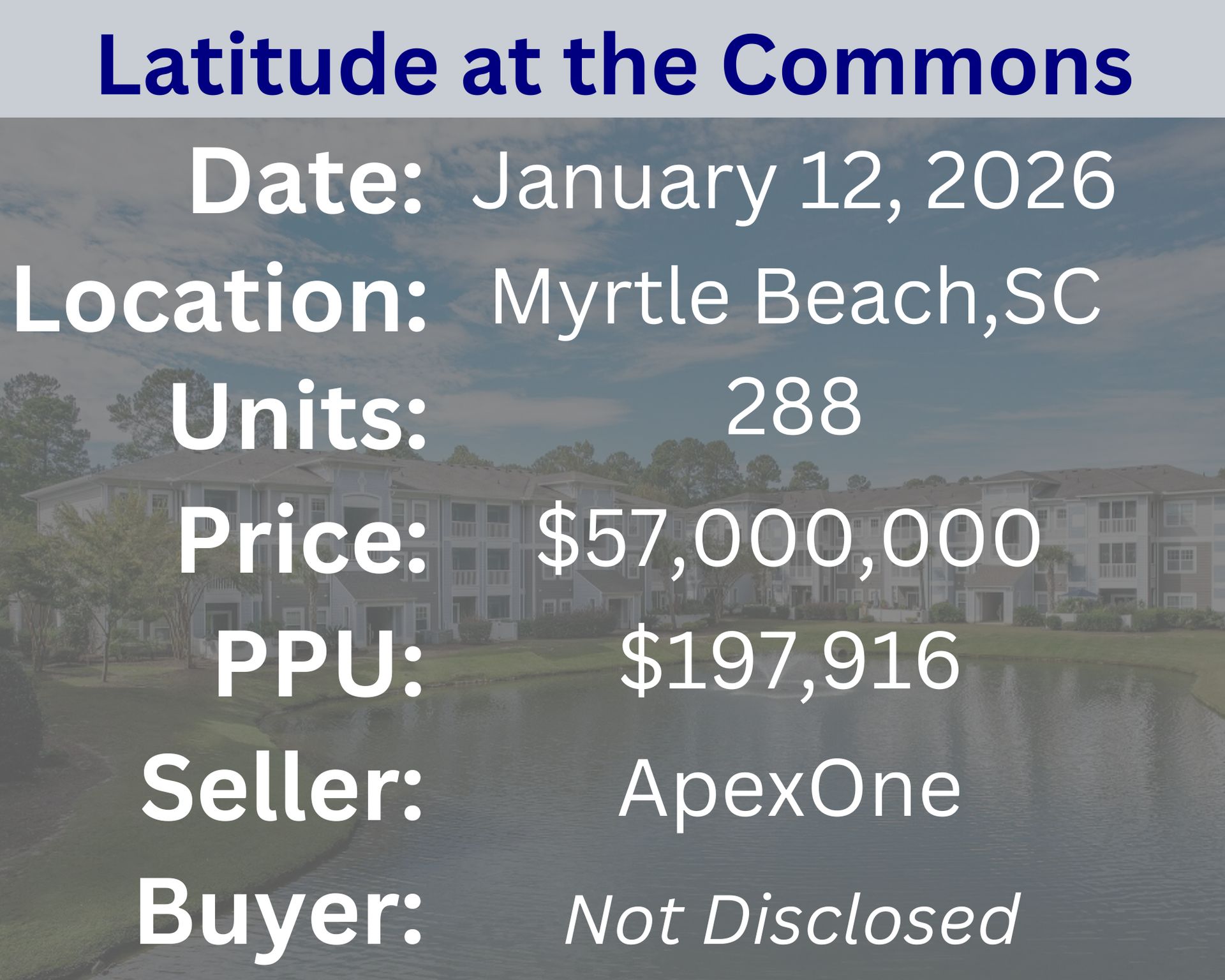

Recent Multifamily Sales (Click to view details)

Recent Multifamily Loans (Click to view details)

Question: How can technology (e.g., smart home features) impact multifamily investments? | Answer: Technology, particularly smart home features, can significantly enhance multifamily investments by increasing property value, improving operational efficiency, and attracting and retaining tenants. Smart thermostats, keyless entry, energy monitoring, and integrated building management systems can reduce utility and maintenance costs while providing data that helps owners optimize performance. For residents, these features offer convenience, security, and energy savings, which can justify higher rents and lower vacancy rates. Additionally, technology-enabled properties often appeal to younger, tech-savvy renters and support scalable management across portfolios, ultimately boosting net operating income and long-term asset competitiveness. |

🕵️🔎Want to get your question answered? Click here to submit your question

The Fight Over Fed Independence Just Got Taken To a Whole New Level Political pressure on the Fed has intensified under the new Trump administration, and the stakes just jumped again. After clashes over interest rates, office renovations, and a Supreme Court-bound fight over Governor Lisa Cook, news broke that Fed Chair Jerome Powell was served with a DOJ subpoena—something Powell has called political retaliation. On this episode, Columbia Law professor Lev Menand, author of The Fed Unbound, explains what this means for Fed independence and why DOJ involvement marks a major escalation. |

Quiz of The Week

What is a "turnover rate" in multifamily housing?

a. The frequency of apartment renovations

b. The rate at which tenants move out and new ones move in

c. The speed at which maintenance requests are fulfilled

uᴉ ǝʌoɯ sǝuo uɐǝu puɐ ʇno ǝʌoɯ sʇuǝuǝʇ ɥɔᴉɥʍ ʇɐ ǝʇɐɹ ǝɥꓕ .q

Random Tip of the Week

🧩 Consistency Beats Perfection in Operations – Small, repeatable improvements in leasing, maintenance, and resident experience compound over time. A disciplined operational approach often outperforms sporadic, large-scale changes.

Current Rates (Weekly Update)

10-Year Treasury - 4.17% (⬆️.01%)

Fed Funds Rate - 3.64% (0%)

1-Month Term SOFR - 3.67% (0%)

About Nuvo Capital Partners

Nuvo Capital Partners is a niche market-focused multifamily investment platform operating throughout the Southeastern United States. As a dedicated sponsor (General Partner), we specialize in institutional quality real estate investments within these regions. Our team comprises industry professionals with 25+ years of combined experience, ensuring expertise and market knowledge. We pride ourselves on offering a transparent investment process, providing our investors with access to high-quality real estate opportunities while upholding integrity throughout.

📩 Was this forwarded? Join for future investigations, Sign Up Here