- Undercover Real Estate

- Posts

- Multifamily Markets Diverge Ahead

Multifamily Markets Diverge Ahead

Unveiling the Market's Secrets from Behind the Scenes

📩 Was this forwarded? Join for future investigations, Sign Up Here

"The U.S. rental market is largely frozen right now, caught between elevated economic uncertainty and the normal seasonal slowdown we see in the winter months. While new supply deliveries are set to ease in 2026, any rebound in rents is unlikely to be uniform. Markets that have already worked through excess inventory may see a faster snapback than what national averages suggest. The spring leasing season will offer a clearer signal of where the market is headed.”

- Anthemos Georgiades, CEO at Zumper

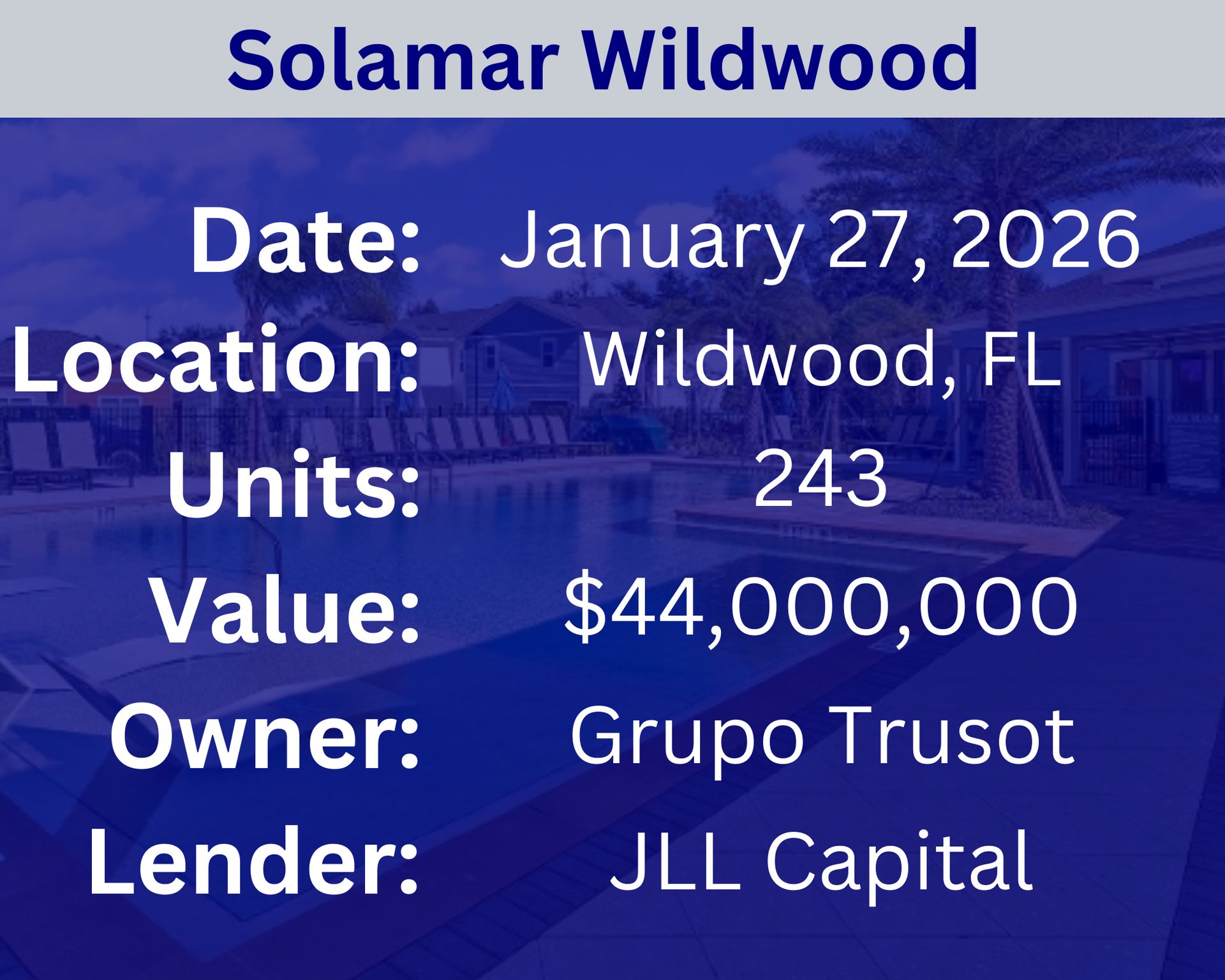

Recent Multifamily Sales (Click to view details)

Recent Multifamily Loans (Click to view details)

Question: What is a "pro forma" and why is it essential for multifamily investors? | Answer: A pro forma is a forward-looking financial projection that estimates a multifamily property’s future income, expenses, and cash flow, and it’s essential for investors because it helps them evaluate whether a deal actually makes financial sense before buying. By laying out assumptions about rent growth, vacancy, operating costs, financing, and exit value, a pro forma allows investors to forecast key metrics like cash-on-cash return, internal rate of return (IRR), and overall profitability, compare different investment opportunities, and identify risks early. In short, it’s the roadmap that turns a property from “interesting” into “investable” by showing how and when it’s expected to make money. |

🕵️🔎Want to get your question answered? Click here to submit your question

Craig Tindale: Critical Materials, A Strategic Analysis MacroVoices Erik Townsend & Patrick Ceresna welcome, Craig Tindale. They’ll discuss why China is holding all the cards, and how those cards were served them, not only on a “silver platter”, but on a platter made from silver mined elsewhere but refined in China. |

Quiz of The Week

Which metric is calculated by dividing the Net Operating Income (NOI) by the property's value?

a. Debt Service Coverage Ratio (DSCR)

b. Capitalization Rate (Cap Rate)

c. Cash-on-Cash Return

ǝʇɐɹ dɐɔ (ǝʇɐɹ dɐɔ) ǝʇɐɹ uoᴉʇɐzᴉʅɐʇᴉdɐɔ ˙q

Random Tip of the Week

📊 Make Data the Backbone of Decision-Making – Use historical trends and current metrics to guide pricing, staffing, and capital improvements. Emotional or anecdotal decisions often lead to missed opportunities or unnecessary costs.

Current Rates (Weekly Update)

10-Year Treasury - 4.22% (⬇️.03%)

Fed Funds Rate - 3.64% (0%)

1-Month Term SOFR - 3.67% (0%)

About Nuvo Capital Partners

Nuvo Capital Partners is a niche market-focused multifamily investment platform operating throughout the Southeastern United States. As a dedicated sponsor (General Partner), we specialize in institutional quality real estate investments within these regions. Our team comprises industry professionals with 25+ years of combined experience, ensuring expertise and market knowledge. We pride ourselves on offering a transparent investment process, providing our investors with access to high-quality real estate opportunities while upholding integrity throughout.

📩 Was this forwarded? Join for future investigations, Sign Up Here