- Undercover Real Estate

- Posts

- Vacancy Relief for Multifamily

Vacancy Relief for Multifamily

Unveiling the Market's Secrets from Behind the Scenes

📩 Was this forwarded? Join for future investigations, Sign Up Here

“The revised forecast reflects a more measured view of near-term performance. Still, a turning point is approaching. In the final quarter of 2025, renters are expected to occupy more units than are added to supply — a first since the third quarter of 2021. That shift should allow vacancy to begin receding in 2026, supported by a shrinking construction pipeline and steady renter demand.”

- Grant Montgomery, National Director of Multifamily Analytics at CoStar Group

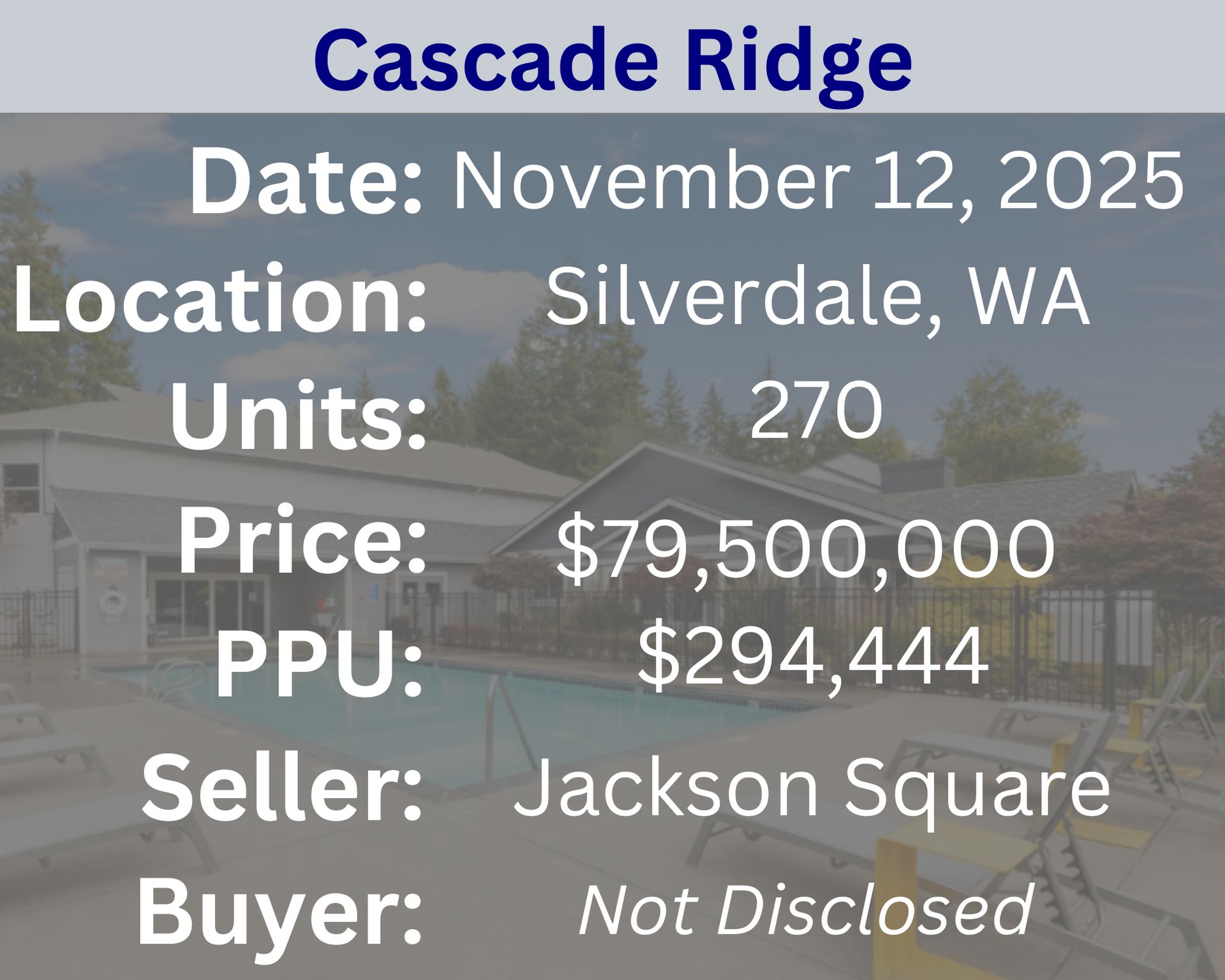

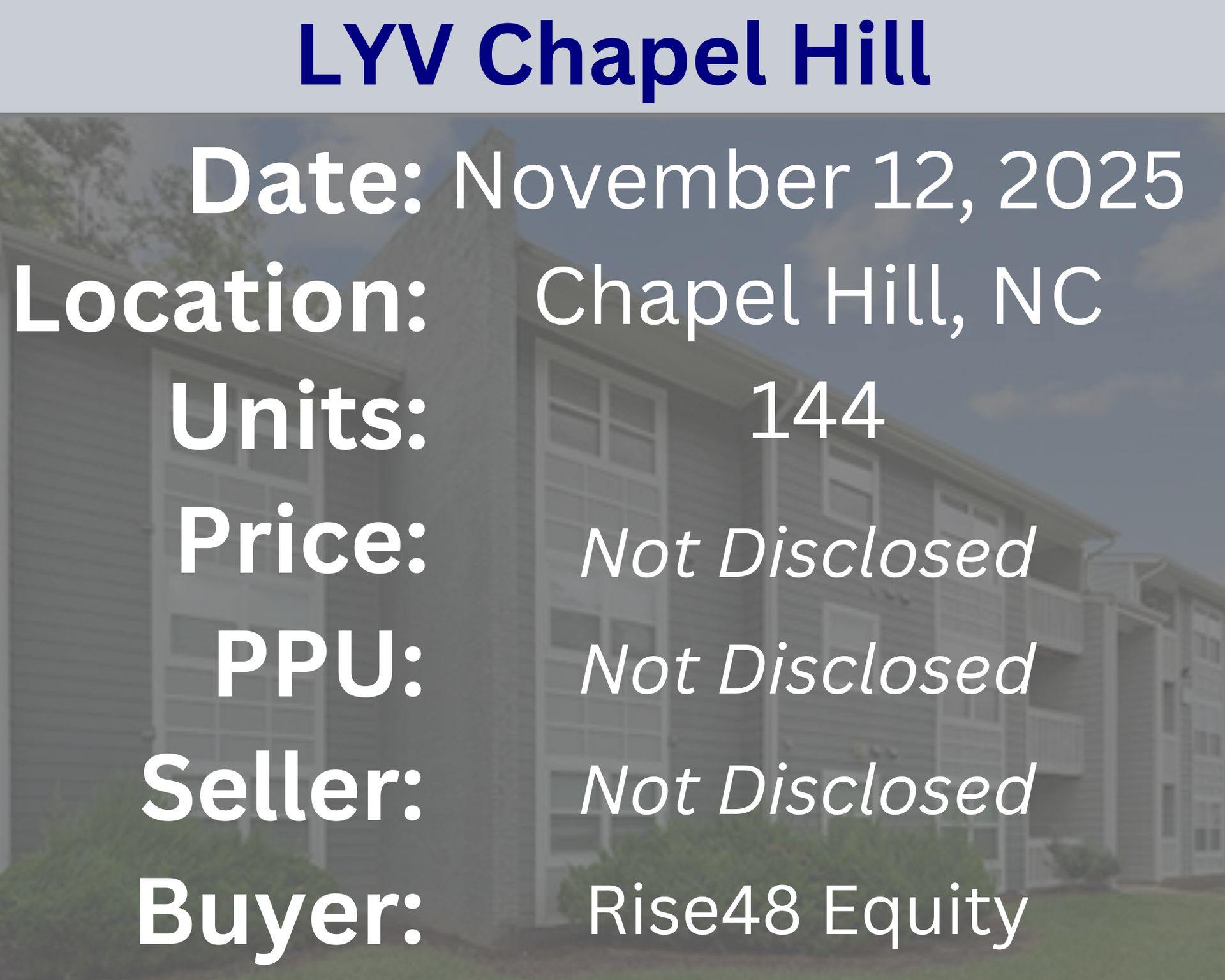

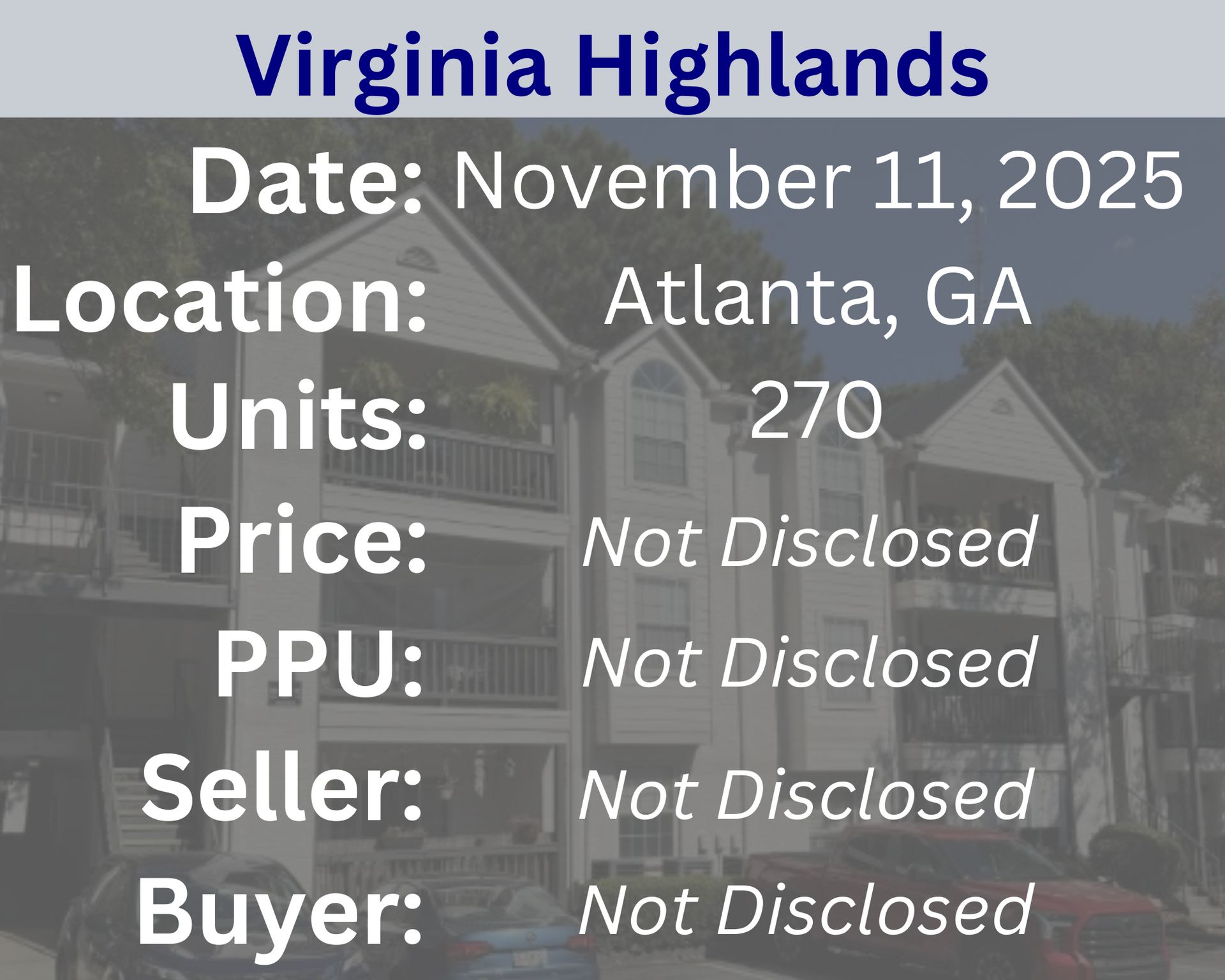

Recent Multifamily Sales (Click to view details)

Recent Multifamily Loans (Click to view details)

Question: How do macroeconomic trends influence the multifamily market? | Answer: Macroeconomic trends—such as GDP growth, employment levels, interest rate policy, and inflation—shape both the demand and the financial dynamics of the multifamily market. When the economy is expanding and job creation is strong, household formation increases, driving higher demand for rental housing and supporting rent growth. Conversely, during periods of economic slowdown or recession, renter demand can weaken, vacancies may rise, and landlords may face pressure to reduce rents or offer concessions. These cycles make the multifamily sector highly sensitive to broader economic performance. |

🕵️🔎Want to get your question answered? Click here to submit your question

CRE Earnings Show Market Resilience, CMBS Issuance Nears $120B, 50-Year Mortgage Debate, & More Lawmakers race to avoid a government shutdown as we discuss the White House’s proposed 50-year mortgage and rising AI investments. In CRE, we review strong brokerage earnings, CMBS issuance expected to top $120B, Amazon’s $700M land buy for data centers, and Marriott ending its deal with Sonder. We also cover key property stories, including multifamily sales, a Blackstone industrial SASB deal, and the Mall of America loan extension. Tune in. |

Quiz of The Week

What is "curb appeal" in the context of multifamily properties?

a. The strength of the building's foundation

b. The attractiveness of the property's exterior and landscaping

c. The efficiency of the HVAC system

ƃuᴉdɐɔspuɐʅ puɐ ɹoᴉɹǝʇxǝ sʇɹǝdoɹd ǝɥʇ ⅎo ssǝuǝʌᴉʇɔɐɹʇʇɐ ǝɥꓕ .q

Random Tip of the Week

👩💼 Invest in Top-Tier Property Management Leadership - Strong, experienced property management leadership is crucial for executing macro strategies, optimizing operations, and achieving financial goals across your portfolio.

Current Rates (Weekly Update)

10-Year Treasury - 4.06% (⬇️.09)

Fed Funds Rate - 3.87% (0%)

1-Month Term SOFR - 3.95% (⬇️.04%)

About Nuvo Capital Partners

Nuvo Capital Partners is a niche market-focused multifamily investment platform operating throughout the Southeastern United States. As a dedicated sponsor (General Partner), we specialize in institutional quality real estate investments within these regions. Our team comprises industry professionals with 25+ years of combined experience, ensuring expertise and market knowledge. We pride ourselves on offering a transparent investment process, providing our investors with access to high-quality real estate opportunities while upholding integrity throughout.

📩 Was this forwarded? Join for future investigations, Sign Up Here