- Undercover Real Estate

- Posts

- Rate Cuts Aid Multifamily

Rate Cuts Aid Multifamily

Unveiling the Market's Secrets from Behind the Scenes

📩 Was this forwarded? Join for future investigations, Sign Up Here

"The labor market's telling you we should continue cutting the rates. We're not seeing a dramatic decline of the labor market going off a cliff, just kind of just continuing to soften and soften. So, we can go at a moderate pace.”

- Christopher Waller, Governor at Federal Reserve System

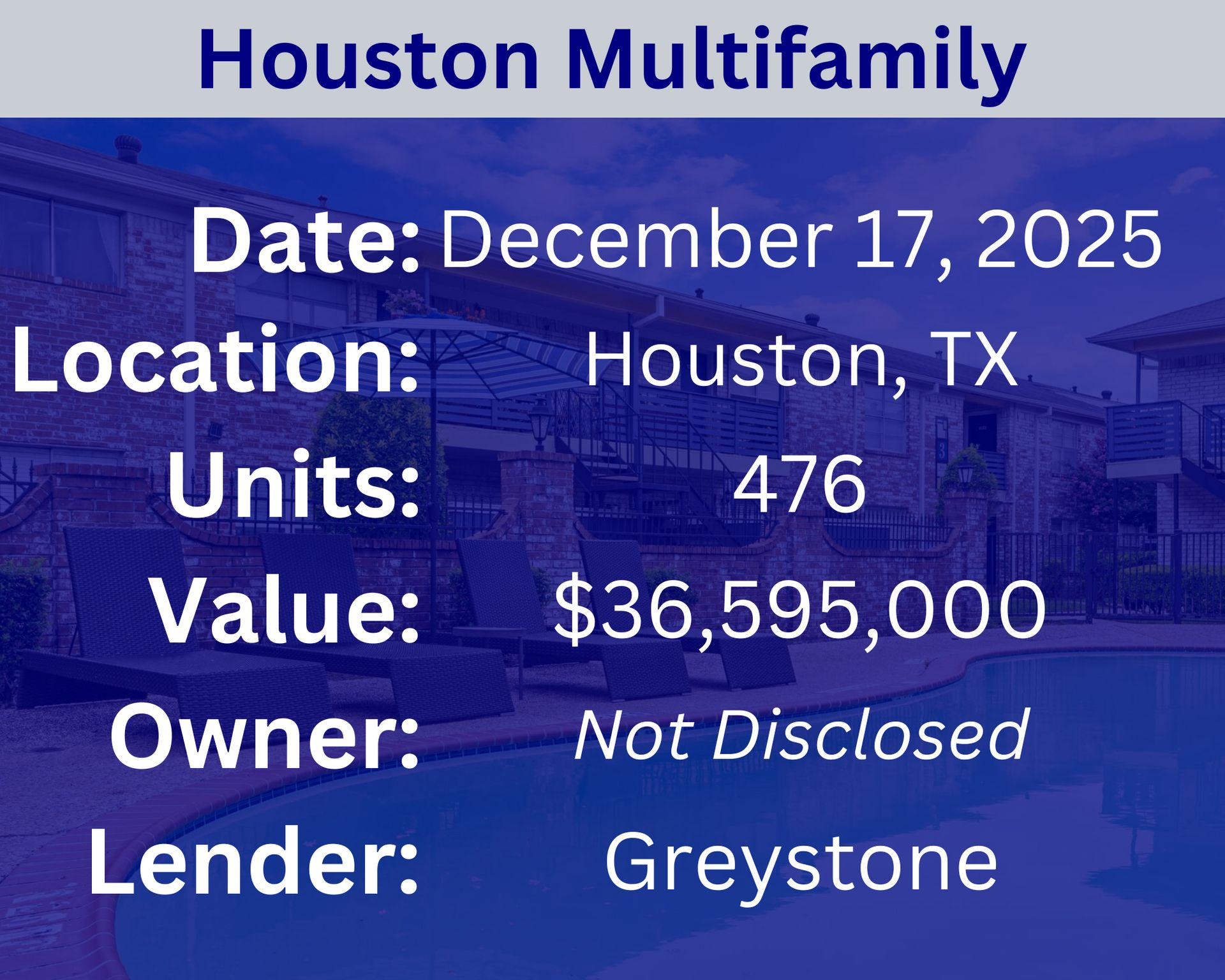

Recent Multifamily Sales (Click to view details)

Recent Multifamily Loans (Click to view details)

Question: What is a "reserves account" in multifamily investing and why is it necessary? | Answer: In multifamily investing, a reserves account is a dedicated pool of cash set aside to cover future or unexpected expenses related to the property, such as major repairs, capital improvements, or temporary shortfalls in operating income. It is necessary because it helps protect the investment from financial stress by ensuring funds are available for items like roof replacements, HVAC systems, or vacancies without needing emergency capital calls or additional debt. Maintaining reserves also provides lenders and investors with confidence that the property can weather unforeseen issues, support stable cash flow, and preserve the long-term value of the asset. |

🕵️🔎Want to get your question answered? Click here to submit your question

Before Circling Back: Jobs Data, Fed Policy, CRE Strategy Featuring Ground Leases, Data Centers, Investor Trends & More This week on The TreppWire Podcast, we discuss the market’s reaction to the Fed’s third consecutive 25-basis-point rate cut and early economic indicators. We review November’s jobs report, noting 64,000 payroll gains but a rise in unemployment to 4.6%. The episode explores how looser monetary policy may impact commercial real estate financing, spreads, and deal flow in 2026, with deep dives into data centers, life sciences, and investor caution on specialty properties. |

Quiz of The Week

What is a "security deposit" for?

a. A non-refundable fee for moving in

b. Money held by the landlord to cover potential damages or unpaid rent

c. An optional payment for extra amenities

ʇuǝɹ pᴉɐdun ɹo sǝƃɐɯɐp ʅɐᴉʇuǝʇod ɹǝʌoɔ oʇ pɹoʅpuɐʅ ǝɥʇ ʎq pʅǝɥ ʎǝuoW .q

Random Tip of the Week

📈 Track Rent vs. Market Monthly – Compare in-place rents to market rents frequently to ensure you’re capturing incremental increases without waiting for annual reviews.

Current Rates (Weekly Update)

10-Year Treasury - 4.14% (0%)

Fed Funds Rate - 3.64% (⬇️.25%)

1-Month Term SOFR - 3.73% (⬇️.03%)

About Nuvo Capital Partners

Nuvo Capital Partners is a niche market-focused multifamily investment platform operating throughout the Southeastern United States. As a dedicated sponsor (General Partner), we specialize in institutional quality real estate investments within these regions. Our team comprises industry professionals with 25+ years of combined experience, ensuring expertise and market knowledge. We pride ourselves on offering a transparent investment process, providing our investors with access to high-quality real estate opportunities while upholding integrity throughout.

📩 Was this forwarded? Join for future investigations, Sign Up Here