- Undercover Real Estate

- Posts

- Multifamily Market Rate Whiplash

Multifamily Market Rate Whiplash

Unveiling the Market's Secrets from Behind the Scenes

📩Was this forwarded? Join for future investigations, Sign Up Here

“Coming out of the gates, things felt pretty good, but a lot of this year’s volatility was based on [interest] rate movement, which was primarily based on geopolitical issues. Had rates come down methodically more like the last two months, there would have been less of an impact. It’s hard for buyers to make decisions when rates are whipsawing like what we saw the past couple years, when we were at 4 [percent] one quarter and flirting with 4.75 [percent] the next.”

- Drew Kile, Executive Managing Director at Institutional Property Advisors

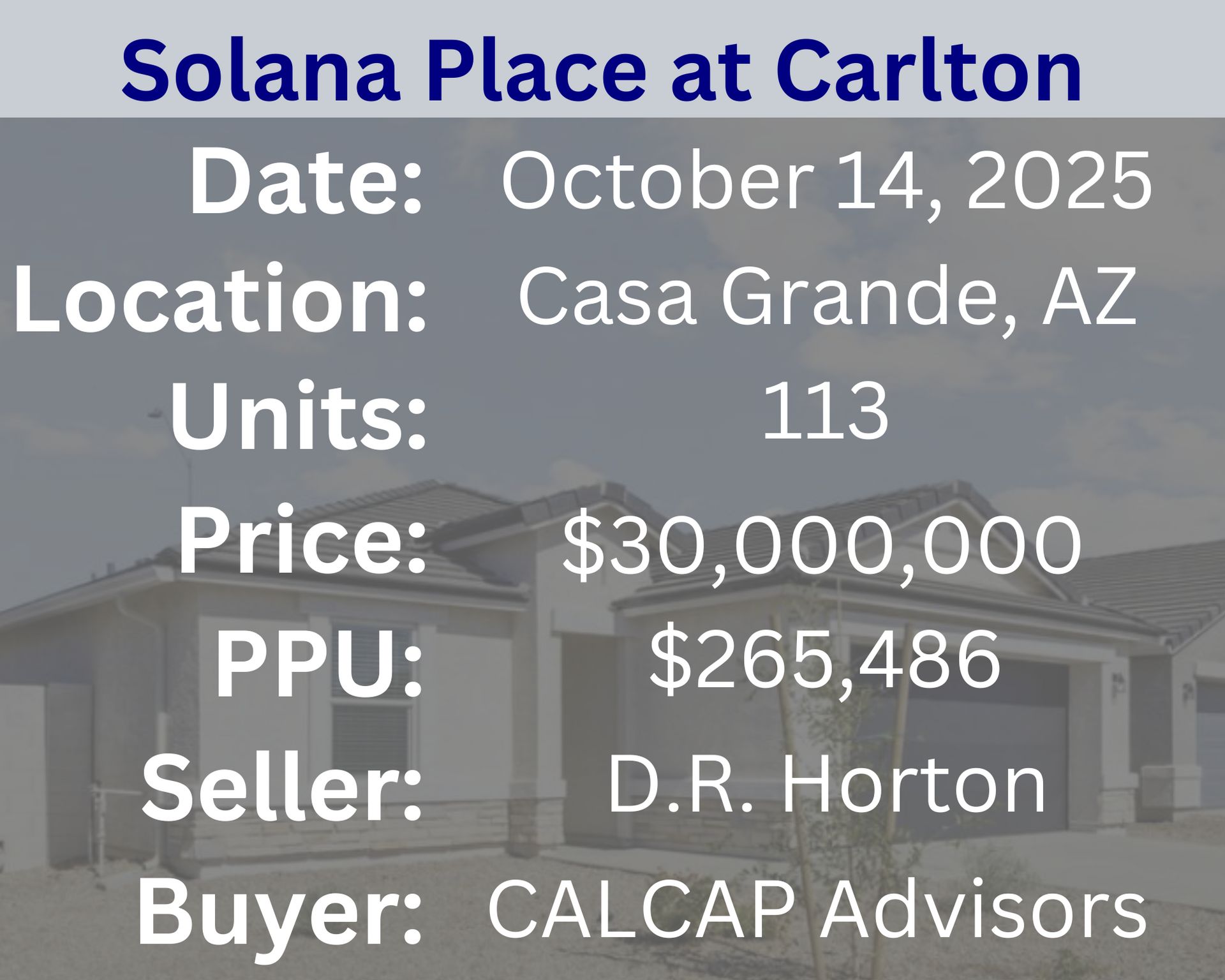

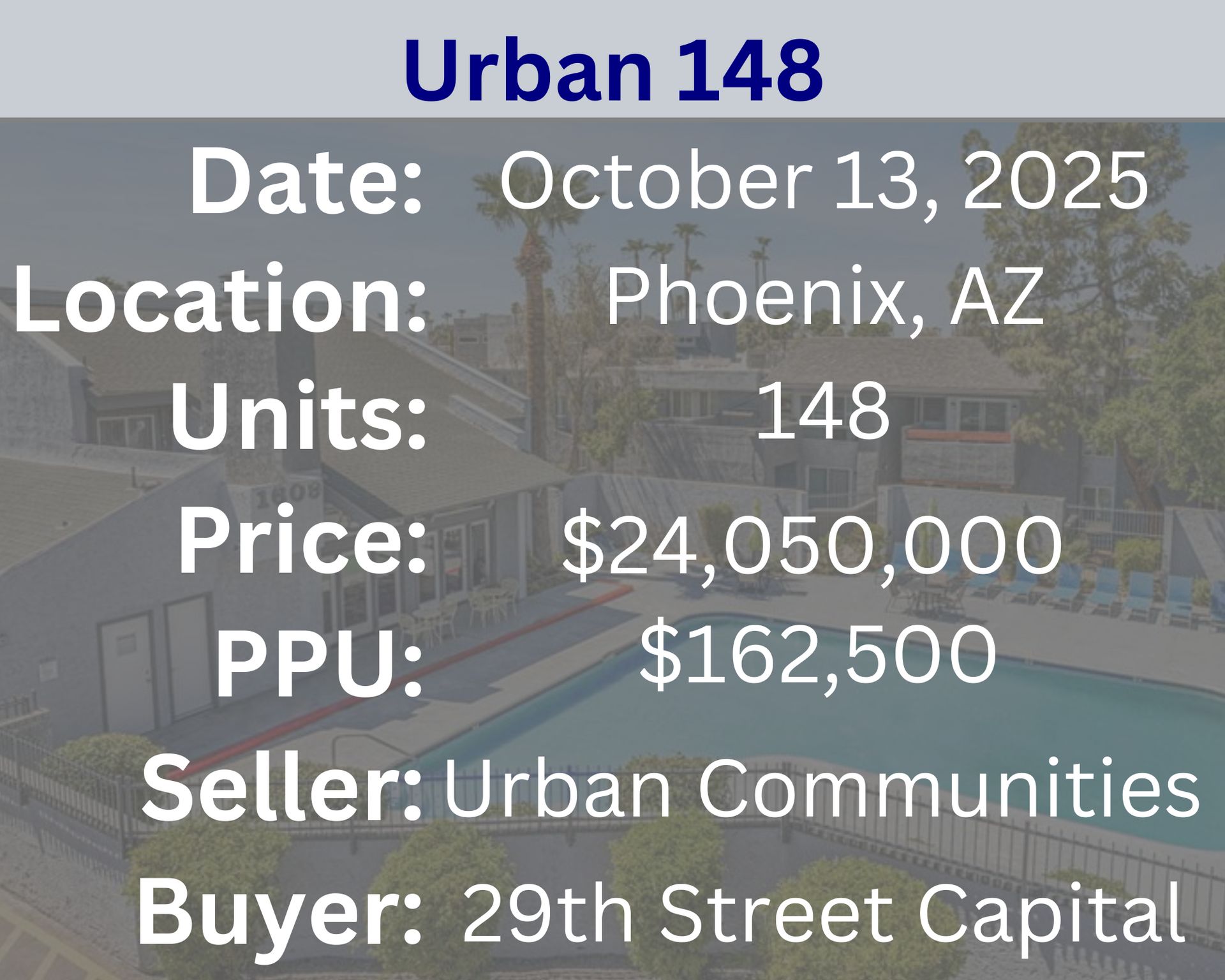

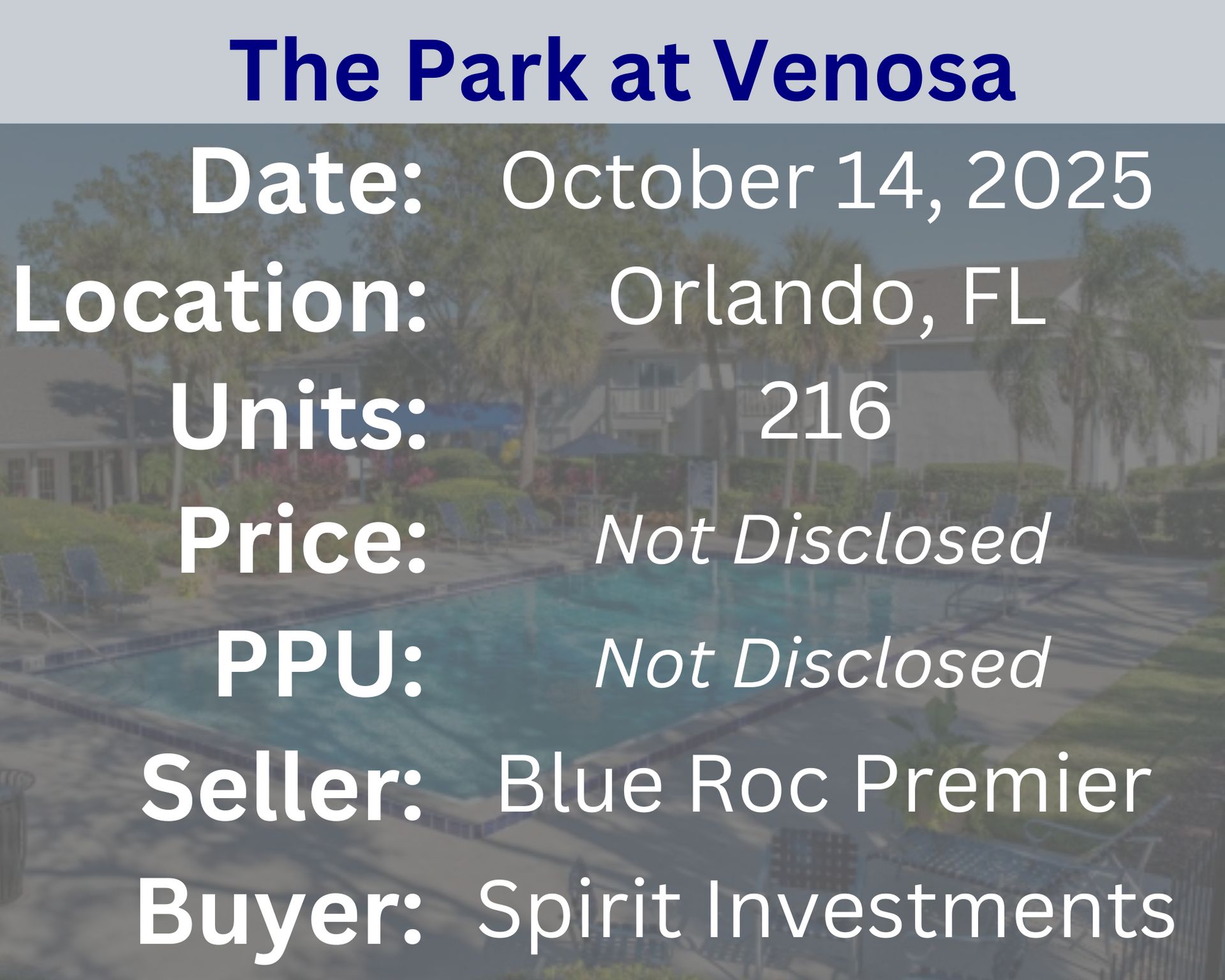

Recent Multifamily Sales (Click to view details)

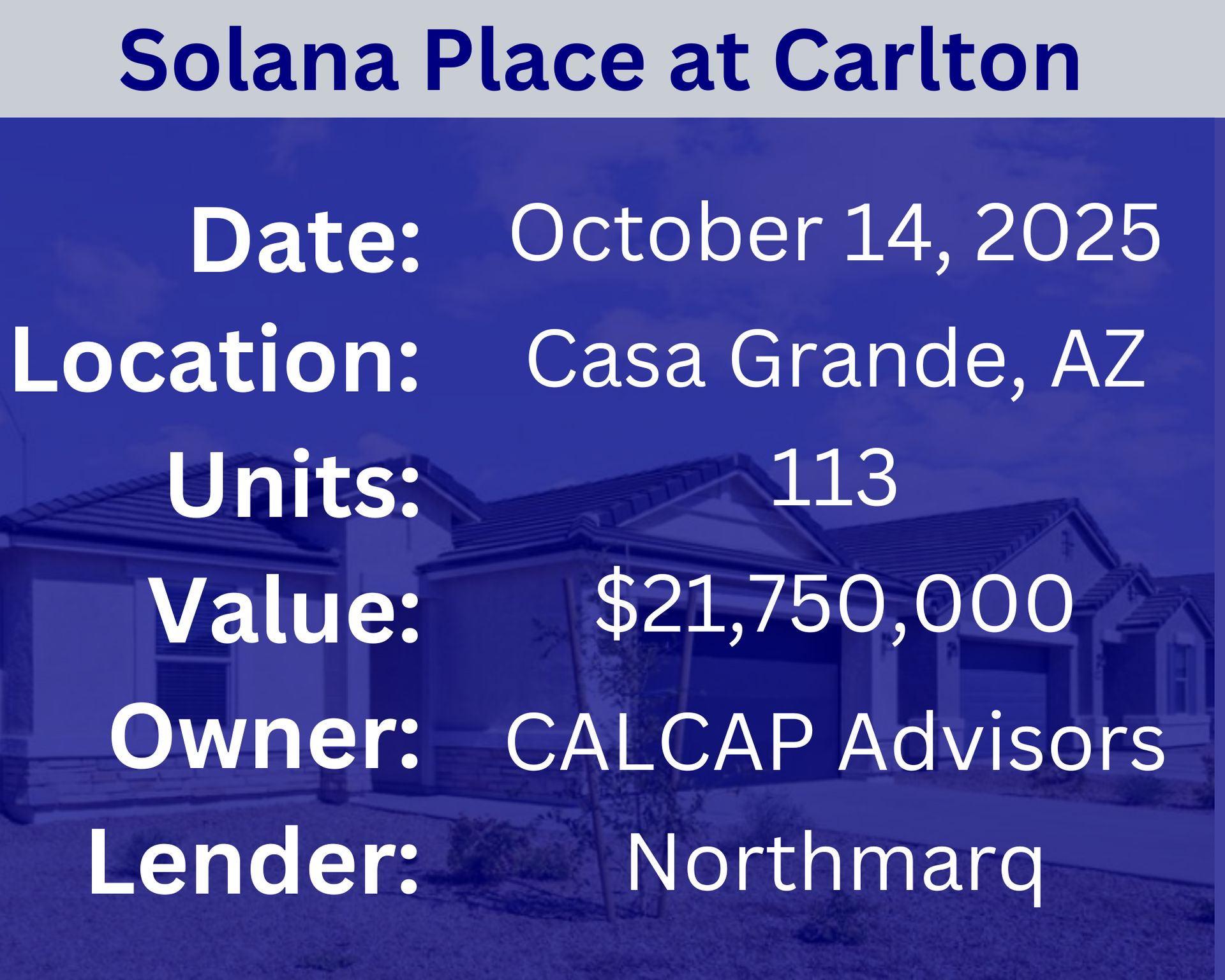

Recent Multifamily Loans (Click to view details)

Question: How does a "recession" typically impact multifamily real estate? | Answer: A recession typically impacts multifamily real estate by slowing rent growth and increasing vacancy rates as job losses and reduced incomes limit tenants’ ability to pay higher rents. However, compared to other property types, multifamily assets often remain relatively resilient since housing is a basic need and demand for rentals may rise when people delay homeownership. Property values can decline due to tighter lending conditions and reduced investor confidence, leading to fewer transactions. Developers may also postpone new construction projects because of financing challenges and lower expected returns. Overall, while recessions create short-term financial pressure, well-located and efficiently managed multifamily properties often recover quickly once the economy stabilizes. |

🕵️🔎Want to get your question answered? Click here to submit your question

Why the Trump Administration is Now Taking Equity Stakes in American Companies It's nothing new for the US government to use public money to support private American companies. The Biden administration, via CHIPS and the Inflation Reduction Act, was aggressive about using loans and grants to accelerate US industry. But the Trump administration has been engaged in something more novel: taking direct stakes in US companies like Intel and MP. |

Quiz of The Week

What does "ROI" stand for in real estate investment?

a. Renters' Overall Income

b. Return On Investment

c. Real Estate Opportunity Index

ʇuǝɯʇsǝʌuI uO uɹnʇǝɹ .q

Random Tip of the Week

📈 Understand Your Target Demographic - Tailor your amenities, marketing, and resident programs to the specific needs and preferences of your ideal tenant, ensuring your property remains attractive.

Current Rates (Weekly Update)

10-Year Treasury - 4.01% (⬇️.12%)

Fed Funds Rate - 4.10% (⬆️.01%)

1-Month Term SOFR - 4.03% (⬇️.05%)

About Nuvo Capital Partners

Nuvo Capital Partners is a niche market-focused multifamily investment platform operating throughout the Southeastern United States. As a dedicated sponsor (General Partner), we specialize in institutional quality real estate investments within these regions. Our team comprises industry professionals with 25+ years of combined experience, ensuring expertise and market knowledge. We pride ourselves on offering a transparent investment process, providing our investors with access to high-quality real estate opportunities while upholding integrity throughout.

📩 Was this forwarded? Join for future investigations, Sign Up Here