- Undercover Real Estate

- Posts

- Multifamily Pipeline Shifts Gears

Multifamily Pipeline Shifts Gears

Unveiling the Market's Secrets from Behind the Scenes

📩 Was this forwarded? Join for future investigations, Sign Up Here

“The multifamily market has slowed due to tighter financing and elevated construction costs and is moving towards a more constrained development environment. However, despite the pullback in starts, multifamily completions reached a 38-year high in 2024 with 608,000 units as projects initiated during the boom years were delivered to market.”

- Danushka Nanayakkara, AVP, Forecasting and Analysis at National Association of Home Builders

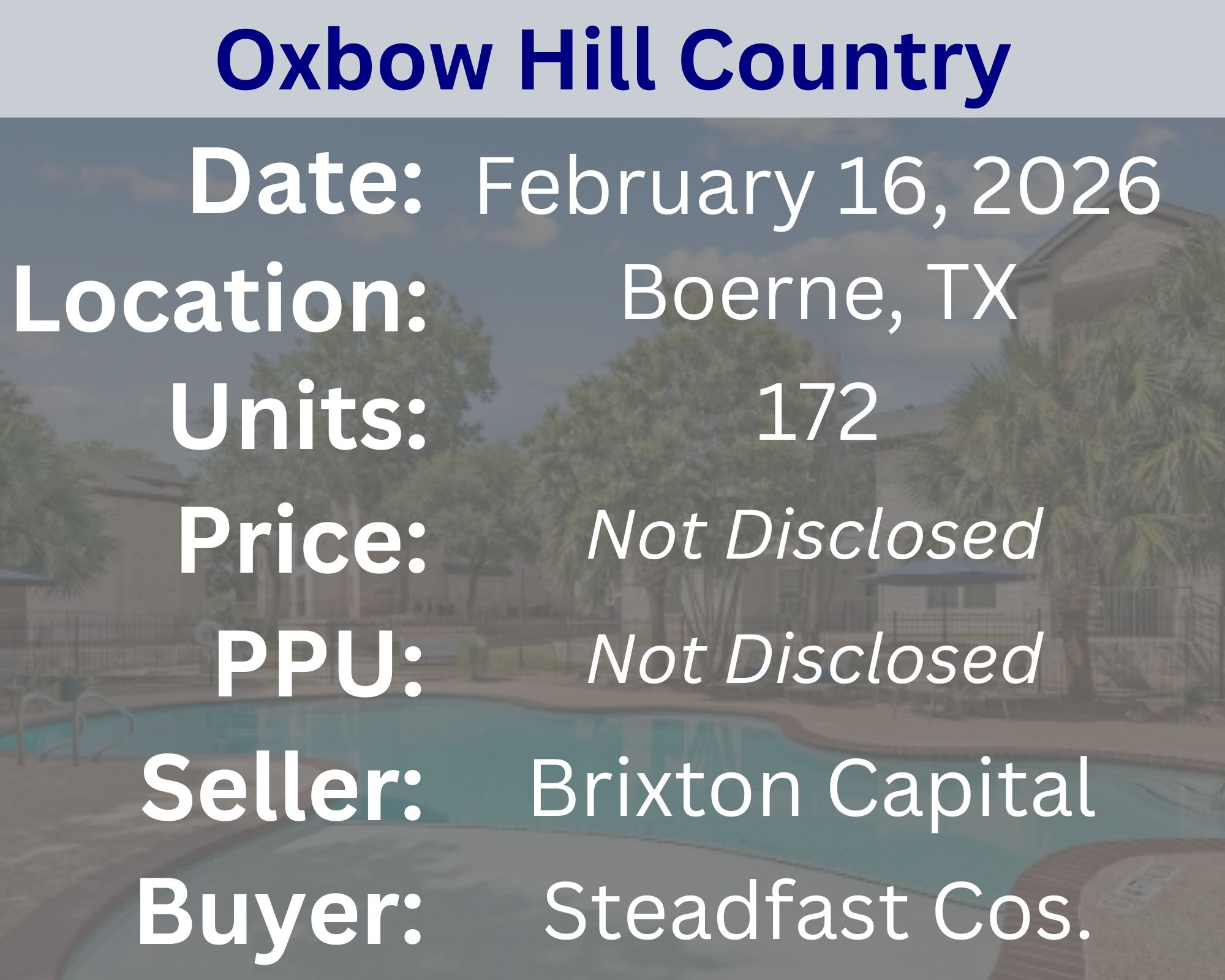

Recent Multifamily Sales (Click to view details)

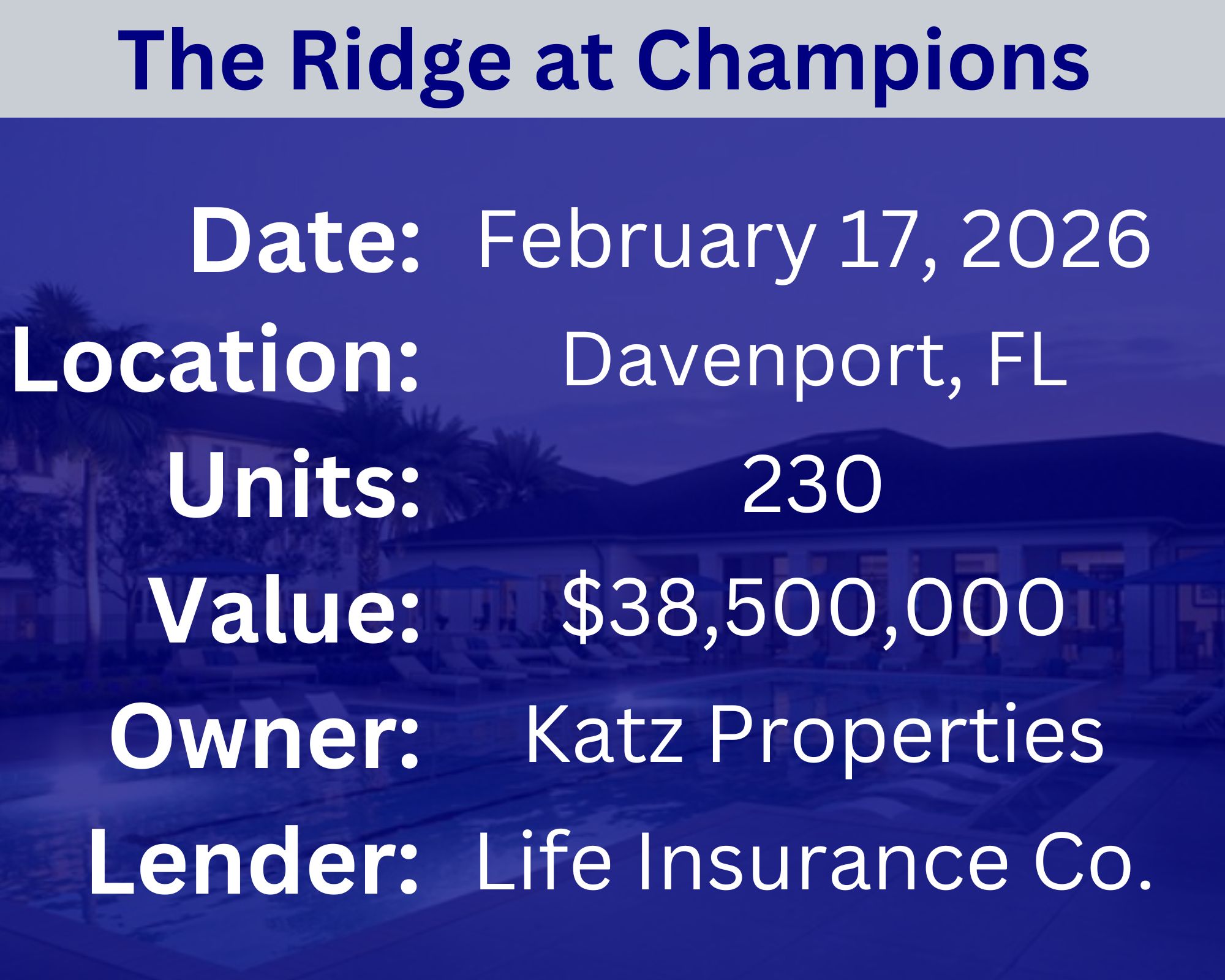

Recent Multifamily Loans (Click to view details)

Question: How do micro-level operational improvements influence exit value? | Answer: Micro-level operational improvements—such as optimizing rent pricing, reducing vacancy and concessions, improving expense controls, and enhancing resident satisfaction—directly increase net operating income (NOI), which is the primary driver of property value. Even small gains in revenue or cost efficiency can meaningfully boost NOI, and when capitalized at market cap rates, those incremental improvements translate into outsized increases in exit value. Consistent operational performance also reduces perceived risk for buyers, potentially leading to stronger pricing, more competitive bidding, and better exit terms. |

🕵️🔎Want to get your question answered? Click here to submit your question

How Larry Connor Built a Multi-Billion-Dollar Multifamily Machine In this TreppWire Podcast episode, Larry Connor, Founder of The Connor Group, shares how he turned early failure into building a leading multifamily investment firm by focusing on operational excellence and data-driven decision-making. He reflects on lessons from the recent liquidity boom, connects his disciplined investment approach to his experience as a space mission pilot, and encourages others to think big and avoid self-imposed limits. |

Quiz of The Week

What is “make-ready” in multifamily management?

a. Preparing financial statements

b. Getting a vacant unit ready for the next tenant

c. Training new leasing staff

ʇuǝuǝʇ ʇxǝu ǝɥʇ ɹoⅎ ʎpɐǝɹ ʇᴉun ʇuɐɔɐʌ ɐ ƃuᴉʇʇǝפ .q

Random Tip of the Week

📉 Plan for Downside Scenarios Early – Stress-test your operations for higher vacancies, rising expenses, or slower rent growth. Having a contingency plan allows you to act decisively during market shifts rather than scrambling under pressure.

Current Rates (Weekly Update)

10-Year Treasury - 4.05% (⬇️.09%)

Fed Funds Rate - 3.64% (0%)

1-Month Term SOFR - 3.66% (0%)

About Nuvo Capital Partners

Nuvo Capital Partners is a niche market-focused multifamily investment platform operating throughout the Southeastern United States. As a dedicated sponsor (General Partner), we specialize in institutional quality real estate investments within these regions. Our team comprises industry professionals with 25+ years of combined experience, ensuring expertise and market knowledge. We pride ourselves on offering a transparent investment process, providing our investors with access to high-quality real estate opportunities while upholding integrity throughout.

📩 Was this forwarded? Join for future investigations, Sign Up Here