- Undercover Real Estate

- Posts

- Every Capital Source Feels the Delinquency Spike

Every Capital Source Feels the Delinquency Spike

Unveiling the Market's Secrets from Behind the Scenes

📩 Was this forwarded? Join for future investigations, Sign Up Here

”Commercial mortgage delinquency rates rose again during the fourth quarter of 2023. Every major capital source has seen an increase over the last six months, as higher interest rates, uncertainty about property values, and challenges in some property fundamentals work their way through the markets.”

-Jamie Woodwell, Vice President, Research at Mortgage Bankers Association

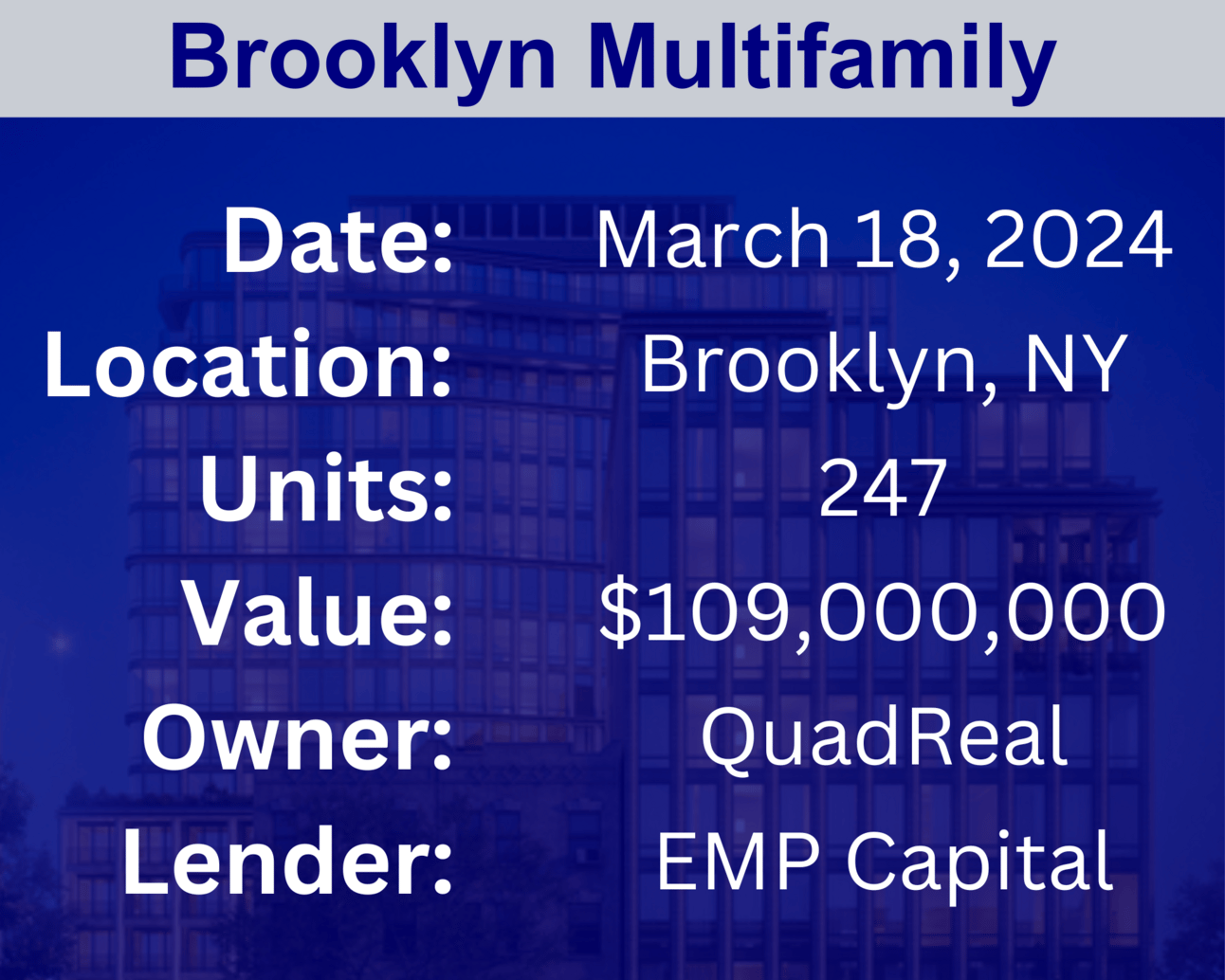

Recent Multifamily Sales (Click to view details)

Recent Multifamily Loans (Click to view details)

Question: In the due diligence process for a multifamily investment, how do you assess the potential impact of changing interest rates on the property's financing and overall performance? | Answer: Assessing the potential impact of changing interest rates in the due diligence process involves a meticulous analysis. Evaluate the property's financing structure, including the type of loan and interest rate terms. Consider the property's sensitivity to interest rate fluctuations and potential impacts on cash flow. Implement stress tests to model the effects of varying interest rate scenarios on the investment's performance. Engage with financial experts to gain insights into the current interest rate environment and forecast future trends. By thoroughly evaluating interest rate risks during due diligence, investors can make informed decisions and develop strategies to mitigate potential challenges. |

🕵️🔎 Want to get your question answered? Click here to submit your question

What is a 'Family Office'? w/ Angelo Robles In this episode, we feature Angelo Robles, a veteran in the family office sector, who shares his insights from years of experience. Angelo discusses his transition into the family office realm, his diverse cultural background, and how he's leveraged his entrepreneurial spirit within the industry. He offers an in-depth look at the structure and significance of family offices, touching on his personal journey and the evolution of his career. Angelo also highlights the critical aspects of family dynamics in wealth management. Tune in to gain practical knowledge from a seasoned expert in the family office space. |

Quiz of The Week

What is the "debt service coverage ratio" (DSCR) used for in real estate financing?

a. Calculating the tax deductions for property improvements

b. Determining the property's potential for rental income

c. Assessing the property's ability to cover its debt payments

sʇuǝɯʎɐd ʇqǝp sʇᴉ ɹǝʌoɔ oʇ ʎʇᴉʅᴉqɐ s╻ʎʇɹǝdoɹd ǝɥʇ ƃuᴉssǝss∀ .ɔ

Random Tip of the Week

🧑💻Tailor Services to Your Needs - When setting up or working with a family office, ensure that the services provided are tailored to your specific needs and goals. Family offices are flexible and can adapt to unique situations, so it's essential to communicate your preferences and priorities clearly to maximize the benefits they offer.

Current Rates (Weekly Update)

10-Year Treasury - 4.30% (⬆️.15%)

Fed Funds Rate - 5.33% (0%)

1-Month Term SOFR - 5.32% (0%)

About Nuvo Capital Partners

Nuvo Capital Partners is a niche market-focused multifamily investment platform operating in the Southeast. As a dedicated sponsor (General Partner), we specialize in institutional quality real estate investments within these regions. Our team comprises industry professionals with 25+ years of combined experience, ensuring expertise and market knowledge. We pride ourselves on offering a transparent investment process, providing our investors with access to high-quality real estate opportunities while upholding integrity throughout.

📩 Was this forwarded? Join for future investigations, Sign Up Here