- Undercover Real Estate

- Posts

- Multifamily Metrics Improve in Q2

Multifamily Metrics Improve in Q2

Unveiling the Market's Secrets from Behind the Scenes

📩Was this forwarded? Join for future investigations, Sign Up Here

"In the second quarter, we saw a modest but meaningful improvement in underwriting metrics across both core and value-add multifamily assets. While sentiment around core assets softened slightly, the rebound in value-add buyer confidence and continued cap rate compression reflect growing optimism as market fundamentals stabilize."

- Travis Deese, Director, Multifamily Research at CBRE

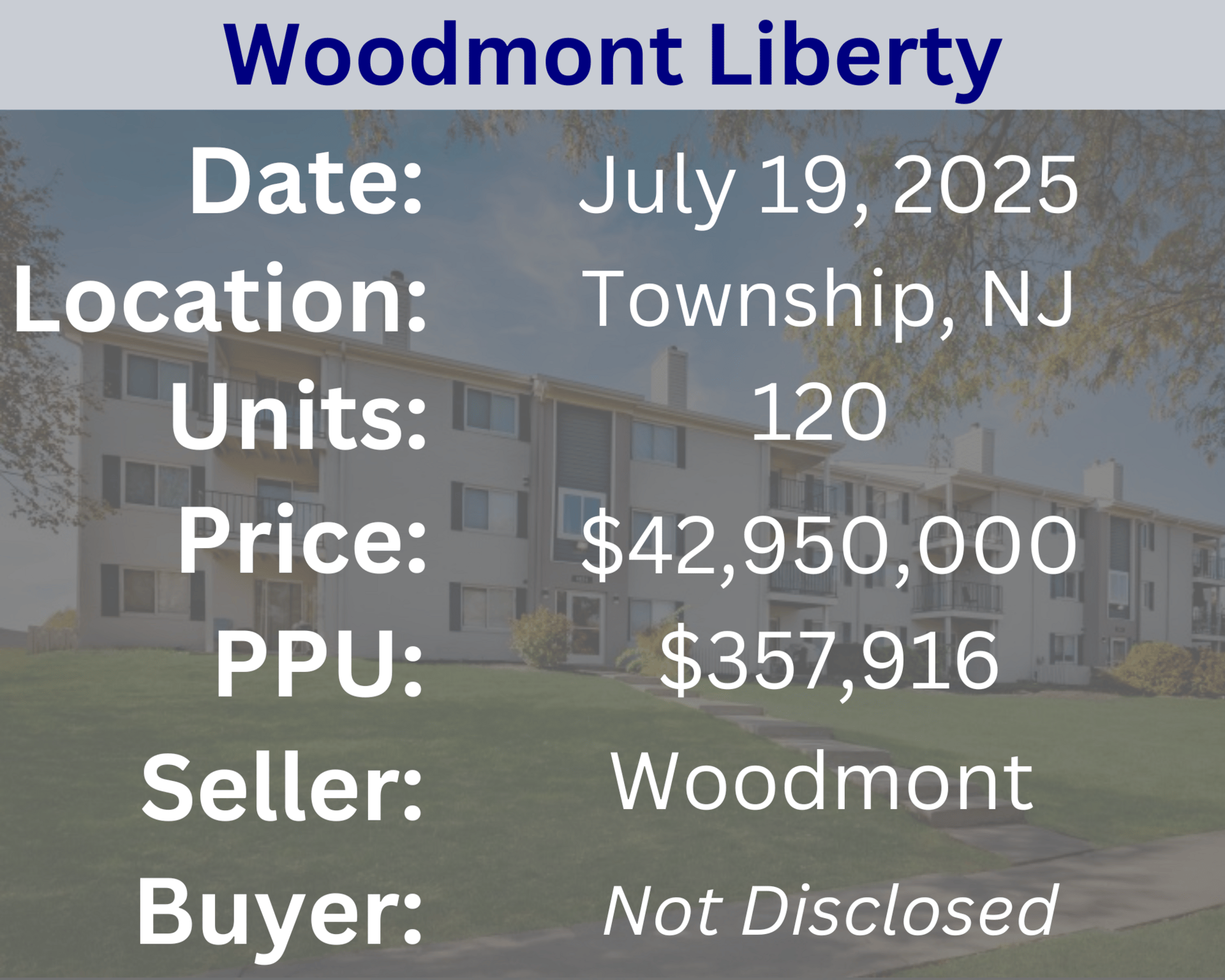

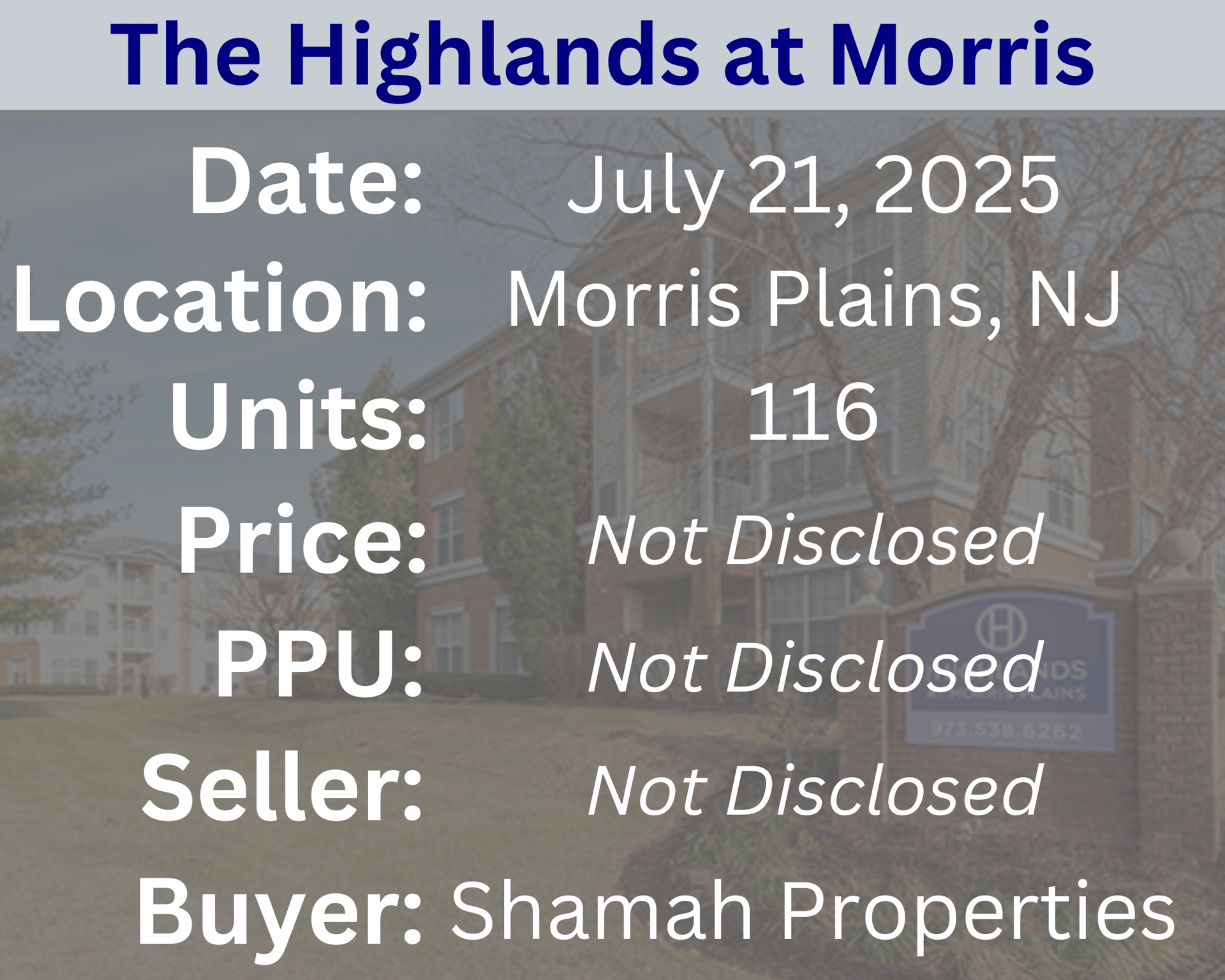

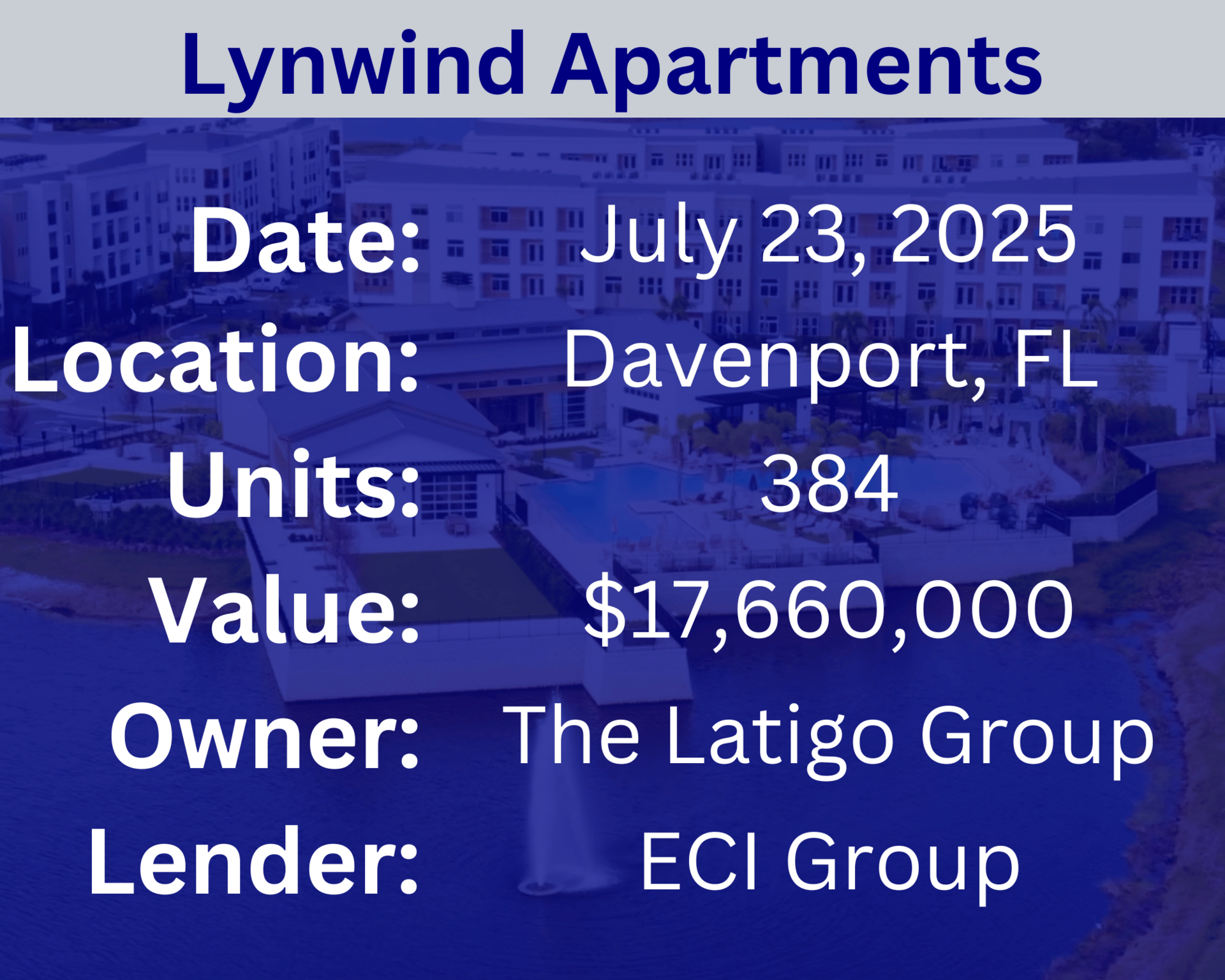

Recent Multifamily Sales (Click to view details)

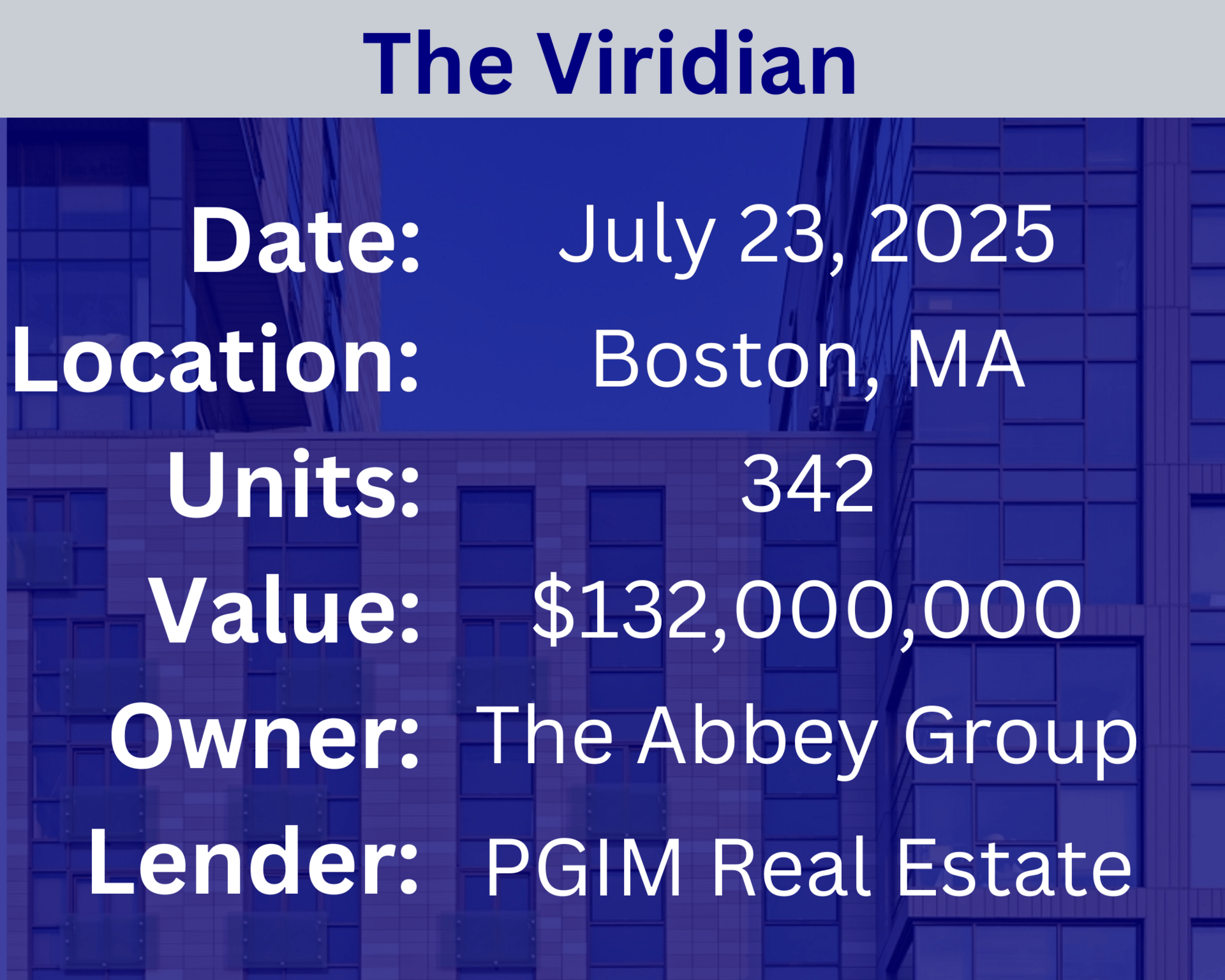

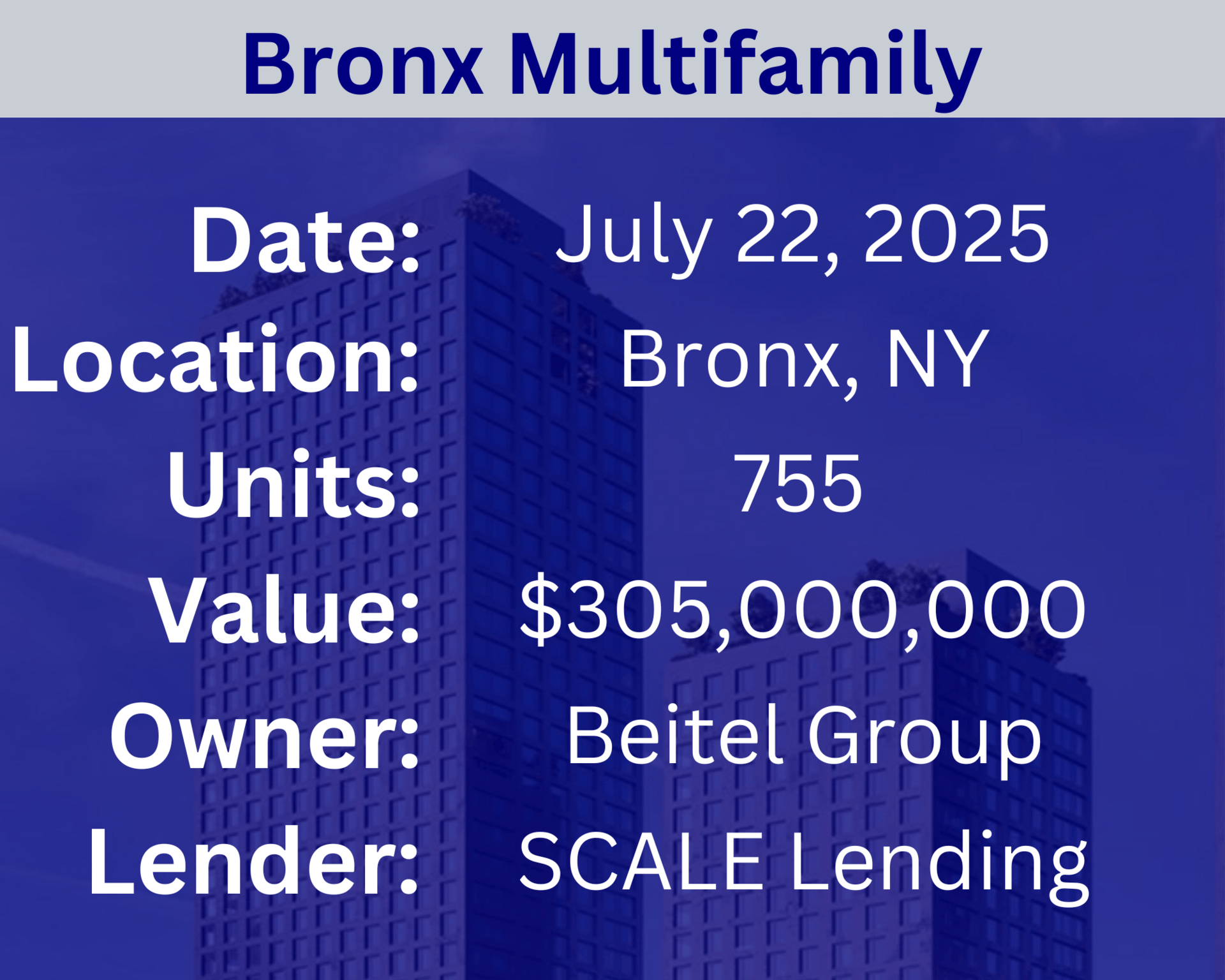

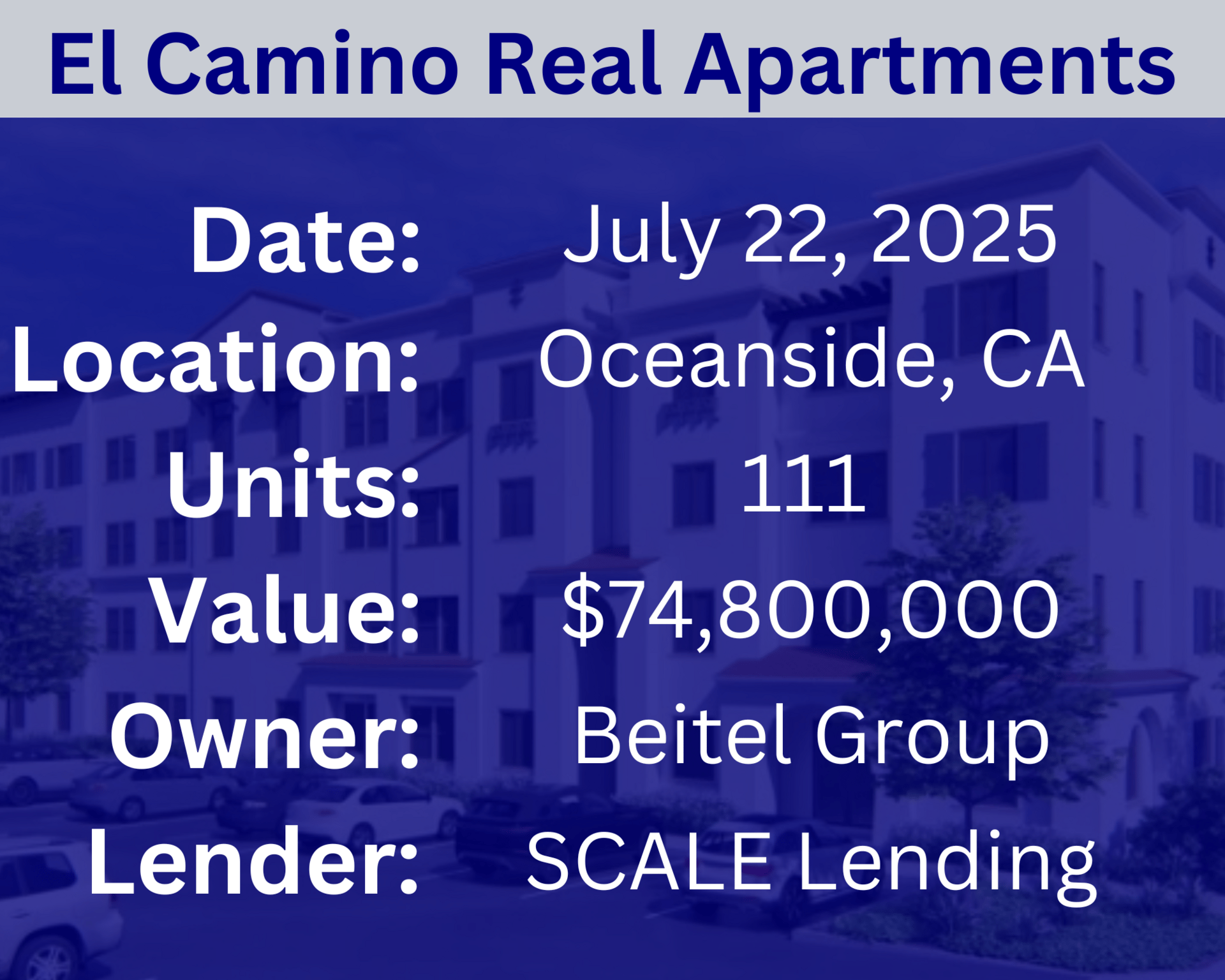

Recent Multifamily Loans (Click to view details)

Question: What are some common risks associated with multifamily investing? | Answer: Common risks include market downturns (impacting occupancy and rents), unexpected capital expenditures (e.g., major repairs), rising operating costs (e.g., property taxes, insurance), interest rate fluctuations (affecting financing), tenant issues (e.g., evictions, property damage), and regulatory changes (e.g., rent control). Thorough due diligence and conservative underwriting help mitigate these risks. |

🕵️🔎Want to get your question answered? Click here to submit your question

Powell's Balancing Act, Private Credit... Hidden Risk?, Office Special Servicing Hits All-Time High, & Mixed Office Signals In this episode of The TreppWire Podcast, we cover rising political pressure on Fed independence, June inflation data, and the expanding role of private credit. We dig into record-high office special servicing rates, market risks, and green shoots in Austin. Plus, updates on Starwood’s $2.2B deal and multifamily activity in Brooklyn, DC, and Minneapolis. Tune in! |

Quiz of The Week

What does "ROI" stand for in real estate investment?

a. Renters' Overall Income

b. Return On Investment

c. Real Estate Opportunity Index

ʇuǝɯʇsǝʌuI uO uɹnʇǝɹ .q

Random Tip of the Week

💰 Invest in Unit Upgrades Strategically - Focus upgrades on features that provide the highest ROI, such as updated kitchens and bathrooms, or energy-efficient appliances, to justify higher rents.

Current Rates (Weekly Update)

10-Year Treasury - 4.38% (⬇️.10%)

Fed Funds Rate - 4.33% (0%)

1-Month Term SOFR - 4.35% (⬆️.01%)

About Nuvo Capital Partners

Nuvo Capital Partners is a niche market-focused multifamily investment platform operating throughout the Southeastern United States. As a dedicated sponsor (General Partner), we specialize in institutional quality real estate investments within these regions. Our team comprises industry professionals with 25+ years of combined experience, ensuring expertise and market knowledge. We pride ourselves on offering a transparent investment process, providing our investors with access to high-quality real estate opportunities while upholding integrity throughout.

📩 Was this forwarded? Join for future investigations, Sign Up Here