- Undercover Real Estate

- Posts

- Multifamily Trends for 2025

Multifamily Trends for 2025

Unveiling the Market's Secrets from Behind the Scenes

📩Was this forwarded? Join for future investigations, Sign Up Here

"Overall multifamily demand has been outstanding, but some areas are feeling the impact of the highest level of new supply since the 1980s. We expect the multifamily market to continue to see subdued but positive growth in 2025, and for origination volume to increase as interest rates continue to stabilize — albeit at a higher level.”

-Sara Hoffmann, Multifamily Research Director at Freddie Mac

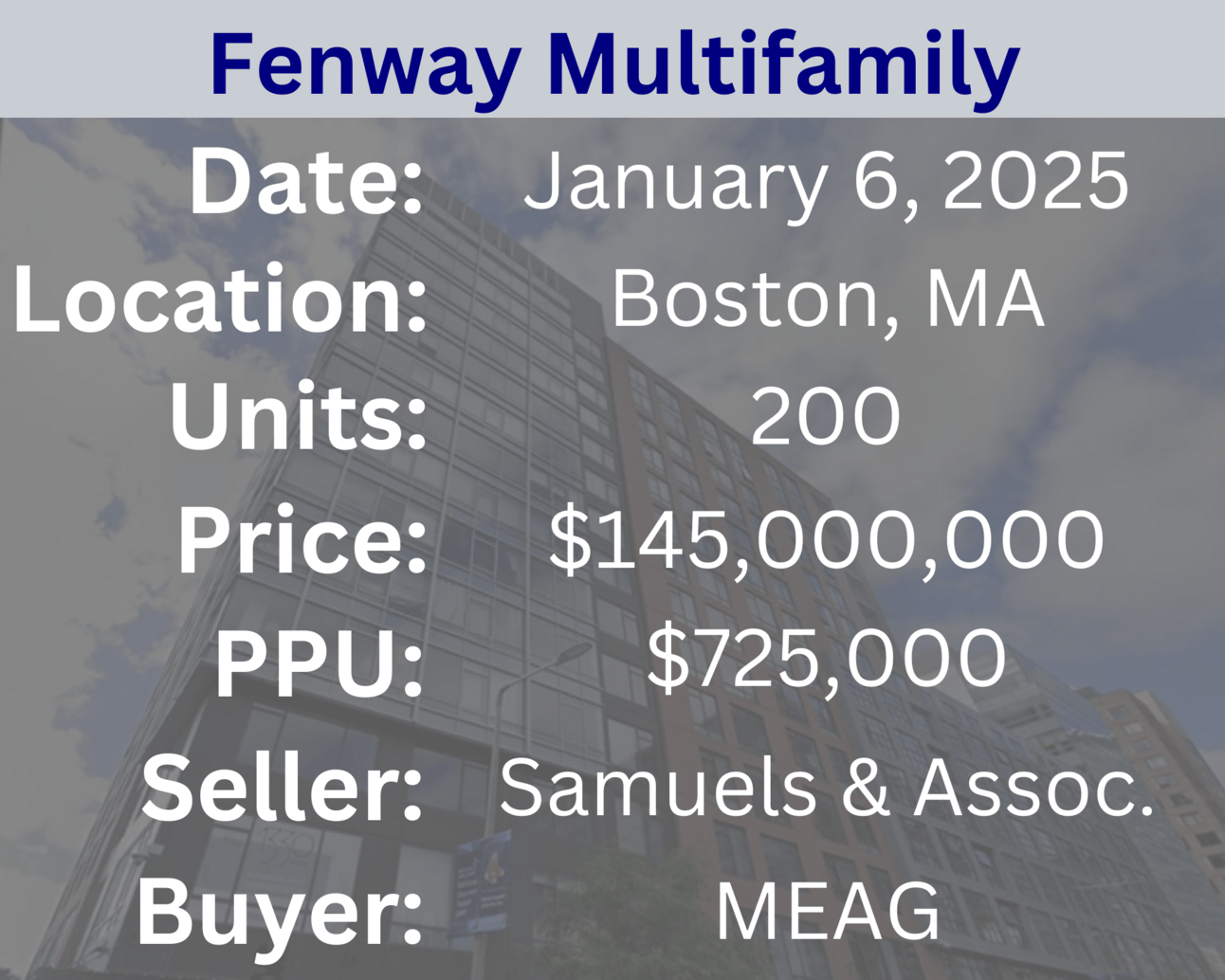

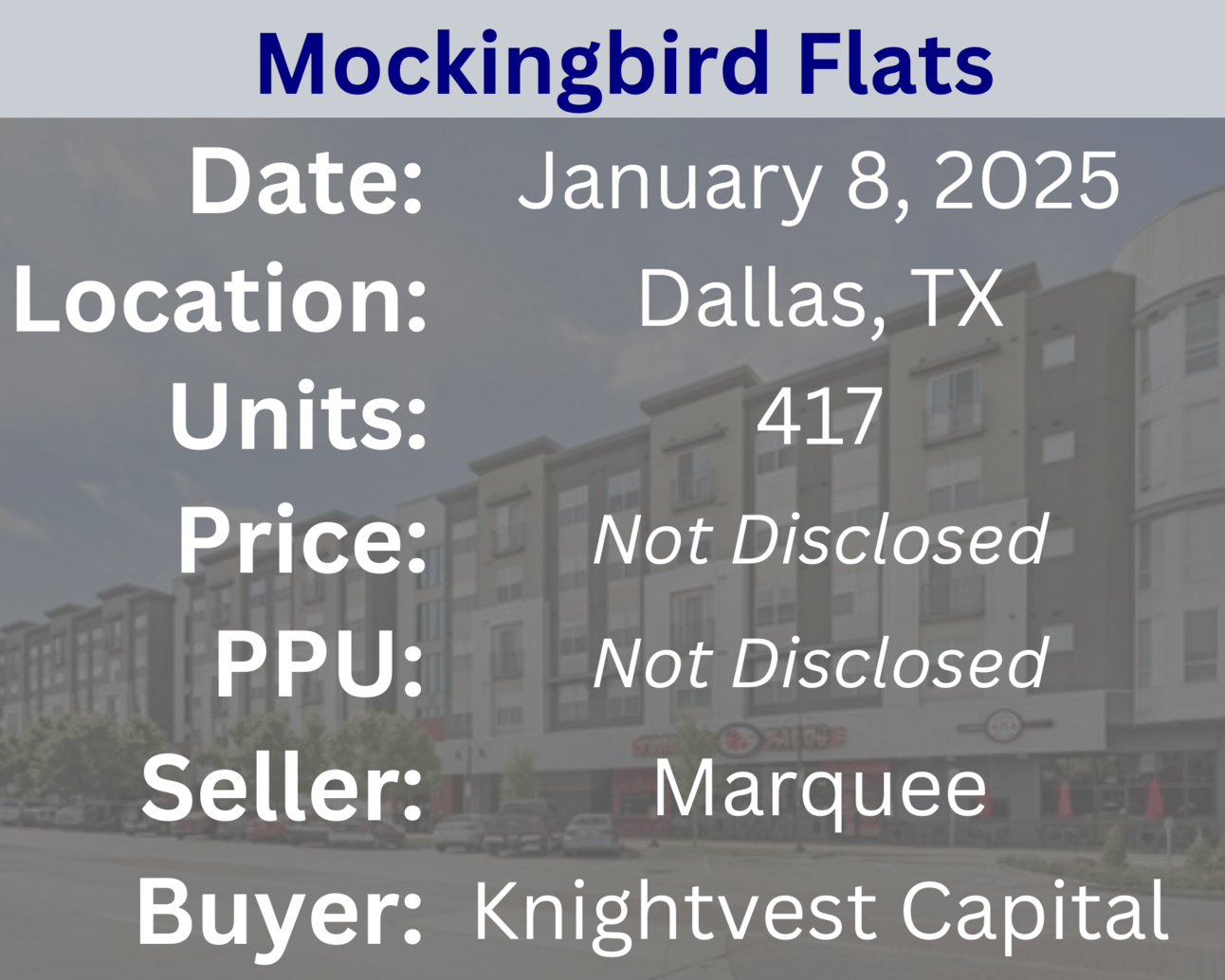

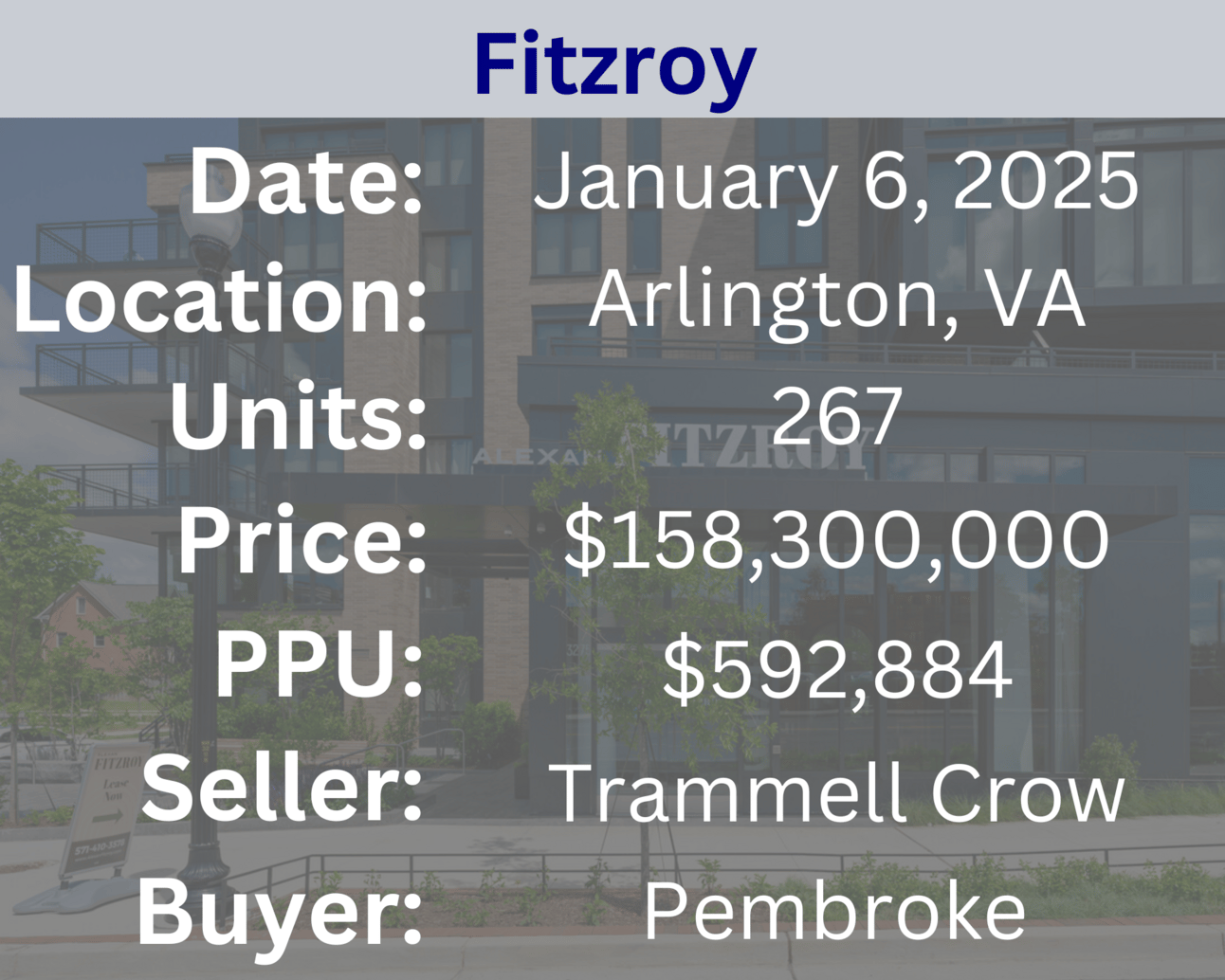

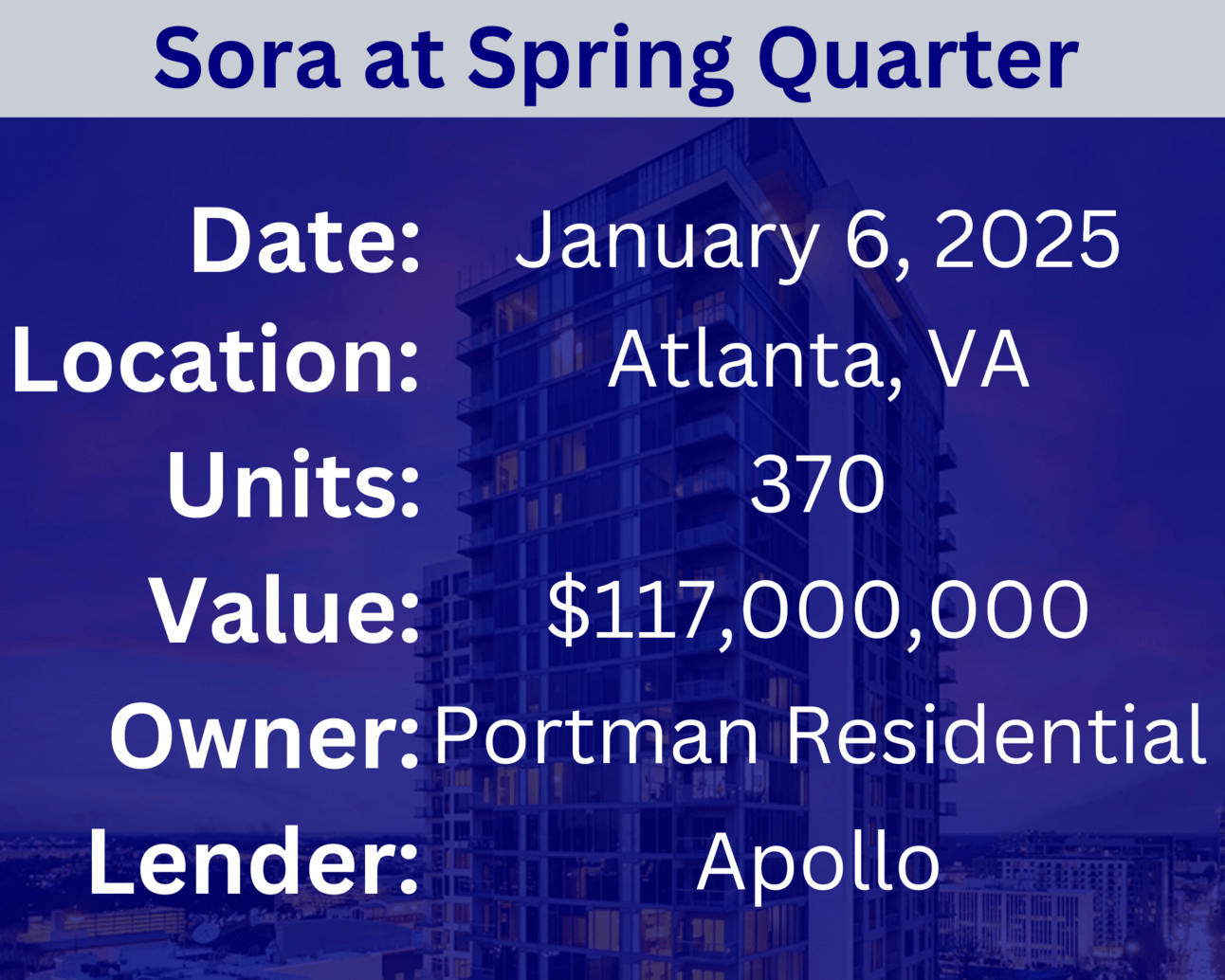

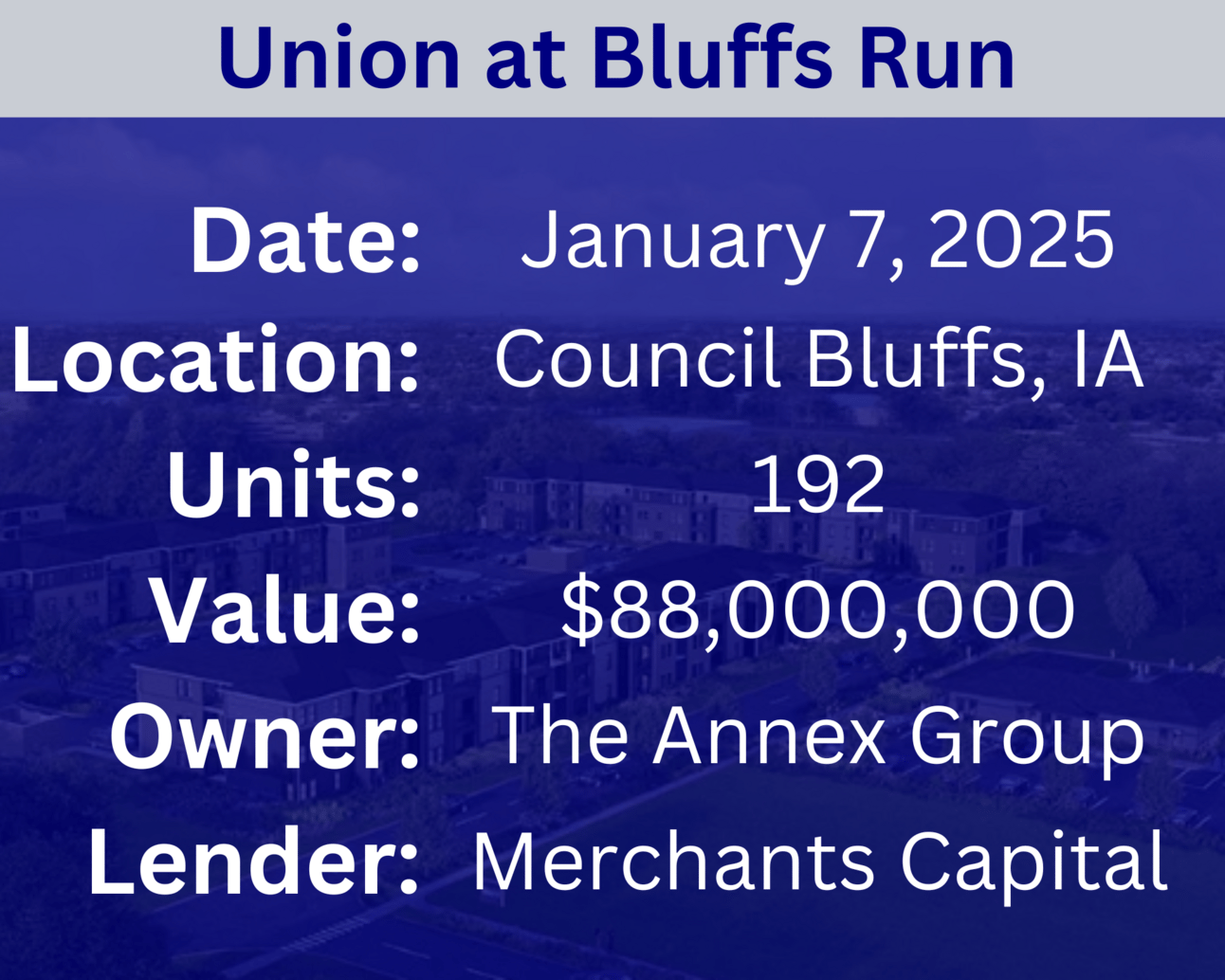

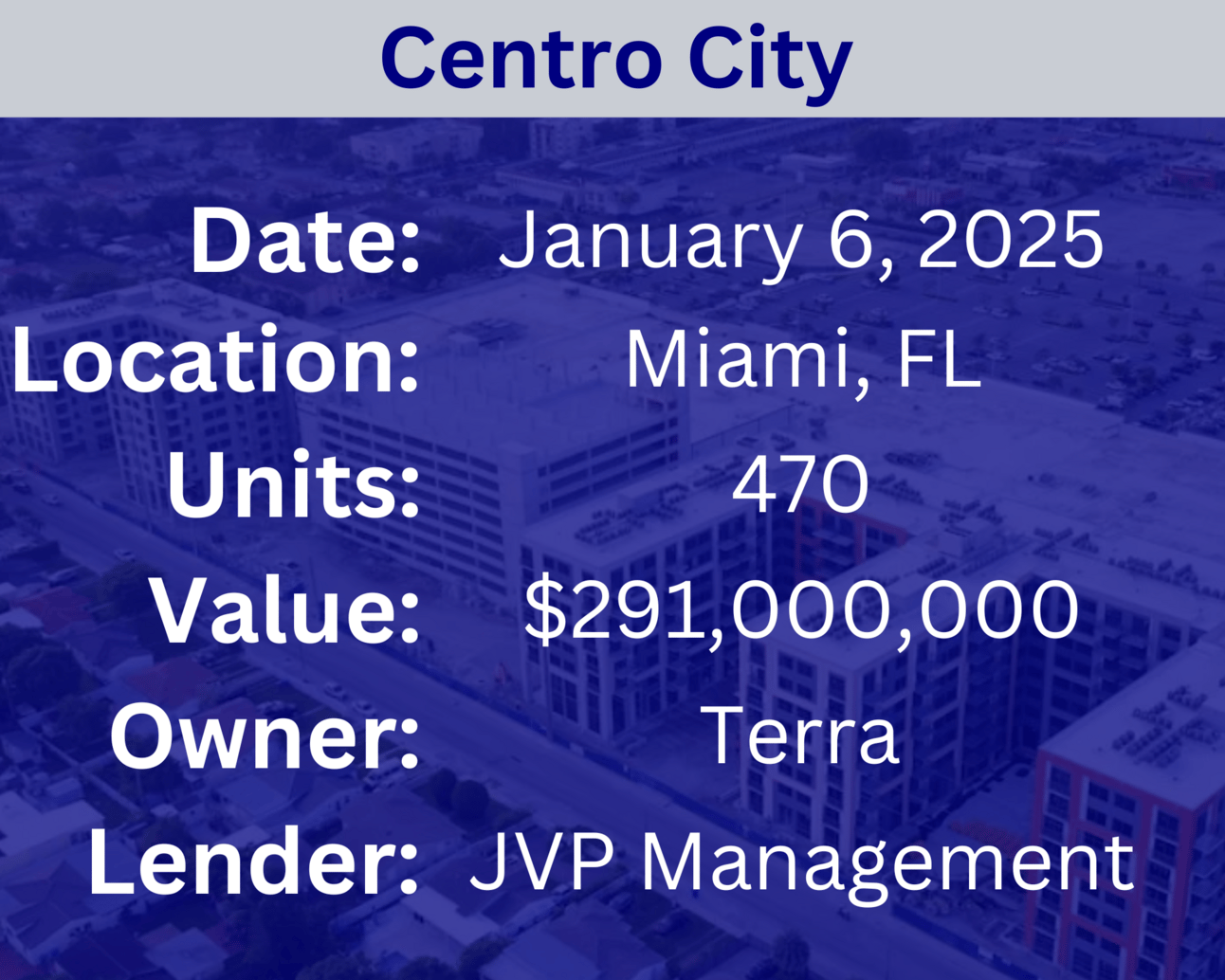

Recent Multifamily Sales (Click to view details)

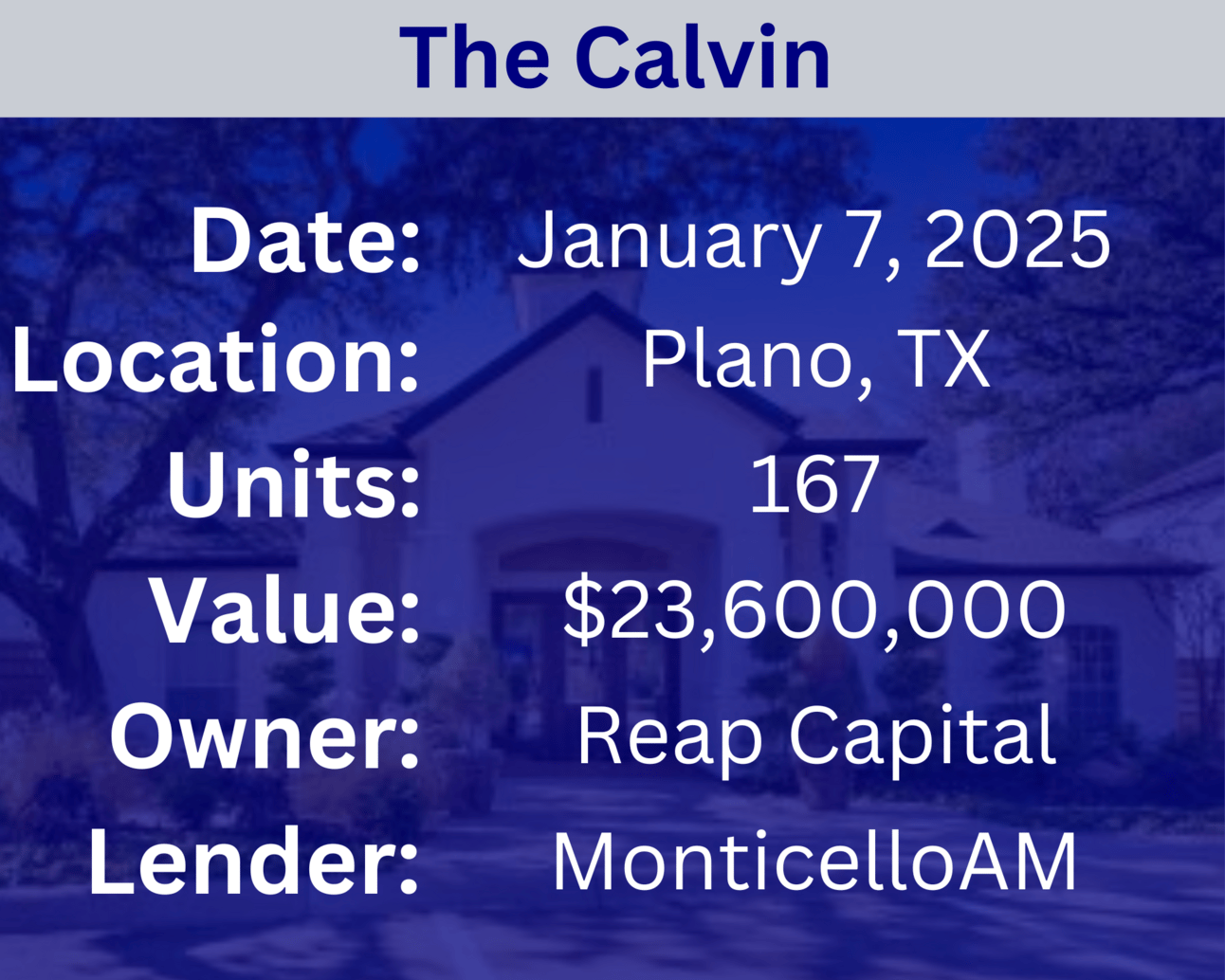

Recent Multifamily Loans (Click to view details)

Question: How do you analyze the historical performance of a multifamily property to forecast future returns? | Answer: Analyzing the historical performance of a multifamily property involves reviewing its past income and expense records to calculate metrics like Net Operating Income (NOI) and cash flow. Assessing trends in rental income growth, vacancy rates, and operating expenses helps identify patterns and factors affecting profitability. Utilizing this historical data, along with market analysis and economic forecasts, allows for more accurate projections of future returns and potential risks associated with the investment. |

🕵️🔎Want to get your question answered? Click here to submit your question

Mastering the Art of Improvement w/ Dallas Pruitt Dallas Pruitt kicks off the Multifamily Mindset Podcast in 2025 with an empowering message on mastering the art of self-improvement. Through diligence, persistence, and resilience, Dallas highlights how honing this skill is crucial for achieving your goals and unlocking your unique version of success. Don't miss this inspiring episode to start your year strong! |

Quiz of The Week

Which of the following is an example of a value-add strategy for multifamily properties?

a. Increasing rents without making improvements

b. Renovating units to increase rent potential

c. Reducing the number of units

lɐᴉʇuǝʇod ʇuǝɹ ǝsɐǝɹɔuᴉ oʇ sʇᴉun ɓuᴉʇɐʌouǝᴚ .q

Random Tip of the Week

💰 Evaluate the Property’s Financing Options - Assess different types of financing, such as conventional loans, FHA loans, or seller financing, to ensure you get the best terms for your investment.

Current Rates (Weekly Update)

10-Year Treasury - 4.68% (⬆️ .14%)

Fed Funds Rate - 4.33% (0%)

1-Month Term SOFR - 4.29% (⬇️ .06%)

About Nuvo Capital Partners

Nuvo Capital Partners is a niche market-focused multifamily investment platform operating throughout the Southeastern United States. As a dedicated sponsor (General Partner), we specialize in institutional quality real estate investments within these regions. Our team comprises industry professionals with 25+ years of combined experience, ensuring expertise and market knowledge. We pride ourselves on offering a transparent investment process, providing our investors with access to high-quality real estate opportunities while upholding integrity throughout.

📩 Was this forwarded? Join for future investigations, Sign Up Here