- Undercover Real Estate

- Posts

- Multifamily Rates Hold Steady

Multifamily Rates Hold Steady

Unveiling the Market's Secrets from Behind the Scenes

📩Was this forwarded? Join for future investigations, Sign Up Here

“We believe that near-term Fed cuts will impact the shorter end of the curve more than the longer end, and the 10-year [Treasury] will remain above 4% for a few years. So, there won’t be an immediate or significant impact on cap rates.”

- Kyle Draeger, Executive Managing Director at CBRE

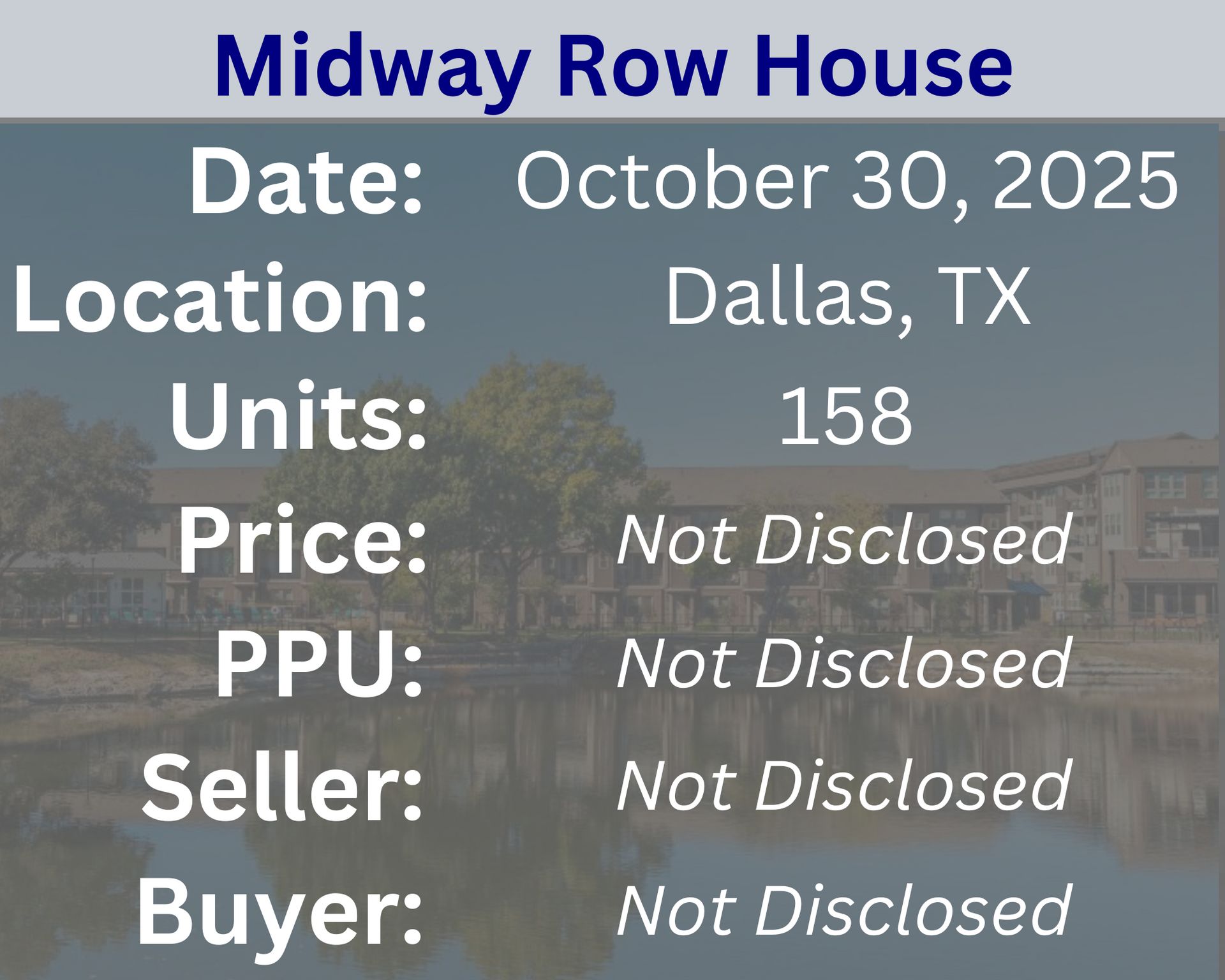

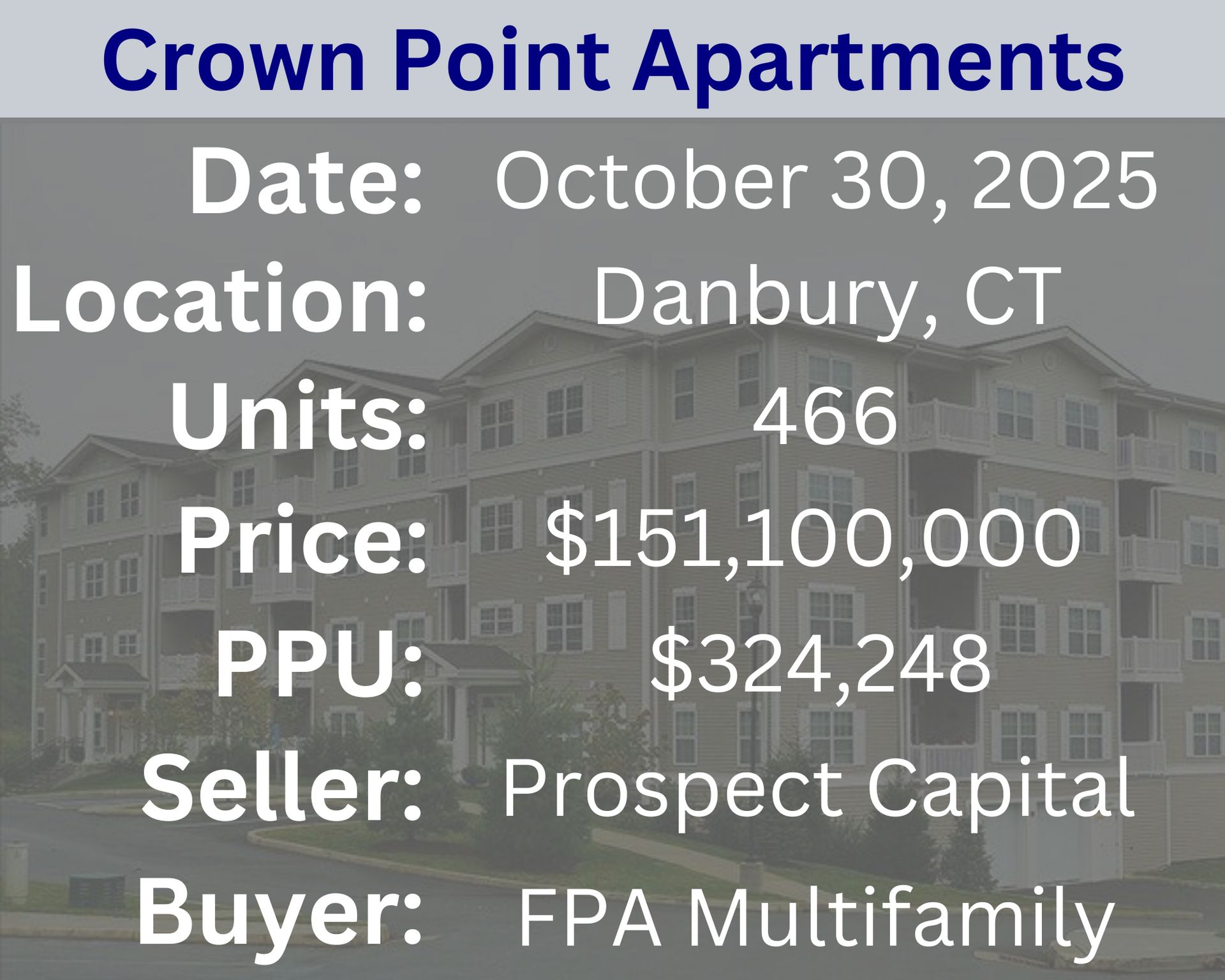

Recent Multifamily Sales (Click to view details)

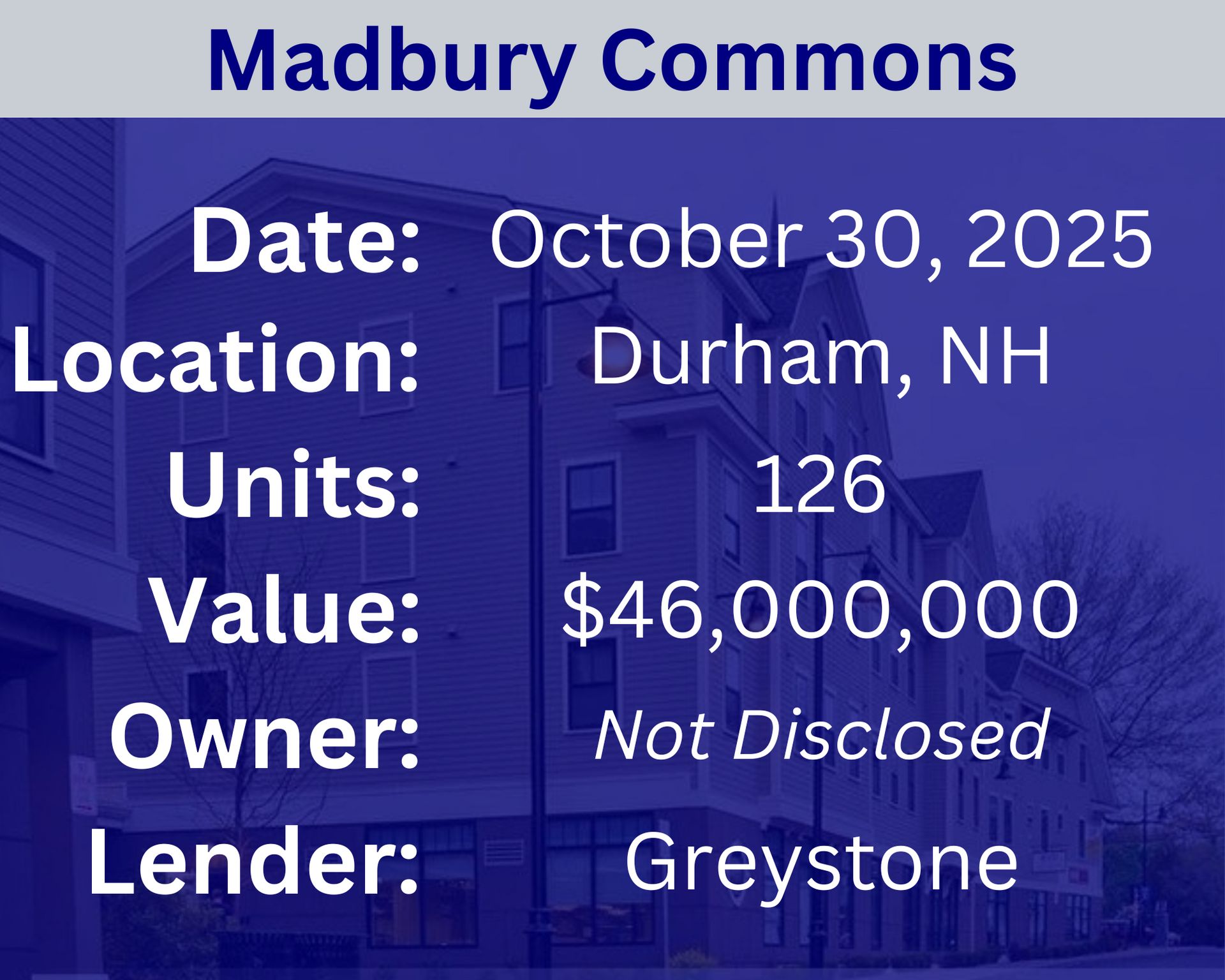

Recent Multifamily Loans (Click to view details)

Question: What is the difference between active and passive multifamily investing? | Answer: Active multifamily investing means you’re directly involved in managing the property — finding deals, arranging financing, overseeing renovations, and handling tenants. It requires more time, expertise, and decision-making control but also offers greater potential returns. Passive multifamily investing, on the other hand, means you invest through a syndication or fund where professionals manage everything on your behalf. This approach allows you to benefit from real estate ownership without the day-to-day responsibilities. In short, active investors run the business, while passive investors fund it and collect the returns. |

🕵️🔎Want to get your question answered? Click here to submit your question

The Importance of "Leading With Your CapEx" and Why You Should Over-Renovate Units Early in Hold Period In this solo episode, Axel reveals why waiting for systems to fail can hurt your multifamily returns. He explains how leading with CapEx creates stability, boosts property value, and why over-renovating early units can help you test market limits and refine your strategy. |

Quiz of The Week

What is the main purpose of "resident events" in a multifamily community?

a. To generate additional income for the property

b. To foster a sense of community and improve resident satisfaction

c. To showcase vacant units to prospective tenants

uoᴉʇɔɐⅎsᴉʇɐs ʇuǝpᴉsǝɹ ǝʌoɹdɯᴉ puɐ ʎʇᴉunɯɯoɔ ⅎo ǝsuǝs ɐ ɹǝʇsoⅎ oꓕ .q

Random Tip of the Week

⬆️ Invest in Unit Upgrades Strategically - Focus upgrades on features that provide the highest ROI, such as updated kitchens and bathrooms, or energy-efficient appliances, to justify higher rents.

Current Rates (Weekly Update)

10-Year Treasury - 4.06% (⬆️.11)

Fed Funds Rate - 4.12% (⬆️.01%)

1-Month Term SOFR - 3.96% (⬇️.04%)

About Nuvo Capital Partners

Nuvo Capital Partners is a niche market-focused multifamily investment platform operating throughout the Southeastern United States. As a dedicated sponsor (General Partner), we specialize in institutional quality real estate investments within these regions. Our team comprises industry professionals with 25+ years of combined experience, ensuring expertise and market knowledge. We pride ourselves on offering a transparent investment process, providing our investors with access to high-quality real estate opportunities while upholding integrity throughout.

📩 Was this forwarded? Join for future investigations, Sign Up Here