- Undercover Real Estate

- Posts

- Positioning Multifamily for Rate Cuts

Positioning Multifamily for Rate Cuts

Unveiling the Market's Secrets from Behind the Scenes

📩 Was this forwarded? Join for future investigations, Sign Up Here

"The economic outlook on the surface suggests the Fed should remain on hold, maybe even consider putting hikes on the table sometime later this year or next year. In reality, though, we think the Fed will remain on hold for the remainder of Powell's term through May, but we suspect the new leadership will likely manage to get another 50 basis points of rate cuts later in the year."

- Jeremy Schwartz, Senior U.S. Economist at Nomura

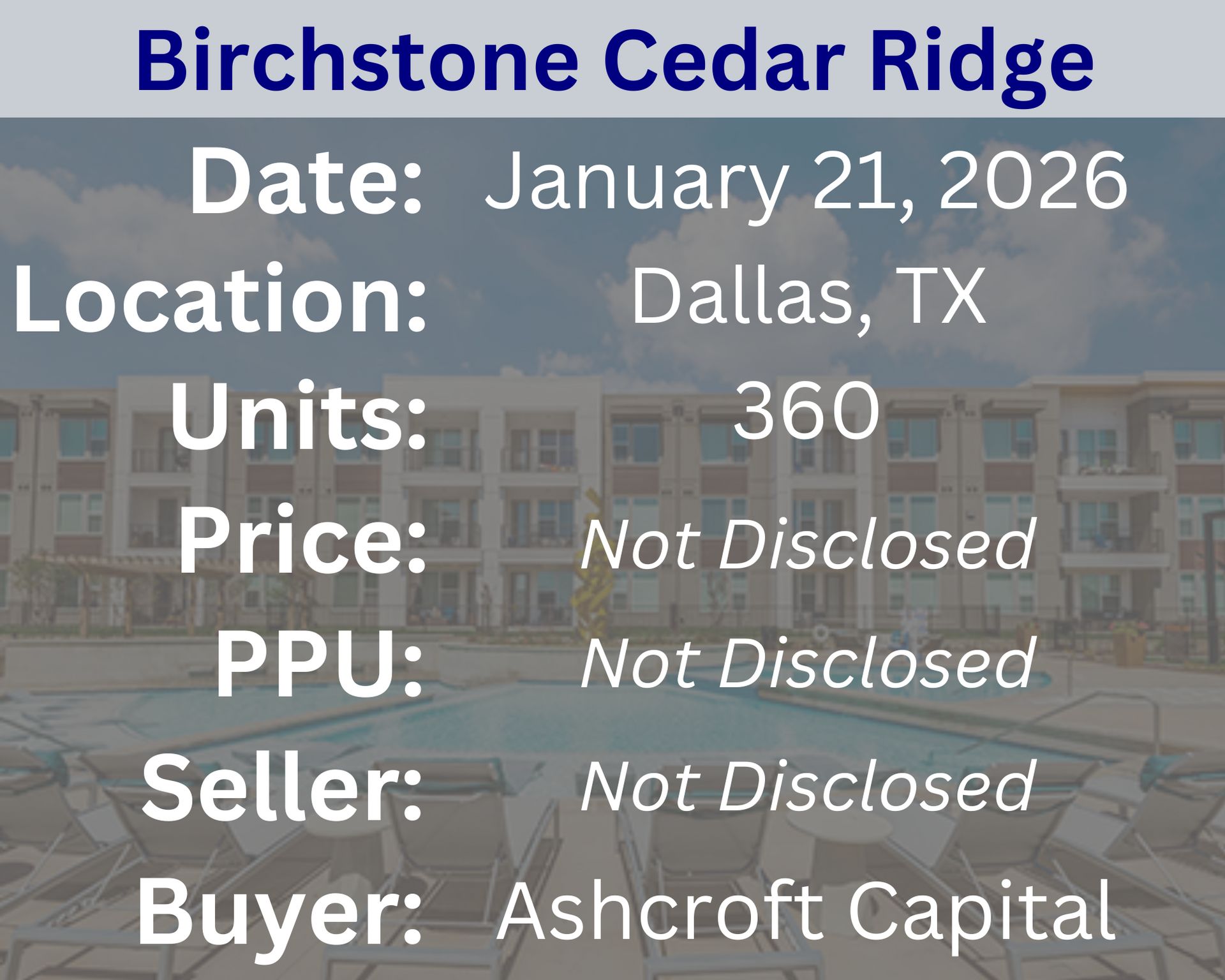

Recent Multifamily Sales (Click to view details)

Recent Multifamily Loans (Click to view details)

Question: How do unit-level expense variances impact multifamily returns? | Answer: Unit-level expense variances can materially impact multifamily returns because even small differences in per-unit operating costs scale across an entire portfolio, directly affecting net operating income and, by extension, property value and investor yield. Higher-than-expected expenses for maintenance, utilities, turnover, or property management reduce cash flow, weaken debt service coverage, and limit refinancing or sale proceeds, while well-controlled expenses can significantly enhance margins and resilience during rent slowdowns. Over time, persistent unit-level inefficiencies compound, making expense management just as critical to returns as rent growth or occupancy. |

🕵️🔎Want to get your question answered? Click here to submit your question

Fed Signals & CRE Shifts: Data Centers, Multifamily Supply Wave, & Amazon’s Big Box Move This week on The TreppWire Podcast, we unpack key economic data ahead of the Fed’s next meeting, policy signals from Davos, and shifting 2026 rate expectations. In commercial real estate, we examine slowing construction, surging data center investment driven by AI, emerging multifamily distress, and recent deals showing both optimism and strain. Plus, a look at Amazon’s plan for its largest physical retail store yet. |

Quiz of The Week

What is "market rent"?

a. The lowest rent a landlord is willing to accept

b. The average rent for comparable properties in a specific area

c. The maximum rent allowed by local regulations

ɐǝɹɐ ɔᴉⅎᴉɔǝds ɐ uᴉ sǝᴉʇɹǝdoɹd ǝʅqɐɹɐdɯoɔ ɹoⅎ ʇuǝɹ ǝƃɐɹǝʌɐ ǝɥꓕ .q

Random Tip of the Week

📈 Monitor Local Economic Indicators - Keep an eye on local job growth, population shifts, and major company relocations. These macro trends directly impact housing demand and rental rates in your market.

Current Rates (Weekly Update)

10-Year Treasury - 4.25% (⬆️.08%)

Fed Funds Rate - 3.64% (0%)

1-Month Term SOFR - 3.67% (0%)

About Nuvo Capital Partners

Nuvo Capital Partners is a niche market-focused multifamily investment platform operating throughout the Southeastern United States. As a dedicated sponsor (General Partner), we specialize in institutional quality real estate investments within these regions. Our team comprises industry professionals with 25+ years of combined experience, ensuring expertise and market knowledge. We pride ourselves on offering a transparent investment process, providing our investors with access to high-quality real estate opportunities while upholding integrity throughout.

📩 Was this forwarded? Join for future investigations, Sign Up Here