- Undercover Real Estate

- Posts

- Multifamily Outlook Remains Tight

Multifamily Outlook Remains Tight

Unveiling the Market's Secrets from Behind the Scenes

📩Was this forwarded? Join for future investigations, Sign Up Here

“This is driven by an increased expectation of new-supply deliveries in 2027, back to pre-COVID levels, as well as a more modest trajectory of household formation as the labor market moderates and population growth returns to its pre-COVID decelerating trajectory. Continued decent GDP growth and high federal government financing needs do not warrant reduced long-term interest rates, which we expect will keep mortgage rates high and multifamily turnover at its current lower level.”

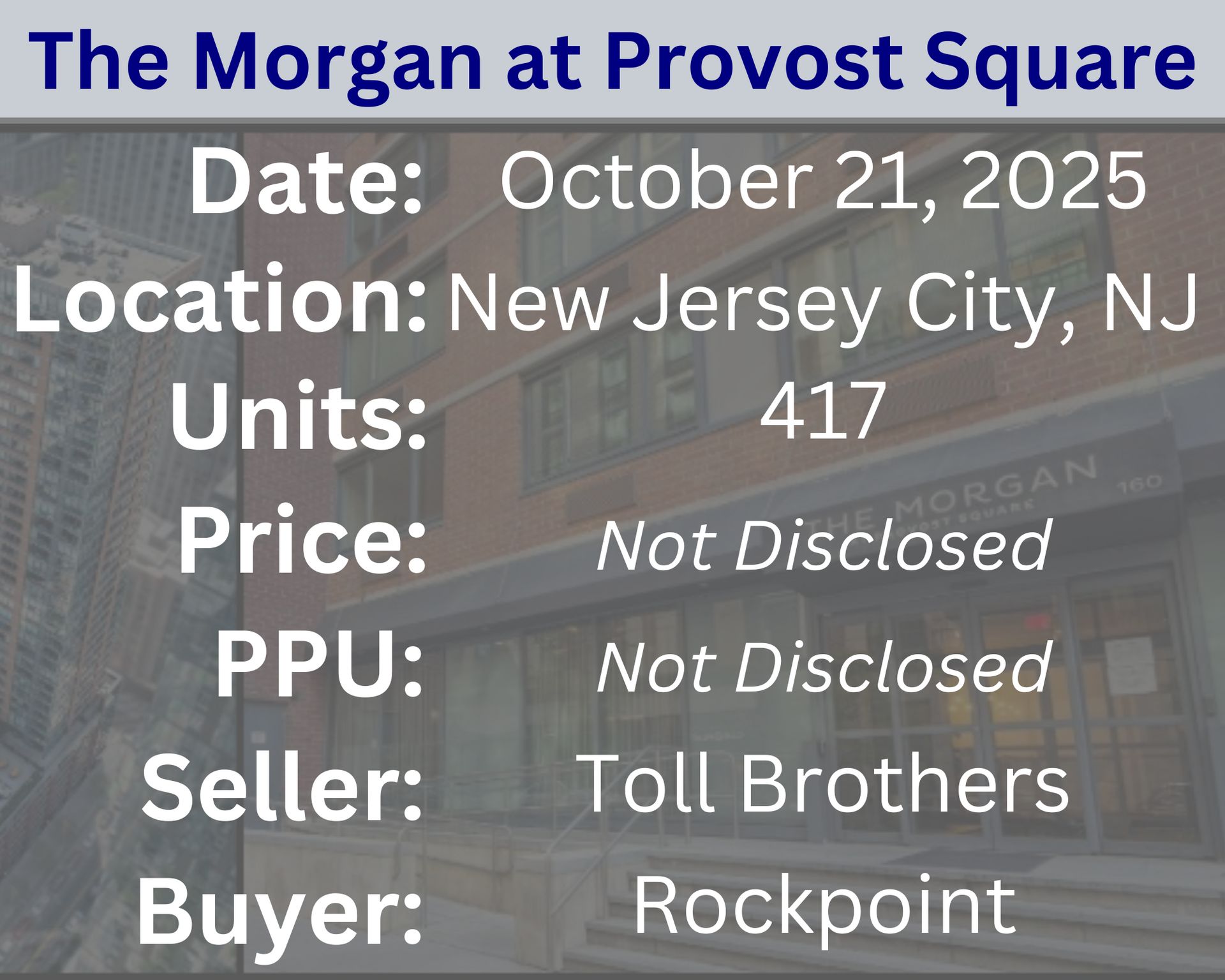

Recent Multifamily Sales (Click to view details)

Recent Multifamily Loans (Click to view details)

Question: How does demographic research influence multifamily investment decisions? | Answer: Demographic research plays a key role in shaping multifamily investment decisions by revealing who is creating housing demand, such as specific age groups, income brackets, and household sizes. It helps investors identify high-growth areas and forecast future rental needs. Understanding demographic shifts—like migration patterns or lifestyle changes—guides what types of units, amenities, and locations will attract tenants. Ultimately, this data-driven approach enables investors to make smarter, lower-risk decisions that align with long-term market trends. |

🕵️🔎Want to get your question answered? Click here to submit your question

Tian Yang: A Whiff of Reflation? MacroVoices Erik Townsend & Patrick Ceresna welcome, Tian Yang. They’ll discuss the leading indicators Variant Perception uses to guide their macro strategy, what they say about growth and inflation, and how that translates to trading opportunities. |

Quiz of The Week

What does it mean for a multifamily property to be "Class A"?

a. It's an older building in a struggling neighborhood

b. It's a newer, high-quality building with premium amenities

c. It's a property primarily for student housing sǝᴉʇᴉuǝɯɐ

sǝᴉʇᴉuǝɯɐ mnᴉɯǝɹd ɥʇᴉʍ ƃuᴉpʅᴉnq ʎʇᴉʅɐnb-ɥƃᴉɥ 'ɹǝʍǝu ∀ sʇI .q

Random Tip of the Week

📈 Monitor Local Economic Indicators - Keep an eye on local job growth, population shifts, and major company relocations. These macro trends directly impact housing demand and rental rates in your market.

Current Rates (Weekly Update)

10-Year Treasury - 3.95% (⬇️.06)

Fed Funds Rate - 4.11% (⬆️.01%)

1-Month Term SOFR - 4.00% (⬇️.03%)

About Nuvo Capital Partners

Nuvo Capital Partners is a niche market-focused multifamily investment platform operating throughout the Southeastern United States. As a dedicated sponsor (General Partner), we specialize in institutional quality real estate investments within these regions. Our team comprises industry professionals with 25+ years of combined experience, ensuring expertise and market knowledge. We pride ourselves on offering a transparent investment process, providing our investors with access to high-quality real estate opportunities while upholding integrity throughout.

📩 Was this forwarded? Join for future investigations, Sign Up Here