- Undercover Real Estate

- Posts

- Optimistic Signs in Multifamily Underwriting

Optimistic Signs in Multifamily Underwriting

Unveiling the Market's Secrets from Behind the Scenes

📩 Was this forwarded? Join for future investigations, Sign Up Here

"We are observing notable improvements in underwriting metrics for prime multifamily assets, marking the first improvement seen in two years. This indicates a potential turning point in the market, with going-in and exit cap rates, along with the stabilized positive spread, showing positive trends. These developments suggest that key underwriting metrics may have reached their peak as the market anticipates potential rate cuts in the future. It is crucial for investors to closely monitor these positive developments as they navigate the multifamily market."

-Matt Vance, Head of Multifamily Research for the Americas at CBRE

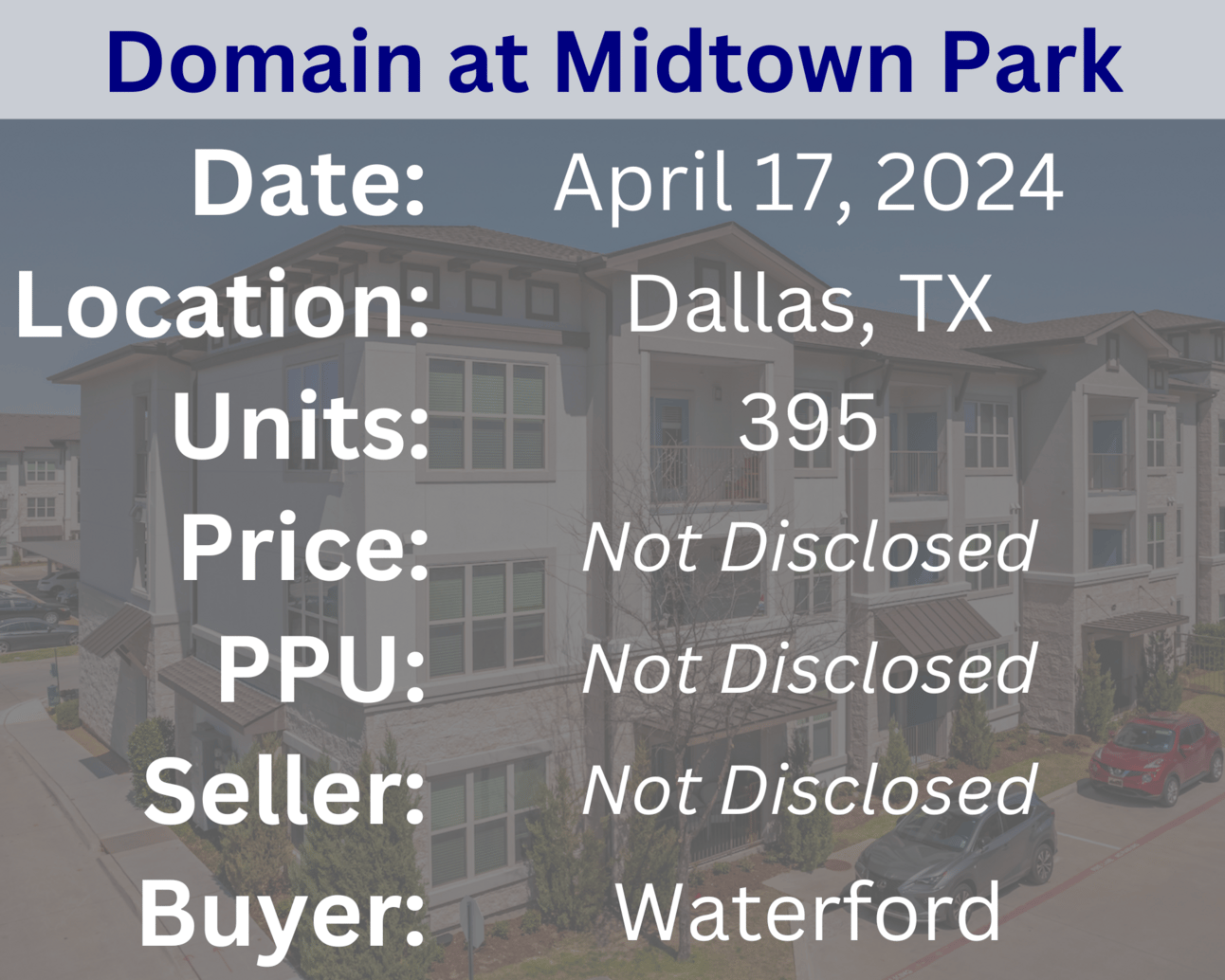

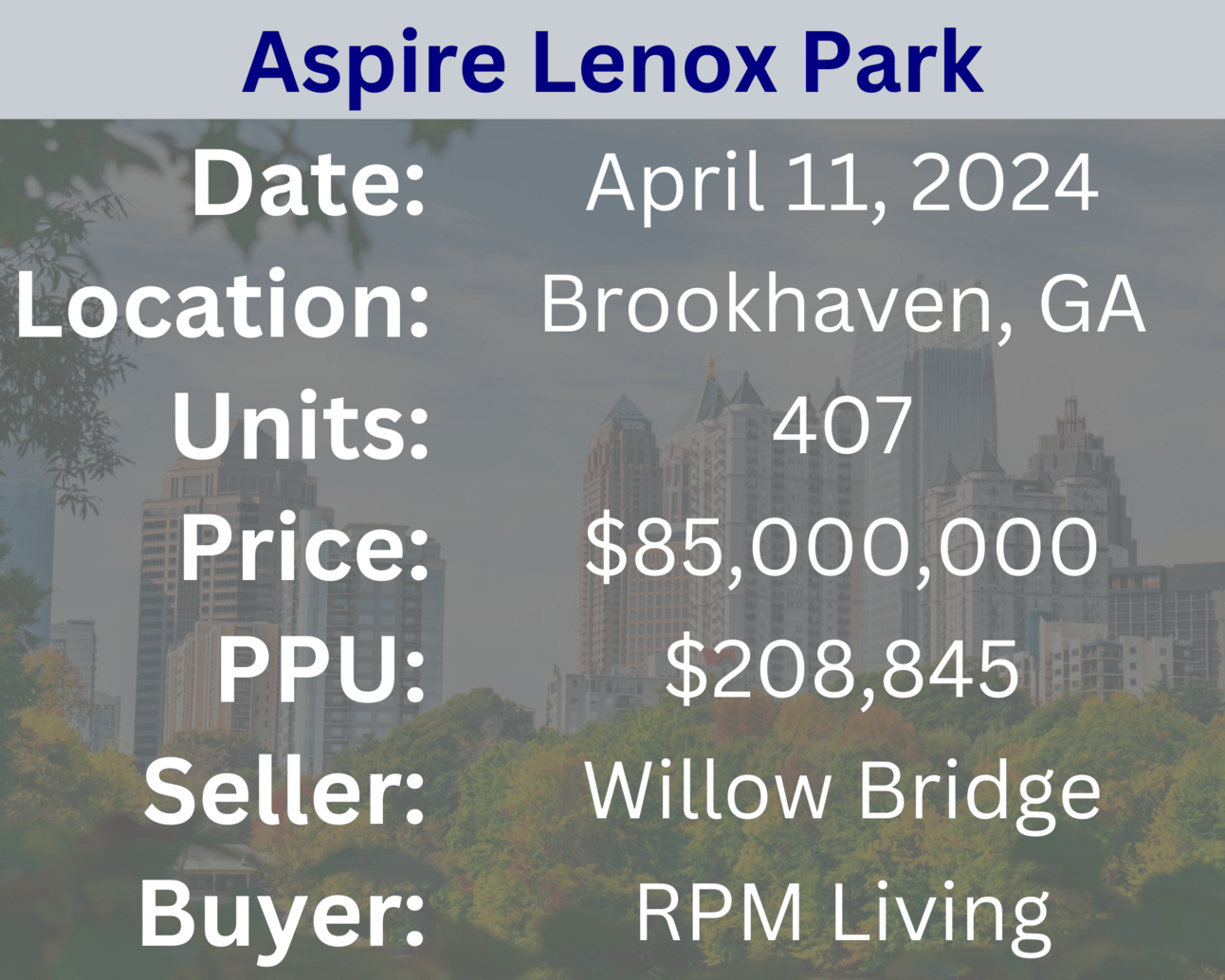

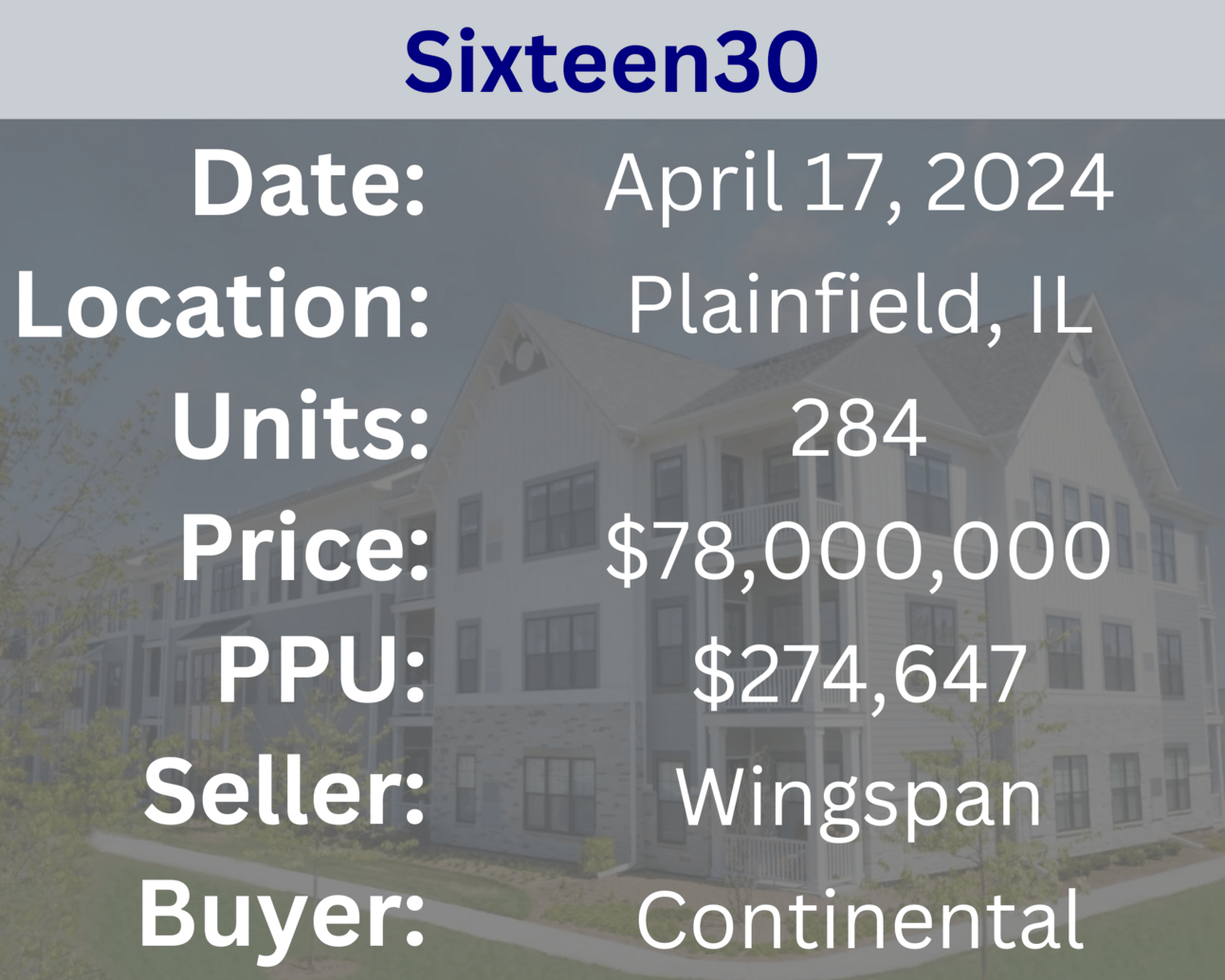

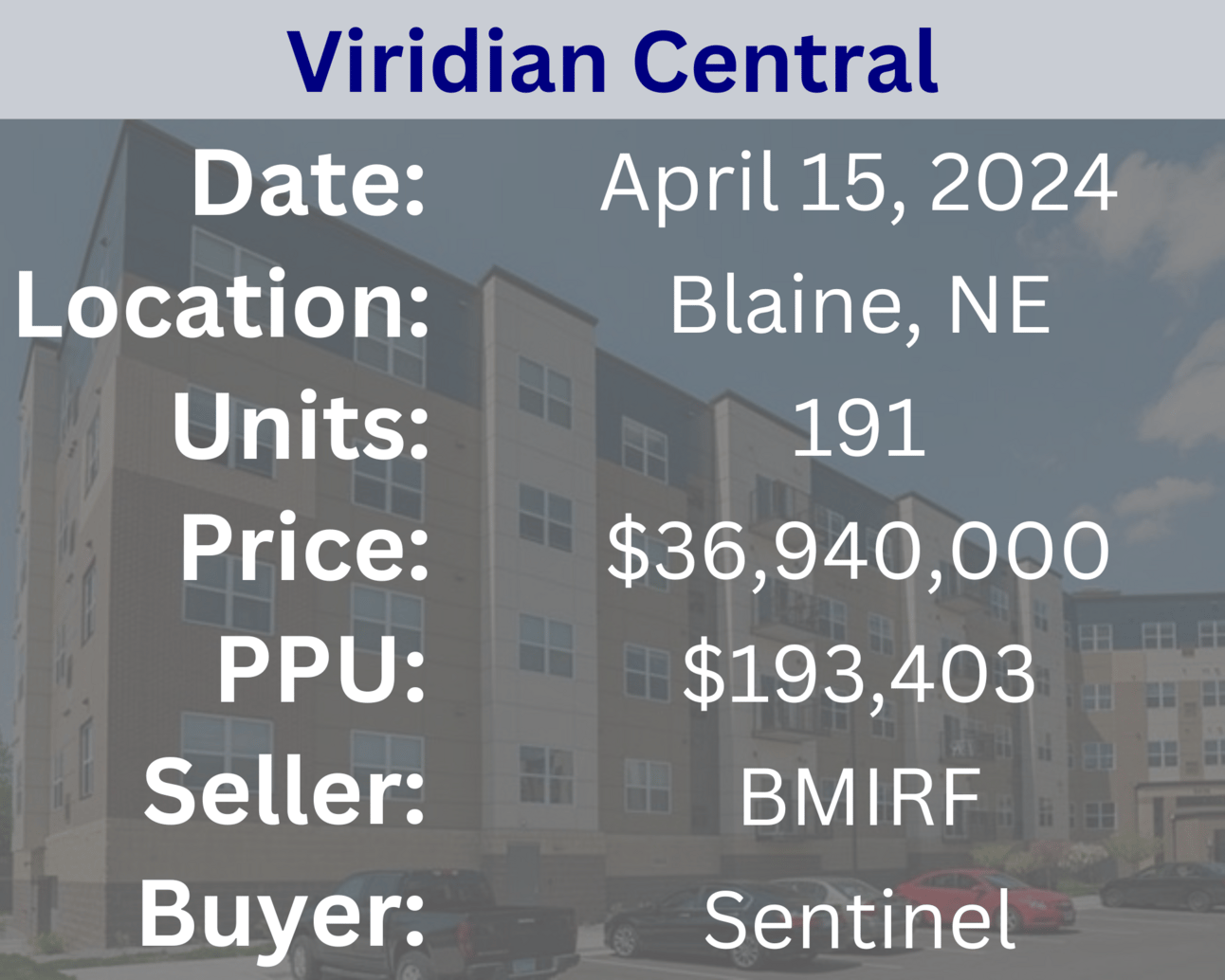

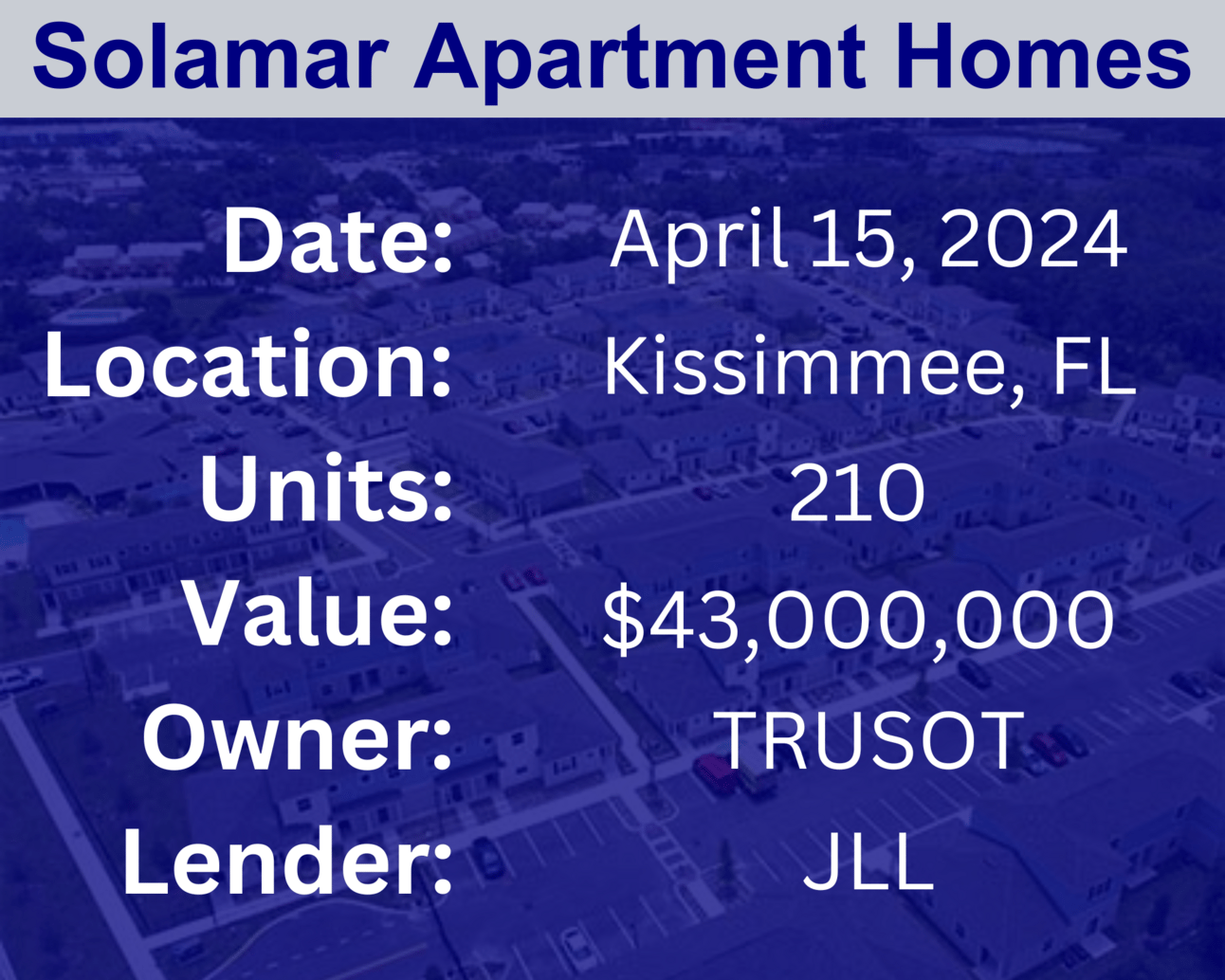

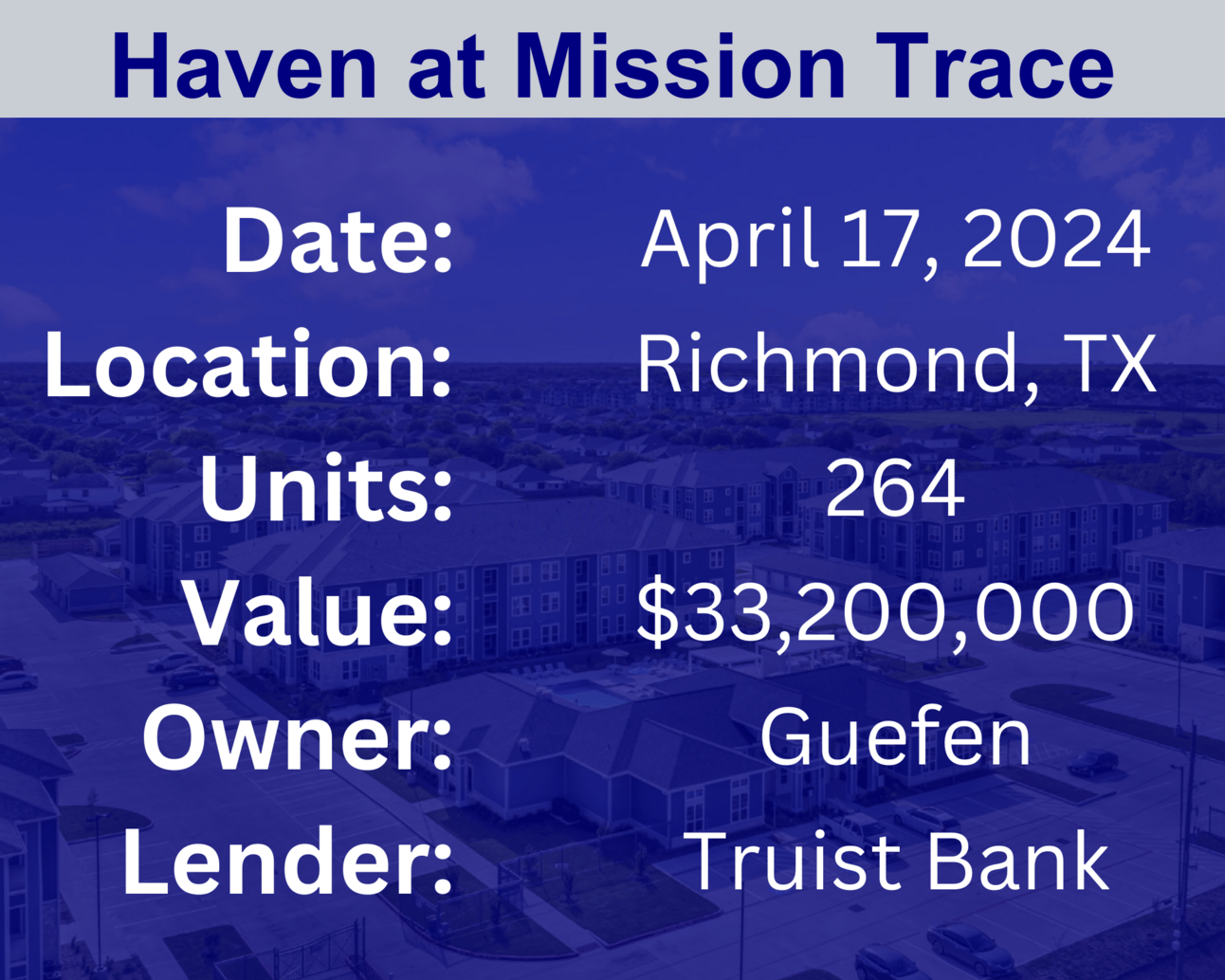

Recent Multifamily Sales (Click to view details)

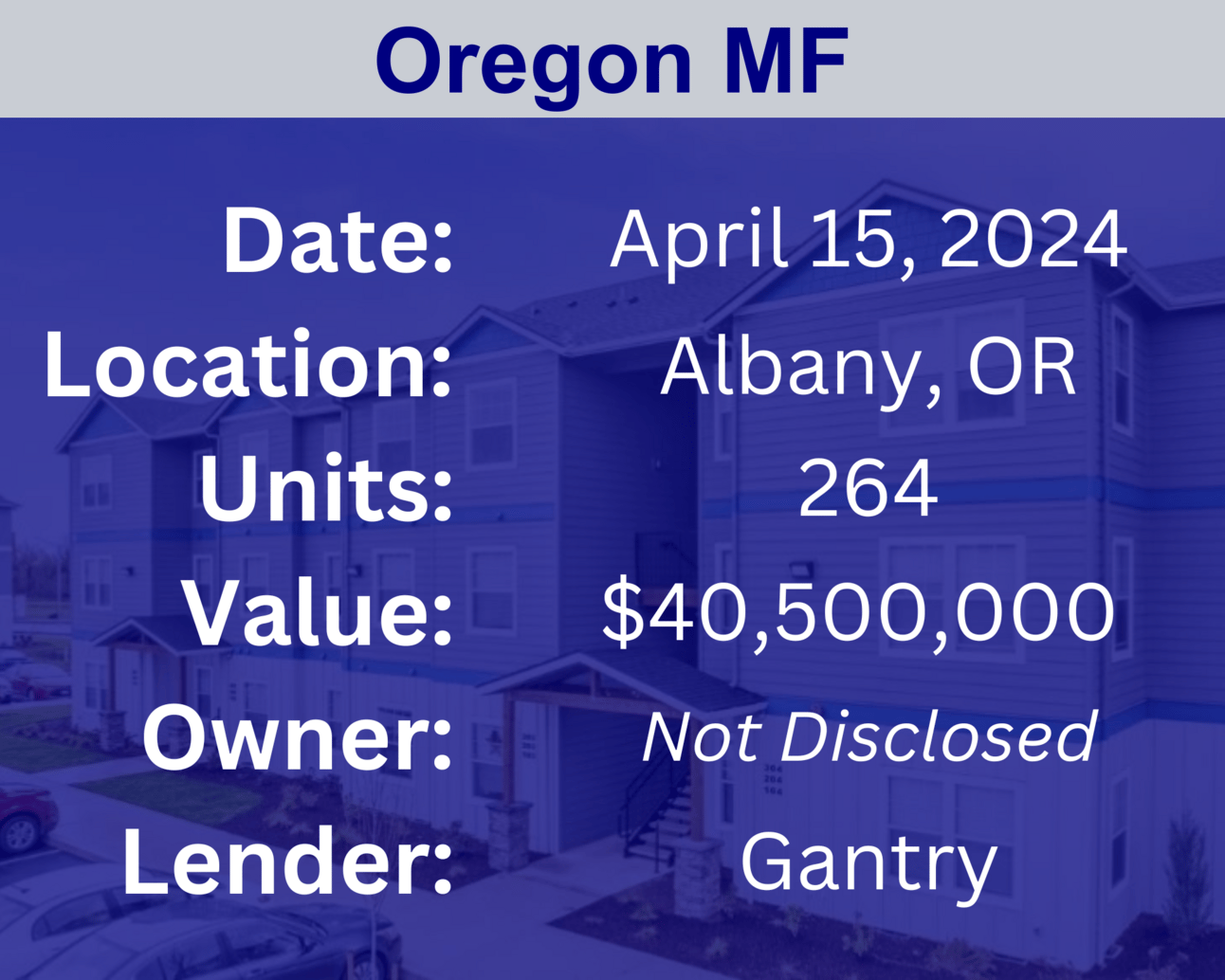

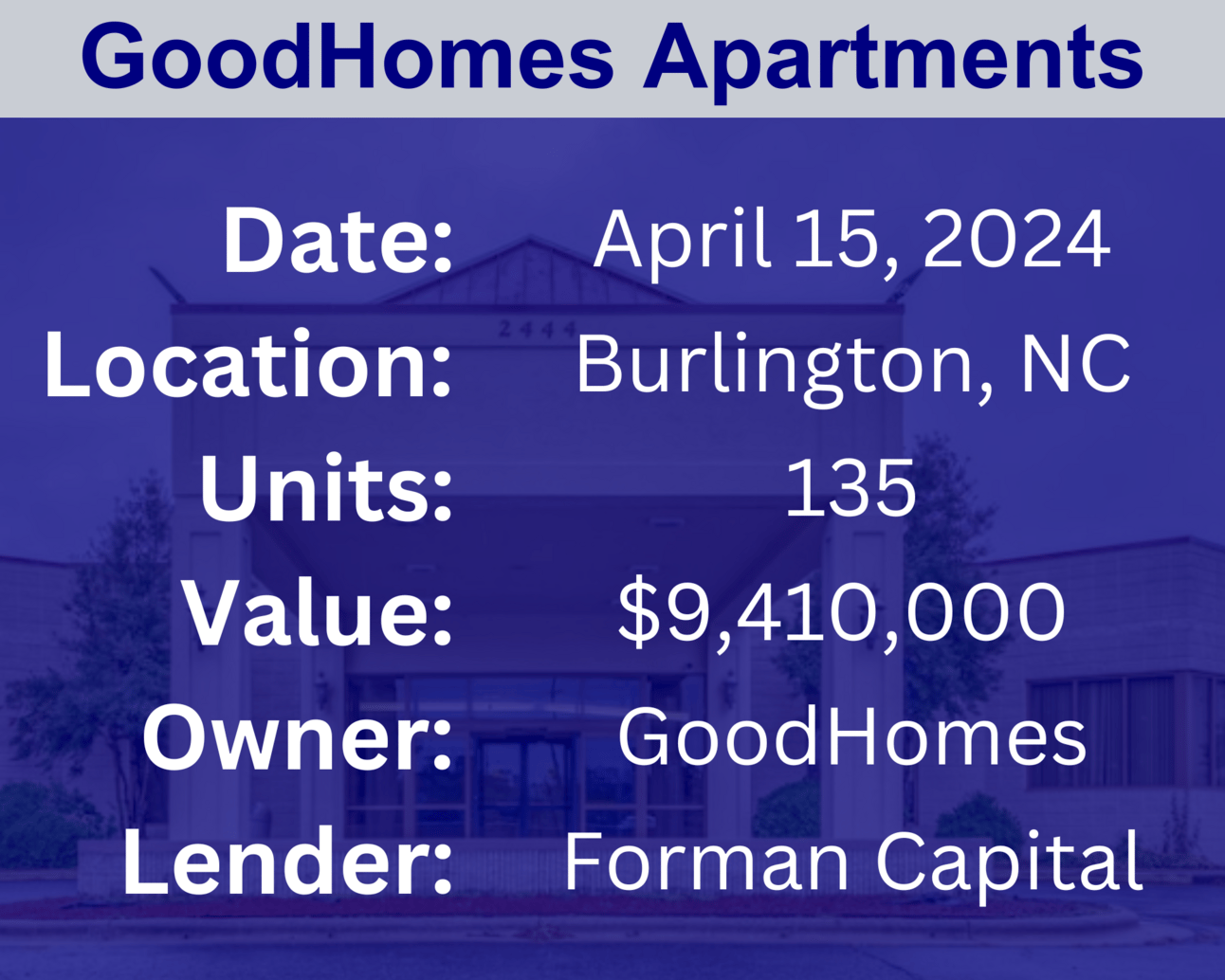

Recent Multifamily Loans (Click to view details)

Question: When it comes to asset management, how do you proactively identify and capitalize on opportunities for value enhancement, and what strategies do you employ to mitigate potential risks that could impact the asset's performance over time? | Answer: Proactively identifying opportunities for value enhancement in multifamily asset management involves a strategic approach. Regularly assess market trends, tenant preferences, and emerging technologies to identify potential enhancements. Implement cost-effective strategies such as targeted renovations, technology upgrades, or amenity improvements to increase property value. Simultaneously, employ risk mitigation strategies by conducting thorough property inspections, staying abreast of regulatory changes, and maintaining a robust maintenance program. This proactive and balanced approach to asset management ensures that the property not only remains competitive in the market but also mitigates potential risks for sustained long-term performance. |

🕵️🔎 Want to get your question answered? Click here to submit your question

Mitch Moody/The RealPage 2024 National Multifamily Fraud Research Study Why has fraud become such a hot topic in multifamily? And what exactly can operators do about it? In this podcast, RealPage® rental screening expert, Mitch Moody, and industry principal Andrew Bowen tackle all things fraud when they dive into the findings from the RealPage 2024 National Multifamily Fraud Research Study – the most robust multifamily fraud study to date. |

Quiz of The Week

What does "CMA" stand for in real estate terms?

a. Comparative Market Analysis

b. Commercial Management Agreement

c. Capital Market Assessment

sᴉsʎʅɐu∀ ʇǝʞɹɐꟽ ǝʌᴉʇɐɹɐdɯoϽ .ɐ

Random Tip of the Week

📝 Evaluate Tenant Demographics - Understand the demographics of the potential tenant base in the area where you're considering multifamily investments. Tailor your property features, amenities, and marketing strategies to cater to the needs and preferences of the target tenant demographic, enhancing tenant satisfaction and retention.

Current Rates (Weekly Update)

10-Year Treasury - 4.66% (⬆️.30%)

Fed Funds Rate - 5.33% (0%)

1-Month Term SOFR - 5.31% (0%)

About Nuvo Capital Partners

Nuvo Capital Partners is a niche market-focused multifamily investment platform operating throughout the Southeastern United States. As a dedicated sponsor (General Partner), we specialize in institutional quality real estate investments within these regions. Our team comprises industry professionals with 25+ years of combined experience, ensuring expertise and market knowledge. We pride ourselves on offering a transparent investment process, providing our investors with access to high-quality real estate opportunities while upholding integrity throughout.

📩 Was this forwarded? Join for future investigations, Sign Up Here